Exclusive Deals & Trending Items

Muthoot Pappachan Swarnavarsham Gold BIS Hallmarked Lakshmi Pendant of 1 gms in 22 KT 916 Purity Fineness

Shop NowThe gold and silver bullion market in India is key to the country’s economy and culture. India is the second biggest gold importer, bringing in 700-900 tonnes every year. In 2021, imports hit 924.6 tonnes, a 165% jump from the year before.

This growth was due to lower global prices and a cut in import duties from 12.5% to 7.5%. The Multi Commodity Exchange (MCX) is at the forefront of gold trading in India. It offers a range of contract sizes, from 1 kg to 1 gram, making it accessible to all investors.

Silver contracts also have various sizes, including 30 kg, 5 kg, and 1 kg. For Indian investors, bullion is a safe haven during tough economic times. The market operates 24/7, mainly through over-the-counter deals. Bullion must be at least 99.5% pure to be officially recognized.

The introduction of BULLDEX, a bullion index with 64% gold and 36% silver, has opened up new opportunities. It requires less capital to enter the market. Understanding the gold and silver bullion market in India reveals its investment potential and cultural importance. It offers a way to diversify portfolios and preserve wealth for future generations.

Key Takeaways

- India imports 700-900 tonnes of gold annually, making it the second largest importer after China

- MCX offers various gold contract sizes from 1 kg down to 1 gram to accommodate different investors

- Official bullion must meet a minimum 99.5% purity standard

- The bullion market operates 24 hours daily, primarily through OTC transactions

- Gold import duty was reduced from 12.5% to 7.5% in 2021, boosting market activity

- BULLDEX provides a more affordable entry point to the bullion market compared to standard contracts

Introduction to Precious Metals Investment in India

Precious metals investment is key in Indian financial planning. The gold market in India is huge, worth around ₹2.5 lakh crore. It’s important to understand this market for good gold investment tips.

The Cultural Significance of Gold in Indian Society

Gold is more than just an investment in India. It stands for heritage, status, and security. About 90% of gold is bought during weddings and festivals, showing its cultural importance.

Gold has kept its value for over 2,500 years. This makes it a top choice for keeping wealth safe in India.

Silver’s Growing Popularity Among Indian Investors

The silver market in India is growing fast, valued at around ₹1 lakh crore. It’s seen a 10% annual growth. Silver is cheaper than gold, making it a good choice for new investors.

Why Indians Trust Precious Metals as a Store of Value

Indians turn to precious metals during tough times for good reasons. Gold keeps its value over time, acting as a shield against inflation. It’s also easy to sell, helping in emergencies.

Gold is the wealth of ancestors, silver is the wealth of gentlemen, and paper is the wealth of fools.

About 70% of Indian homes own gold. This shows how much Indians trust precious metals for their financial safety.

The Current State of the Gold and Silver Bullion Market in India

India is a big player in the global precious metals market, making up about 25% of gold demand worldwide. The gold and silver bullion market in India has seen a lot of growth. In 2024, gold consumption hit 802.8 tonnes, a 5% jump despite a 27% price hike.

This shows how much Indians trust in precious metals as a safe investment.

Gold prices hit a record high of ₹82,400 per 10 grams in October 2024. It showed a 26% return in domestic markets last year. Experts think gold could reach ₹90,000 in 2025.

Investment demand for gold has gone up by 29%, especially in ETFs and coins. This shows more people are interested in gold beyond jewelry.

Gold ETFs are a smart choice for your portfolio, say financial advisors. They suggest a 15-25% allocation for retail investors looking for stability and growth.

Silver prices in India are also attractive for investors. Silver crossed ₹1 lakh per kg in late 2024. Today, silver in Mumbai is ₹107,000 per kilogram, down 0.93% from yesterday.

Several factors influence silver prices, including festive demand, global markets, politics, and government policies.

The gold and silver bullion market in India mainly trades on the Multi-Commodity Exchange of India Ltd. Trading volumes have grown a lot. With gold possibly hitting ₹84,894 per 10 grams and silver on the rise, precious metals are key for investors in India.

Gold Market Analysis: Trends and Forecasts

The gold market has shown remarkable resilience in recent years. It attracts investors seeking stability in uncertain economic times. A thorough gold market analysis reveals significant growth potential. The global market was valued at USD 276.04 billion in 2023 and is projected to reach USD 457.91 billion by 2032.

Historical Gold Price Movements in India

Gold prices in India have followed an upward trajectory. Current rates are above $2,910 per ounce. The precious metal has gained 11.09% since early 2025, reaching an all-time high of $2,956.22 in February.

These price movements reflect India’s position as a major gold consumer. Demand fluctuates seasonally but maintains strong cultural significance.

Factors Influencing Gold Prices in the Indian Market

Several key factors shape gold prices in the Indian market:

- Daily rates set by the Indian Bullion and Jewellers Association

- International price benchmarks from COMEX and LBMA

- Rupee-dollar exchange rate fluctuations

- Government policies on import duties and taxes

- Seasonal demand spikes during festivals and wedding seasons

The Asia Pacific region dominates the gold market with a 66.25% share. It generated USD 182.88 billion in 2023. India’s reliance on imports to meet domestic demand makes the market sensitive to global price shifts and currency movements.

Expert Predictions for Gold in 2023-2024

Gold is expected to trade at 2,948.88 USD per troy ounce by the end of the current quarter. Forecasts suggest prices will continue climbing. They are expected to reach approximately 3,063.60 USD within the next 12 months.

This positive outlook comes despite a recent decline in India’s gems and jewelry exports. Exports totaled $7.22 billion between April and June 2023.

| Time Period | Forecasted Gold Price (USD/oz) | Growth Factors |

|---|---|---|

| Current Quarter | 2,948.88 | Market stability, investor confidence |

| Next 12 Months | 3,063.60 | Inflation hedge, geopolitical uncertainty |

| 2032 Projection | Market size: $457.91 billion | 5.8% CAGR, technology applications |

Silver Market Trends: What You Need to Know

The silver market in India offers great chances for investors looking to diversify. Knowing the trends can guide you in choosing this valuable metal.

Silver Price Fluctuations in Recent Years

Silver prices have been quite unpredictable, unlike gold. This unpredictability comes from silver’s role in both the precious metal and industrial markets. In recent years, prices have changed a lot, influenced by global and local economic factors.

Experts suggest putting 10-15% of your investment in silver by 2025. They see its growing role in a well-rounded investment strategy.

Industrial Demand vs. Investment Demand for Silver

Silver’s demand is different from gold’s because of its industrial uses. It’s crucial in:

- Electronics manufacturing

- Solar panel production

- Medical applications

- Automotive industry components

This industrial need affects silver prices differently than gold. When industrial activity grows, silver prices tend to rise.

Comparing Silver’s Performance with Gold in India

Gold is big in India, but silver has its own story. Silver prices can swing more during economic changes. It sometimes beats gold when industry grows.

The bullion market in India operates 24/7, with silver prices reacting quickly to both global market trends and local dealer activities.

The silver-to-gold ratio is important for deciding when to invest in each. A high ratio means silver might be cheaper than gold.

How to Buy Gold Bullion in India: A Complete Guide

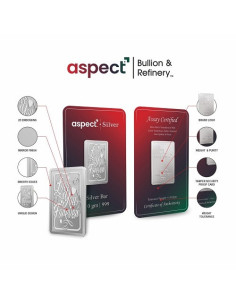

Buying gold bullion in India is a safe investment choice with many options. Gold bars range from 0.5 grams to 1 kg, marked with weight, purity, and mint details. When you buy gold online in India, make sure it has the BIS hallmark for quality and purity.

Gold coins are also popular, available from 0.5 grams to 50 grams. They often have special designs and are great for gifts or small investments. Buying bullion is cheaper than gold jewelry, which can cost 10-20% more due to making charges.

- Traditional jewelers and bullion dealers with established reputations

- Government entities like MMTC and banks offering certified gold products

- Digital platforms where you can buy gold online in India with convenience

- Sovereign Gold Bonds providing 2.5% annual interest with tax benefits

When buying online, pick sites with good authentication and clear prices. Most good dealers charge 3-5% more than the spot gold price. Gold ETFs have a 1% expense ratio, while physical gold costs for storage.

Gold should ideally constitute no more than 10% of your investment portfolio to maintain proper diversification while still benefiting from its wealth preservation qualities.

For big buys, you need to provide PAN card details. Buying gold online in India is now easier, with good prices and delivery right to your door. Your purchase is insured during shipping.

Exploring Silver Bullion Investment Options

Silver bullion is a great way for Indian investors to start with precious metals. It usually has a BIS hallmark, which ensures its quality and purity. This makes it a reliable choice for your investment.

Silver Coins vs. Silver Bars: What’s Right for You

Think about your investment goals when choosing silver bullion. Silver coins are good for small transactions and often have cultural value. They come in various weights, from 10 grams to 1 kilogram.

- Coins: Higher premiums but more liquid and easily divisible

- Bars: Lower premiums per ounce, ideal for larger investments

Understanding Purity Standards for Silver in India

In India, silver purity is measured in fineness. 999 or 999.9 means 99.9% pure silver. Silver ETFs need 99.99% purity, with at least 95% in physical silver or related items.

The tracking error for these funds is 2%, and the expense ratio is 1% at most.

Where to Buy Authentic Silver Bullion Products

You can buy silver bullion from jewelers, banks, bullion dealers, and online. E-silver trading lets you buy digital silver like stocks, without storage worries. Physical silver needs secure storage, like bank lockers, which adds to the cost.

Taxes depend on how long you hold the silver. Short-term gains are taxed based on your income tax slab. Long-term gains are taxed at 20% with indexation benefits. This makes silver a good choice for long-term investment diversification.

Top Gold and Silver Dealers Across India

Finding reliable dealers is key when investing in precious metals. India has many trustworthy options for both online and physical purchases. You can find high-quality bullion products here.

Best Online Platforms to Buy Gold in India

The digital world has changed how Indians buy gold. Many online platforms are top choices for their reliability and service. MMTC-PAMP, SafeGold, and Coinbazaar offer good prices and authentic products with secure delivery.

Platforms like eBullion let you buy gold online in India starting at ₹100. This makes precious metals available to all. These services offer full insurance, clear pricing, and quick selling options.

Brick-and-Mortar Bullion Retailers with Strong Reputations

Traditional markets are still loved for bullion shopping. Mumbai’s Zaveri Bazaar handles about 80% of India’s gold imports. It’s the top place for physical gold. Delhi’s Chandni Chowk is another historic spot with experienced dealers.

Stores like Tanishq and Kalyan Jewellers have high quality standards. They offer certified products with proper documents. This gives buyers confidence in their investments.

How to Verify a Dealer’s Authenticity Before Purchasing

Before buying gold online in India, look for BIS hallmarking. Also, check dealer credentials through groups like IBJA. Real dealers give proper invoices and buy-back promises.

Read reviews and ask about storage for big purchases. Good dealers have clear prices without high premiums. Gold purity certification and proper documents are essential when investing.

Understanding Taxation and Regulations for Precious Metals

Investing in gold and silver in India comes with tax rules to know. Budget 2024 raised long-term capital gains tax to 12.5% from 10%. Short-term gains now face a 20% tax, up from 15%. The tax exemption limit has been increased to ₹1.25 lakhs, helping investors a bit.

Buying physical gold attracts a 3% GST. Making charges add another 5% GST. For example, buying gold worth ₹1 lakh means paying ₹3,450 in GST alone. The total tax on physical gold is 18%, including customs duty and cess.

There’s a limit on how much gold you can own without proof. Married women can have up to 500 grams, unmarried women 250 grams. Men, married or not, can only have 100 grams. A family of four can legally have up to 950 grams together.

| Investment Type | Long-Term Tax Rate | Short-Term Tax Rate | Holding Period for LTCG |

|---|---|---|---|

| Physical Gold/Silver | 20% + 4% cess | As per income slab | 36 months |

| Gold ETFs | 12.5% | As per income slab | 12 months |

| Sovereign Gold Bonds | 20% with indexation | As per income slab | 36 months |

| Gold Mutual Funds | 12.5% | As per income slab | 24 months |

Gold found during raids without explanation faces big penalties—a 78% tax plus a 10% penalty. Gold gifts over ₹50,000 from non-relatives are taxed. But gifts from family members are still free from tax. These rules greatly affect investment choices in India’s gold and silver market.

Gold vs. Silver: Which Should You Include in Your Portfolio?

Deciding between gold and silver for your portfolio isn’t a simple choice. Each metal has its own benefits. It’s important to know what they offer and how they fit with your financial goals.

Risk and Return Profiles of Gold and Silver

Gold is stable during market ups and downs, with price changes less than silver. This makes gold a safe choice during tough times. Silver, though cheaper, can have bigger price swings. This might appeal to those looking for quick profits.

Diversification Benefits of Owning Both Metals

Having both metals in your portfolio is wise. Gold doesn’t move much with stocks and bonds, making it a great diversifier. Silver, on the other hand, has growth potential in industries like electronics and solar energy.

Allocation Strategies Based on Your Investment Goals

Smart investment tips suggest adjusting your mix based on your risk level and time horizon:

- For keeping wealth safe: Go with a 70-30 gold-to-silver ratio

- For growth: Try a 50-50 mix for balance

- For big returns: Use 60-70% silver if you can handle big swings

In India, gold is often the go-to choice. But adding silver makes your portfolio stronger. Remember, precious metals don’t earn income like stocks or bonds. They’re best for keeping wealth safe rather than for regular income.

Storing and Protecting Your Bullion Investments

Keeping your precious metals safe is key. Physical bullion is at risk of theft, unlike digital assets. In India, gold and silver owners face this threat often.

Your storage options include:

- Home safes: Affordable but limited security for smaller collections

- Bank safety deposit boxes: Available during banking hours with basic protection

- Private vaults: Premium security with biometric access and climate control

- Specialized bullion depositories: Purpose-built facilities with comprehensive insurance

For home storage, use the “three layers deep” method. This means keeping valuables behind at least three barriers. It’s also wise to keep your holdings secret, as knowing about them can attract thieves.

Spread out where you store your gold. Many investors use fake safes with less valuable items. This trick keeps thieves guessing while the real treasure is elsewhere.

Keep detailed records of your gold purchases. Include authentication certificates, receipts, and photos. These documents are crucial for insurance claims and selling your gold later.

Think about getting specialized bullion insurance. Standard homeowner policies usually don’t cover precious metals well. Dedicated insurance is a must for serious investors.

Common Mistakes to Avoid When Investing in Precious Metals

Investing in precious metals wisely means knowing the pitfalls that can hurt your returns. Start by avoiding common mistakes to protect your portfolio.

Paying Excessive Premiums

Many investors pay too much for gold or silver without realizing it. Premiums on small gold pieces are often higher than on larger items. TV ads can charge 50-200% more than the actual price, hurting your returns.

Gold coins have making charges between 8-16%. Bars are more cost-effective because they have lower production costs.

Ignoring Authentication Measures

It’s vital to verify the authenticity of precious metals. Look for hallmarks with the BIS logo, purity mark, and a unique 6-digit code. Gold must be 99.5% pure or higher to be investment-grade.

Skipping these checks can lead to buying fake gold, making your investment worthless.

Poor Timing of Purchases and Sales

Many buy gold only when prices are high, during economic downturns. This is not a smart strategy. Instead, invest steadily, like through dollar-cost averaging.

Gold should make up 5-20% of your portfolio for the best diversification.

- Verify all bullion purchases have proper authentication markings

- Compare premiums across dealers before making purchases

- Maintain balanced allocation rather than emotional buying

- Document all transactions for tax and resale purposes

Be careful with resale value expectations. Banks won’t buy back gold coins, and jewelers often don’t include making charges. Knowing these facts helps in making better investment decisions.

Digital Gold and Silver: Modern Alternatives to Physical Bullion

Digital platforms have changed how you invest in silver bullion. You can own precious metals easily with just a few clicks. This makes investing more accessible than ever.

Sovereign Gold Bonds offer a 2.5% annual interest and tax benefits if held until maturity. Silver ETFs let you trade shares during market hours. They cost between 0.5% to 1% annually.

Digital gold and silver platforms allow micro-investments from just ₹1. They’re great for building your investment slowly. These platforms charge a 6% spread but save you from storage worries.

| Digital Option | Minimum Investment | Annual Costs | Liquidity |

|---|---|---|---|

| Digital Gold/Silver | ₹1 | 6% spread | High |

| ETFs | ₹50-₹100 | 0.5-1% | Very High |

| Sovereign Gold Bonds | ₹5,000 | None visible | Low (5-year lock-in) |

| Precious Metal Mutual Funds | ₹100 | 0.6-1.2% | High |

Experts suggest putting 10-15% of your portfolio in gold. They also recommend increasing silver to similar levels by 2025. The digital route has many benefits for those looking to invest in silver bullion:

- Zero storage costs or security concerns

- Ability to start with small amounts

- Easy liquidation during market hours

- Elimination of purity verification issues

- Simplified buying process without visiting physical stores

The tax treatment varies by option. Long-term capital gains (held over 3 years) are taxed at 12.5% as of Budget 2024. Short-term gains face a 20% tax rate. Sovereign Gold Bond interest earnings are fully taxable but gains become tax-free after 5 years.

Conclusion: Building Your Precious Metals Strategy in India’s Dynamic Market

When you explore the gold and silver bullion market in India, a solid investment plan is crucial. The launch of the India International Bullion Exchange (IIBX) and new rules aim to make things clearer and safer. But, the market is always changing. So, keep an eye out, spread your precious metals portfolio, and learn more to make the most of it.

Gold’s rich history or silver’s industrial use might attract you. But, invest smartly, thinking about your risk level and goals. Knowing the gold market analysis and trends helps you handle market ups and downs. Dive into India’s precious metals scene and it could lead you to a bright financial future.

16 Responses

It’s interesting to see how the MCX has made bullion trading more accessible by offering different contract sizes. This helps both small and large investors participate in the market, which has traditionally been dominated by big players.

I didn’t realize how crucial the MCX is in shaping India’s bullion market. It’s fascinating to see how such a vast market operates 24/7, especially with bullion being treated as a safe haven in times of uncertainty.

It’s fascinating how the MCX has adapted to cater to both large and small investors with different contract sizes. This flexibility definitely plays a big role in making bullion more accessible to everyone, from individual investors to large institutions.

It’s interesting how bullion is seen as a safe haven for investors during uncertain economic times in India. Do you think this trend will continue as the global economy faces more challenges, or could other investment options become more appealing?

It’s fascinating how India has such a deep connection with gold—both culturally and economically. The MCX’s role in making gold trading accessible to a wider range of investors really reflects the shift in how people view gold as a financial asset in India. It would be interesting to see if more retail investors continue to flock to these platforms as they gain more awareness.

The fact that gold imports jumped 165% in 2021 really shows the growing appetite for safe-haven assets in India. It’s also interesting how the MCX’s flexible contract sizes make bullion trading more accessible for both large and small investors.

I found it interesting how India’s gold imports surged in 2021 due to a combination of lower global prices and reduced import duties. It really shows the impact of policy changes on market behavior.

The role of the MCX in shaping India’s bullion market is impressive, especially how they’ve made it accessible to both large and small investors with varied contract sizes. Do you think this kind of accessibility will continue to drive gold demand in India in the coming years?

The role of the Multi Commodity Exchange in making bullion more accessible to all investors is impressive. Offering contract sizes from 1 gram to 1 kg helps democratize the market, allowing people to invest at different levels, which is essential for financial inclusivity.

Given how the bullion market operates around the clock, it’s interesting that it’s still largely based on over-the-counter deals. Does this mean there’s less volatility compared to more centralized markets?

With the rise in bullion imports, do you think this trend will continue as more Indians look for safe-haven investments, or are there other factors we should be considering in the market’s future growth?

The introduction of BULLDEX seems like a great step toward making bullion investments more accessible to retail investors in India. I’m curious about how it might affect the broader market—will it make gold more volatile or provide more stability?

The gold and silver bullion market in India seems to be thriving, especially with the growing import volumes and the role of MCX. It’s fascinating to see how the market is evolving and adapting to investor needs with different contract sizes. Curious to see how the introduction of BULLDEX might impact the market going forward.

The MCX’s wide range of contract sizes is a great move to make gold and silver trading more accessible to both small and large investors. It’s a smart way to democratize participation in the bullion market.

The insights into India’s bullion market are fascinating, especially the impact of lower import duties on gold imports. It’s interesting to see how MCX has made gold and silver trading more accessible to different types of investors. With bullion serving as a safe-haven asset, do you think India’s growing digital gold investments will impact physical bullion demand in the long run?

The introduction of BULLDEX is an interesting move in making gold and silver trading more accessible to the average investor. I wonder if we’ll see more indices like this in the future for other commodities?