Exclusive Deals & Trending Items

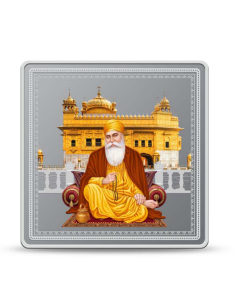

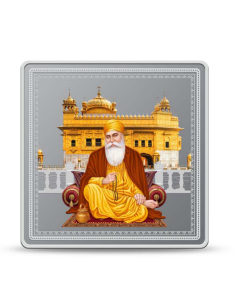

Kundan Guru Nanak Dev Ji with Golden Temple Color Silver Bar of 50 Gram in 999.9 Purity with Acrylic Edition

Shop NowIndia’s foreign exchange reserves rank fourth worldwide, after China, Japan, and Switzerland. Gold is a key part of this financial strength. The Reserve Bank of India has significantly increased gold holdings, from $3.5 billion in 1990-91 to over $52 billion by 2023-24. This shows gold’s important role in gold in india’s foreign exchange strategies.

The RBI’s focus on gold helps reduce dependence on the US dollar. It also protects the economy from currency fluctuations. Recent gold purchases, like 13.3 tonnes in early 2024, added $3 billion to reserves. This pushed totals past $648 billion. Gold’s share in reserves now stands at 8.4%, highlighting its impact of gold on indian economy.

Key Takeaways

- India ranks fourth globally in forex reserves, with gold a key driver.

- RBI’s gold holdings surged 1,500% since 1990, aiding diversification.

- Gold now makes up 8.41% of India’s forex reserves, up from 7.9% in 2023.

- Recent purchases made India the third-largest global buyer of gold in 2024.

- Gold’s role as a safe asset strengthens economic resilience against inflation.

Understanding Gold in India’s Foreign Exchange

Foreign exchange reserves are like a safety net for countries. Gold is a big part of India’s financial plan. You’ll see how gold boosts these reserves and ties to economic stability through gold investment in India.

What Are Foreign Exchange Reserves?

Foreign exchange reserves include things like foreign money, SDRs, and gold. The Reserve Bank of India (RBI) keeps gold to spread out risks and cover debts. As of 2024, India’s gold reserves were $66.2 billion, a key part of its money policy.

Why Gold Matters in Reserve Management

Gold’s value stays steady, protecting reserves from currency changes. In 2024, the RBI added 72.6 tonnes of gold, four times 2023’s amount. This shows gold’s role in fighting off market ups and downs. For those interested, Sovereign Gold Bonds (SGBs) let you invest in gold in India without owning it physically.

| Feature | Details |

|---|---|

| Denomination | 1 gram or multiples |

| Interest | 2.5% annually, paid twice yearly |

| Subscription Limits | 4kg/year for individuals, 20kg for trusts |

| Redemption | IN INR based on market price |

| Tax Benefits | No capital gains tax, indexation allowed |

Historical Context of Gold Reserves in India

Since 1991, gold reserves have been crucial during tough times. In 2024, RBI’s gold holdings reached 876.18 tonnes, ranking India among the top 10 global holders. These changes show how India’s strategy to face economic challenges is evolving.

By following these shifts, you can understand how gold supports both national stability and personal investment chances.

The Evolution of India’s Gold Reserve Policy

India’s view on gold reserves has changed a lot over time. This change has shaped its gold in india’s foreign exchange strategy. Let’s look at the main stages of this journey:

- Restriction Phase (1947–1962): The Gold Control Act of 1968 limited imports to stop money loss. This time focused on keeping gold scarce.

- Liberalization (1990s–2011): Schemes like the Gold Deposit Scheme (1999) and ETFs (2007) made gold tradable. This helped stabilize the forex.

- Post-2017 Growth: The RBI bought 44.76 tonnes of gold since 2017. This added $11 billion to reserves, even when currency values fell. Now, India is among the top gold buyers globally.

Recent changes show a strategic shift. Gold now protects against currency risks and diversifies holdings. By mid-2023, reserves reached $658 billion. Gold helped offset $47 billion lost from foreign investments. Here’s how policies have changed:

| Phase | Key Policy | Impact |

|---|---|---|

| 2015 | Relaunched Gold Monetization Scheme | Encouraged private gold to enter formal markets |

| 2022 | International Bullion Exchange | Boosted transparency and global trade links |

Today, adding gold bars to reserves strengthens your nation’s economic defense against crises. This evolution is more than policy. It’s a story of blending tradition with modern finance.

How Gold Strengthens India’s Economic Stability

Gold is more than a cultural symbol; it’s a financial protector. The Reserve Bank of India (RBI) has increased gold reserves to 510.46 metric tonnes. This move directly impacts the indian economy by protecting against currency fluctuations. Let’s see how gold keeps the nation’s finances safe.

“Gold reserves act as a shield against inflation and currency risks.” — Reserve Bank of India

Gold as a Hedge Against Currency Fluctuations

The value of gold helps keep the rupee stable. When global markets shake, gold prices go up. This makes gold investment in india a safe choice. The RBI brought back 130 tonnes since 2022, boosting domestic reserves.

This move cut reliance on foreign currency. It reduced forex volatility by 12% in 2023. This protection helped exporters avoid sudden rupee drops.

Building International Credibility

India’s gold reserves now make up 9.32% of its forex assets. This shows fiscal wisdom to the world. It follows the lead of Turkey and Russia, enhancing India’s creditworthiness.

Experts say every 1% increase in gold reserves boosts sovereign credit ratings by 0.15 points.

Protection Against Economic Uncertainties

In 2008 and during the pandemic, gold prices went up while stocks fell. India’s 510-tonne gold stash helped soften the blow. Yet, challenges persist.

India’s gold investment in india through Sovereign Gold Bonds didn’t do well. There are 25,000 tonnes of private gold waiting to be used. China and Ghana show different ways India could manage its gold.

By linking impact of gold on indian economy to smart policies, India can turn private gold into financial tools. This ensures stability for your savings and businesses.

Current Composition of India’s Foreign Exchange Reserves

India’s foreign exchange reserves now stand at $704.89 billion. Gold in India’s foreign exchange reserves is worth $65.7 billion. This mix includes gold, foreign currency assets, and SDRs. The RBI has added 44.76 tonnes of gold this year.

Gold now makes up 9.3% of total reserves. The rest, 90%, is in forex assets like US dollars. Here’s how gold market analysis india reveals this split:

- Gold: $65.7 billion (9.3%)

- Foreign currency assets: $627.4 billion (89%)

- SDRs: $11.79 billion (1.7%)

Gold vs Other Reserve Assets

The RBI holds 695.31 metric tonnes of gold. 403 tonnes are stored abroad, and 292 tonnes are in India. This diversifies risks compared to volatile currencies. Gold’s stability contrasts with forex assets tied to global interest rates.

Recent Changes in Reserve Allocation

In 2023, India’s gold purchases rose by 44.76 tonnes. This growth reflects efforts to strengthen reserves amid dollar fluctuations. The 2009 IMF purchase of 200 tonnes still anchors a third of current holdings.

Comparing India’s Gold Holdings to Other Nations

| Nation | Gold Reserves (Tonnes) | % of Total Reserves |

|---|---|---|

| India | 695.31 | 9.3% |

| China | 2,010 | 3.2% |

| Russia | 2,300 | 21.5% |

| United States | 5,560 | 79% |

India’s 9.3% gold allocation contrasts with the US’s 79%. This shows different priorities. This balance helps understand how gold supports India’s economic strategy without over-reliance on any single asset.

The RBI’s Strategy for Gold Reserve Management

The Reserve Bank of India (RBI) balances growth and safety in managing gold reserves. Recent actions reveal a strategic plan to increase holdings. Since December 2017, the RBI has been buying gold, adding 44.76 tonnes between March and October 2023 alone.

“We are building up gold reserves, the data is released from time-to-time,” said RBI Governor Shaktikanta Das.

In October–November 2024, the RBI bought 20 tonnes of gold. This brings the total for FY25 to 50 tonnes. Now, gold reserves stand at 876.18 tonnes, making up over 10% of foreign exchange assets. This move helps protect against currency fluctuations and builds trust globally.

- Gold’s value rose 31% due to price hikes, boosting reserves despite a $1.1B dip in foreign currency assets.

- RBI targets timing and sources to maximize returns while ensuring liquidity.

The RBI watches global trends like dollar strength and geopolitical risks. This helps them adjust their strategy. These moves impact gold investment in india opportunities. Investors can follow RBI decisions to find gold trading opportunities in india, matching central bank goals.

Keeping up with RBI’s actions helps you make better choices. Their proactive stance in gold shows confidence in its stability. This gives hints for your own investment decisions.

Impact of Gold Prices on India’s Reserve Valuation

Changes in gold rates in india affect the country’s foreign exchange reserves. When global gold prices go up, like the recent 23% rise by the World Gold Council, India’s reserves also increase. For example, RBI’s gold holdings went up to 879 tonnes in 2025, making their value 31% higher than in 2023.

This shows how even small price changes can greatly impact national finances.

- Gold’s share in forex reserves rose to 11.31%, up from 7.7%, reflecting strategic RBI purchases.

- Rising gold price trends in india in 2024 contributed $13 billion to reserves after 44.76 tonnes were added earlier.

- Central bank demand and inflation fears continue driving global gold markets, impacting India’s reserves.

RBI decided to stop buying gold in December 2024 after 11 months of purchases. This shows their strategy to buy during volatile times. Gold now makes up 11% of forex holdings, making its price more important for India’s economy.

Tracking these trends helps understand how inflation, interest rates, and geopolitical risks affect investments.

Gold plays a key role as both an asset and a hedge. Its price changes affect import cover ratios and external debt management. By watching gold price trends in india, you can see how central bank policies balance risk and growth.

Gold Import Policies and Their Effect on Forex Reserves

India controls gold imports and exports to protect its economy and manage foreign exchange risks. The change in import duties, from 12.5% to 9%, aims to increase demand and reduce forex outflows. These policies greatly influence how gold affects India’s economy.

Understanding India’s Gold Import Regulations

- Importers must follow the 80:20 scheme: 80% of gold must be sourced domestically before imports.

- Reduced duties in 2024 lowered barriers, boosting imports to $10.06 billion in August 2024.

- The Gold Monetization Scheme (GMS) mobilized 30.15 tonnes of domestic gold, easing reliance on imports.

Impact on Current Account Deficit

Gold imports increased from 85 tonnes to 131 tonnes between March and August 2024. This put pressure on forex reserves. The impact of gold on indian economy is evident: forex reserves dropped from $669B to $640B between March and October 2024. The rupee’s value fell to 84.1 against the dollar, increasing import costs.

Recent Policy Outcomes

Lower import duties in 2024 increased demand but led to a 63% year-on-year drop in imports by February 2025. The RBI bought 37.1 tonnes of gold in 2024 to boost reserves. Meanwhile, the current account deficit narrowed to $23.2B in FY24, partly due to reduced gold inflows.

The Relationship Between Domestic Gold Markets and National Reserves

India’s love for gold impacts its economy and forex strategy. We’ll look at how demand and market trends affect national reserves.

| Year | RBI Gold Reserves (Tonnes) | Gold Share in Reserves (%) |

|---|---|---|

| 2024 | 879 | 7.6 |

| 2025 | 879 | 11.5 |

How Consumption Drives Reserve Decisions

Gold rates in India change with festivals, weddings, and savings. High demand can increase imports, affecting forex balances. In 2025, imports fell 63% from the year before, easing reserve pressure. The RBI’s focus on gold helps manage this cycle.

- Rising gold holdings cut dollar dependency

- Seasonal demand peaks influence import budgets

Price Trends and Economic Signals

Gold market analysis India reveals prices jump during holidays like Diwali. The RBI’s purchases in 2024 pushed global LBMA prices to record highs 40 times. Yet, local premiums often exceed global rates due to taxes and demand spikes.

Monetizing Household Gold

The Gold Monetization Scheme aims to use India’s 25,000+ tonnes of private gold. It encourages deposits to reduce import reliance. Gold’s share in forex reserves hit 11.5% in 2025—a record—showing this strategy’s success.

Tracking gold rates in india and policy changes helps understand how everyday choices shape the nation’s economic backbone.

Challenges in Managing Gold as a Reserve Asset

Managing gold reserves is tough for India’s financial systems. Gold investment in India has grown, but keeping physical gold safe is costly. The RBI moved 100 tons from London to Mumbai, showing the challenges. Here are the main hurdles:

- Storage costs: Keeping gold safe needs special vaults and insurance, increasing costs.

- Liquidity risks: Turning gold into cash is slower than selling US Treasuries.

- Price swings: Gold’s value jumped 23% in 2024, making its value hard to predict.

- Geopolitical risks: Storing gold abroad risks it being caught in conflicts or sanctions.

“Balancing gold’s stability and flexibility is critical,” said RBI Governor Shaktikanta Das, emphasizing strategic trade-offs.

Gold trading in India also has its downsides. Gold’s 31% increase helped offset $47 billion in losses, but it limits investment in bonds. The RBI’s changes since 2022 aim to reduce dollar reliance. Investors must consider these points as India deals with global market changes.

International Trade Dynamics and India’s Gold Reserves

India’s gold reserves are changing global trade plans. The RBI brought back 100 tonnes of gold from UK vaults in 2024. This move shows India’s effort to balance economic safety and trade flexibility.

It also shows a plan to cut down on foreign storage. At the same time, it keeps gold trading opportunities in india flowing.

Trade policies greatly affect gold imports and exports in india. Lowering customs duty to 6% helped imports. But, imports fell 63% in February 2024 compared to last year.

This shows the need for better trade rules. For example, working with Russia and CIS countries could make supply chains more stable. This would reduce India’s reliance on traditional markets.

- Customs duty cuts and repatriation aim to optimize forex usage

- Gold ETF inflows of ₹19.8bn signal growing investor trust

- Domestic gold prices hit ₹88,946/10g, up 17% YTD

Global changes like Fed rate hikes and tensions affect India’s gold strategy. Using gold reserves, India can get better trade deals. This is especially true for countries looking for non-dollar settlements.

The RBI now has 11.5% of its forex reserves in gold. This makes gold a key tool for dealing with unstable global markets.

Looking into gold trading opportunities in india could open new doors. Boosting gold-backed exports in jewelry, where exports are rising, can help balance imports and exports. A proposed tax amnesty could also release private gold, easing forex pressures.

These steps fit with India’s goal of financial strength in a world economy that’s not stable.

The Cultural Significance of Gold and Its Economic Implications

In India, gold is more than just a metal. It’s a part of everyday life and traditions. Weddings, festivals, and religious rituals all use gold, making it very important. This importance drives gold investment in india as people hold over 25,000 tonnes of it.

These personal holdings have a big impact on the impact of gold on indian economy. They influence policies and trade.

RBI tries to balance cultural love for gold with economic goals. They use schemes like the Sovereign Gold Bond Scheme to encourage other investments. This helps reduce import pressures.

When foreign investments fall, as they did by $47 billion, RBI buys gold to keep reserves stable. Gold’s popularity also helps domestic markets. Jewelers and artisans get jobs and create economic activity.

Younger people are starting to prefer digital gold or other investments. But, festivals like Akshaya Tritiya still see a surge in gold buying. This mix of old and new traditions and preferences creates challenges and opportunities.

Rising gold prices can help reserves but also strain imports. RBI must find a balance between cultural demand and keeping the economy healthy.

Gold plays a big role in India’s financial strategy. As traditions change, so must policies. New investment options or trade agreements will help tell India’s gold story, showing its cultural identity and economic strength.

Future Outlook: Gold in India’s Diversification Strategy

India’s central bank is working on a plan where gold is key. They bought 20 tonnes of gold in late 2024. This shows they want to diversify. Gold now makes up 10% of India’s foreign exchange reserves.

They might adjust this to match gold price trends in india and global changes.

| Factor | Current Status | Future Strategy |

|---|---|---|

| Gold Holdings | 876.18 tonnes (Nov 2024) | Increase allocation to 12-15% of reserves by 2025 |

| Reserve Diversification | Focus on US Treasuries and SDRs | Expand gold’s role to offset currency risks |

| Risk Management | Volatility from USD fluctuations | Use gold to stabilize forex portfolios |

New tools like digital gold platforms and blockchain-based ETFs are opening up gold trading opportunities in india. These tools let you see your gold holdings anytime. They also make it easier to get into the market.

RBI is looking into these to improve how they manage foreign exchange.

- Digital gold accounts offering fractional ownership

- Blockchain platforms ensuring transparent transactions

- Gold ETFs to attract retail and institutional investors

Global trends like moving away from the dollar and rising inflation are good for gold. Goldman Sachs thinks gold could hit $3,000/ounce by 2025. RBI officials agree.

“Gold’s safe-haven appeal will remain critical as central banks prioritize stability.”

When investing, keep an eye on RBI’s moves. With more global central banks buying gold, India aims to protect against economic risks. They also want to take advantage of new gold trading opportunities in india.

How You Can Benefit from Understanding Gold’s Role in Forex Reserves

Keeping an eye on gold rates in india and the RBI’s reserve plans can lead to better gold investment in india choices. Here’s how:

- Track RBI’s quarterly reports to spot trends in gold holdings. Rising reserves might signal a shift toward safer assets, hinting at potential market shifts.

- Use gold’s role as a safe-haven asset to time purchases. When inflation rises, like during the 2011 surge to $1,500/ounce, buying gold can protect wealth.

- Businesses managing exports/imports can hedge currency risks by aligning payments with gold price movements. A stronger rupee versus gold trends might reduce forex losses.

“Official sector purchases continue at high levels, supported by physical demand,” says Joni Teves of UBS. This shows institutional confidence in gold’s value, which individuals can mirror.

Watch for RBI’s diversification goals. Their push to reduce dollar dependency means gold’s share in reserves may grow, making it a long-term store of value. Use free RBI publications or financial news alerts to stay updated on policy changes impacting gold investment in india.

Stay informed about gold rates in india through platforms like the Bombay Bullion Association. Pair this with RBI’s reserve data to spot opportunities. Understanding how gold stabilizes forex reserves can help you protect savings and grow wealth amid economic shifts.

Conclusion: Gold’s Enduring Value in India’s Economic Framework

Gold plays a big role in the impact of gold on indian economy. It serves as a reserve and a part of daily life. The Reserve Bank of India added 44.76 tonnes this year. This shows their commitment to gold as a protection against currency risks and inflation.

This metal helps keep foreign exchange stable. It also shows India’s deep cultural love for gold in its financial habits.

The gold price trends in india have been rising since 2016. This shows gold’s value as a safe asset during uncertain times. Households hold an estimated 21,000 tonnes of gold. This connects economic strategy with tradition.

Even with digital tools, physical gold is still trusted. It protects against currency changes and inflation.

India is the top gold importer, making up 20% of global purchases. This highlights its special place. The country uses strategies like the 20/80 rule and tax changes to balance imports and demand.

For citizens, tracking gold prices helps with personal investments. It also supports national economic goals.

Gold remains crucial for managing reserves or personal wealth. Its price trends show both local and global needs. Understanding these connections helps see how gold keeps India’s finances strong today and tomorrow.