Exclusive Deals & Trending Items

Muthoot Pappachan Swarnavarsham Gold BIS Hallmarked Ganesh Pendant of 10 gms in 22 KT 916 Purity Fineness

Shop NowKnowing how the gold price works is key for investors and traders. The global gold market is shaped by a few major exchanges. These exchanges are crucial in setting the current gold price.

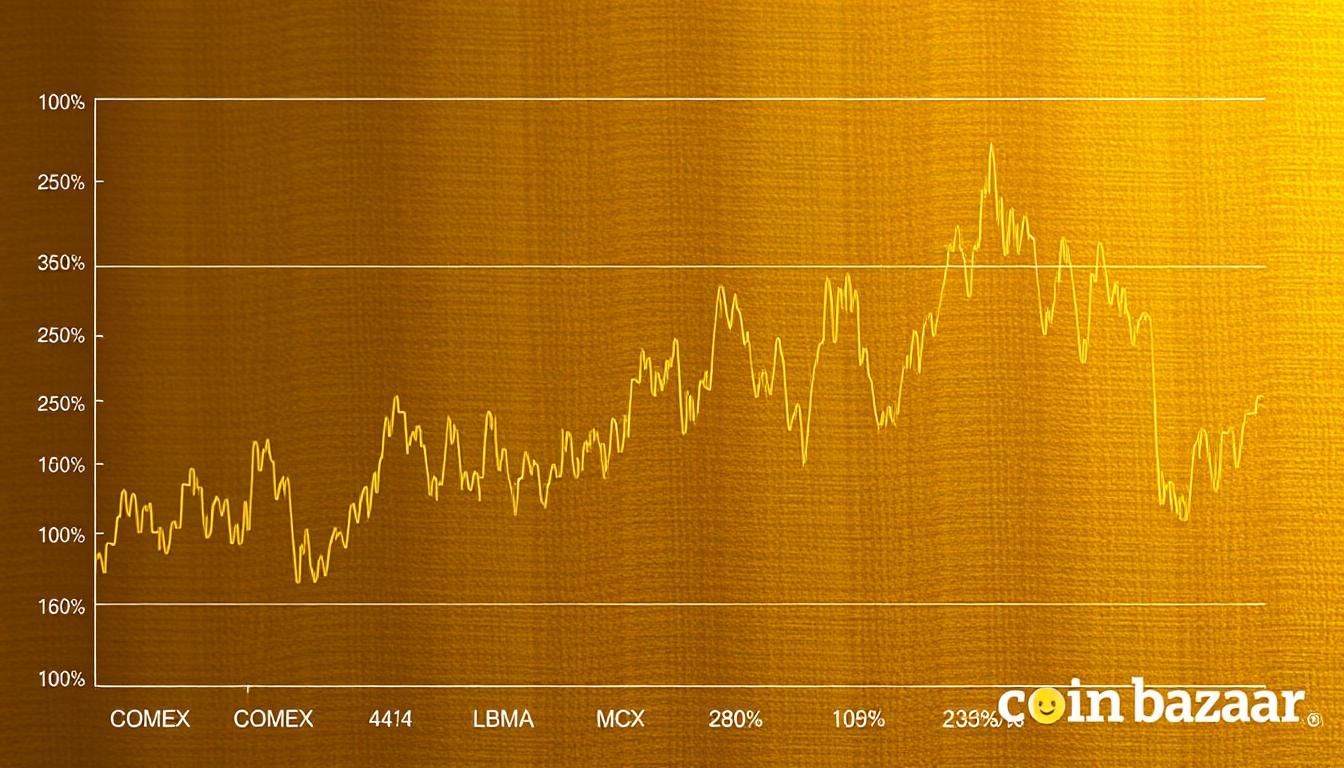

Ever wondered how these exchanges affect the gold price chart? COMEX, LBMA, and MCX are three big exchanges. They help set the gold price by offering a place to trade gold. This trading activity influences the global gold price.

Learning about these exchanges can help you make better choices for your investments in the gold market.

Key Takeaways

- COMEX, LBMA, and MCX are major exchanges influencing global gold price.

- These exchanges provide a platform for gold trading, impacting the current gold price.

- Understanding their role can help investors make informed decisions.

- The gold price chart is affected by the activities on these exchanges.

- Global gold market dynamics are significantly influenced by COMEX, LBMA, and MCX.

Understanding Gold as a Global Asset

Gold’s value as a global asset comes from its long history and current market trends. For investors, knowing gold’s role is key. This is especially true when looking at gold price today and live gold price.

Gold’s Historical Significance as a Store of Value

Gold has been a symbol of wealth for centuries. It was used as a medium of exchange and tied to currency value. Today, it’s seen as a safe asset during economic uncertainty. Its long history adds to its value and shapes the gold price forecast.

The Modern Gold Market Structure

The modern gold market is complex. It involves many players, from investors to industrial users. The market splits into physical and paper gold markets.

Physical vs. Paper Gold Markets

The physical gold market deals with gold bullion, coins, and jewelry. The paper gold market includes financial tools like futures, options, and ETFs. The interaction between these markets impacts the live gold price. Trading in both areas shapes the market.

It’s important for investors to understand the difference between physical and paper gold markets. This knowledge helps them make better decisions based on gold price today and market trends.

What is Price Discovery in Gold Markets?

Gold price discovery is key to setting gold’s value worldwide. It’s shaped by many economic and political factors. Knowing this helps investors make smart choices.

Definition and Mechanisms of Price Discovery

Price discovery in gold markets is about finding gold’s price through buyer and seller interactions. It happens on different exchanges. These exchanges are influenced by supply and demand, and other market factors.

The process involves trading on places like COMEX, LBMA, and MCX. Here, gold futures and spot prices are set.

Factors Influencing Gold Price Discovery

Many things affect gold price discovery. These include supply and demand, and geopolitical events.

Supply and Demand Dynamics

The balance between gold supply and demand drives its price. Supply factors are mine production, recycling, and central bank sales. Demand factors are jewelry use, investment, and industrial needs.

Geopolitical Influences

Geopolitical events like conflicts and economic sanctions can change gold prices. Investors see gold as a safe asset during uncertainty. This increases demand and prices.

| Factor | Impact on Gold Price | Examples |

|---|---|---|

| Supply and Demand | Balances or imbalances affect price | Mine production, jewelry demand |

| Geopolitical Events | Increased demand during uncertainty | Conflicts, economic sanctions |

| Economic Indicators | Influence investor sentiment | Inflation rates, interest rates |

Overview of Major Gold Exchanges

It’s key to know the major gold exchanges to understand how gold prices are set worldwide. The global gold market is complex. It has many exchanges that help set prices.

The Global Gold Exchange Ecosystem

The global gold exchange system includes big players like COMEX, LBMA, and MCX. These exchanges work in different time zones. This creates a never-ending trading cycle.

Trading Volumes and Market Significance

COMEX and LBMA have huge trading volumes. The trading volume on these exchanges affects the live gold price and current gold price.

24-Hour Trading Cycle

The global gold market trades 24 hours a day. When one exchange closes, another opens. This ensures trading never stops. It’s vital for gold price prediction and tracking market trends.

| Exchange | Trading Volume | Significance |

|---|---|---|

| COMEX | High | Primary exchange for gold futures |

| LBMA | Very High | Sets the global gold price benchmark |

| MCX | Significant | Major exchange for gold trading in India |

The way these exchanges work together keeps the gold market liquid. Prices reflect global supply and demand. Knowing this system is vital for investors and traders in the gold market.

COMEX: The Commodity Exchange

COMEX plays a big role in the gold market. It’s a key place where gold prices are set. COMEX is part of the CME Group and is one of the biggest futures and options exchanges globally.

History and Evolution of COMEX

COMEX started in 1933 by merging smaller exchanges. It has grown to be a top spot for trading gold futures. The exchange keeps up with new tech and market changes, staying important in the global market.

COMEX Gold Futures Contract Specifications

The COMEX gold futures contract is a deal to buy or sell gold at a set price later. The details of the contract are:

| Contract Size | 100 Troy Ounces |

|---|---|

| Price Quote | USD per Troy Ounce |

| Tick Size | $0.10 per Troy Ounce |

Trading Mechanisms on COMEX

COMEX uses both electronic and open outcry trading. Electronic trading is fast and cheap. Open outcry lets traders talk and set prices face-to-face.

Electronic Trading vs. Open Outcry

Electronic Trading is quick and cuts costs. Open Outcry is open and lively for setting prices. Both are used on COMEX, meeting different trader needs.

Knowing how COMEX gold futures work is key for gold market success. By looking at the gold price chart and keeping up with the gold price today, investors can make smart choices. This helps them stay on top of the gold price forecast.

How COMEX Influences Gold Price

The COMEX exchange is key in setting gold prices worldwide. It’s a major spot for gold futures trading. This has a big impact on gold price trends.

Price Setting Mechanisms at COMEX

COMEX sets gold prices through its trading. It’s where buyers and sellers trade gold futures. This helps find the fair price of gold.

This process is vital for gold price analysis. It shows what the market thinks.

The Impact of COMEX Trading on Global Gold Prices

COMEX trading affects gold prices globally. It’s one of the biggest gold futures exchanges. Its trading volumes and prices are watched by many.

This makes COMEX a big player in historical gold price trends.

COMEX Settlement Process

The settlement process at COMEX is crucial for gold prices. It makes sure prices are fair and reflect the market. Here’s a quick look at the COMEX settlement process:

| Settlement Type | Description | Impact on Gold Price |

|---|---|---|

| Cash Settlement | Contracts are settled in cash based on the final settlement price. | Reflects market conditions and influences spot prices. |

| Physical Delivery | Buyers receive physical gold, and sellers deliver it. | Affects supply and demand dynamics. |

Knowing the COMEX settlement process is key for investors. By looking at gold price trends and how COMEX works, investors can make smarter choices.

LBMA: London Bullion Market Association

The LBMA is a major player in the global gold market. It has a long history and a strong structure. Knowing about the LBMA is key for smart gold investment choices.

History and Structure of the LBMA

The LBMA started in the early 20th century. It has grown to be a key part of the global gold market. It helps with OTC trading and sets standards for the industry.

The LBMA’s structure makes trading efficient and clear. It includes banks, traders, and refiners. They all help set the live gold price through their deals.

The LBMA Gold Price Benchmark

The LBMA created a gold price benchmark. This benchmark is a key reference for gold price prediction. It’s used worldwide by investors and analysts.

The LBMA Gold Price is set through an electronic auction. Major players in the market take part. This ensures the benchmark reflects the current gold price fairly.

OTC Trading in the London Market

OTC trading is a big part of the LBMA’s work. It lets gold be traded outside of formal exchanges. This adds flexibility and liquidity to the market.

LBMA Clearing System

The LBMA Clearing System is key for OTC trading. It makes settling trades safe and efficient. This lowers the risk in gold transactions.

Key features of the LBMA Clearing System include:

- Secure and efficient trade settlement

- Reduced counterparty risk

- Enhanced market integrity

Understanding the LBMA’s role in the gold market helps you navigate gold trading. It makes you better equipped for smart investment choices.

LBMA’s Role in Gold Price Discovery

LBMA is key in the global gold market, shaping gold prices. As an investor, knowing how LBMA affects gold prices is crucial. This is especially true when looking into gold investments.

The London Fix and Its Global Influence

The London Fix, or LBMA Gold Price, sets a global gold price benchmark. It’s decided twice daily through an electronic auction by the LBMA. This benchmark is vital for setting gold prices worldwide, including gold price chart and gold price forecast analysis.

Its global impact is clear in its widespread use. Many gold price today quotes are based on this benchmark. It’s a key part of the global gold market.

LBMA Good Delivery Standards

LBMA’s Good Delivery Standards ensure gold quality and integrity in London. These standards outline what makes a gold bar ‘good delivery’. This includes purity, weight, and assaying standards.

Impact on Physical Gold Premium

The Good Delivery Standards affect physical gold premiums. Bars meeting these standards are more valuable due to their quality. This affects the premium you pay for physical gold over the benchmark price.

| Standard | Description | Impact on Premium |

|---|---|---|

| Purity | Minimum gold content of 99.5% | Higher purity bars command a higher premium |

| Weight | Bars must be within specified weight ranges | Standardized weights reduce transaction costs |

| Assaying | Bars must be assayed by accredited refineries | Verified quality increases buyer confidence |

Understanding these standards and their market impact is key for informed investment decisions. Whether you’re looking at the gold price chart or the gold price forecast, knowing LBMA’s role is essential.

MCX: Multi Commodity Exchange of India

The Multi Commodity Exchange (MCX) of India is key for gold trading. It shapes gold price trends in the country.

Development and Growth of MCX

MCX started in 2003 and is now a top commodity exchange in India. It offers gold futures among other products. Its growth includes the start of electronic trading, making trading easier and faster.

Learning about MCX’s growth helps you understand the changing world of commodity trading in India.

MCX Gold Contract Specifications

MCX has gold futures contracts that many traders and investors use. These contracts have clear rules on size, trading times, and how they settle. For example, the gold futures contract is for 1 kg, making it easy for many to join.

Regulatory Framework for MCX

The Securities and Exchange Board of India (SEBI) watches over MCX. This makes sure the exchange is fair and open.

SEBI Regulations for Commodity Trading

SEBI rules cover many parts of trading on MCX, like margins and limits. These rules help keep the market fair and safe for investors. Knowing these rules is key for those trading gold on MCX.

By keeping up with SEBI’s rules, you can better understand the MCX gold trading world. This helps you make smarter choices based on gold price analysis and historical gold price data.

MCX’s Impact on Indian Gold Price

The Multi Commodity Exchange (MCX) is key in setting the live gold price in India. Being the largest commodity exchange, MCX greatly affects the gold market.

Price Discovery in the Indian Context

Price discovery is vital for any commodity exchange, and MCX is no different. It offers a place where gold prices are set based on supply and demand. The current gold price in India is heavily influenced by MCX prices.

Many market players, like traders and investors, take part in this process. Their actions on the exchange help find gold’s fair value. This value then impacts physical gold prices across the country.

Correlation Between MCX and Physical Gold Prices in India

There’s a strong link between MCX gold prices and physical gold prices in India. MCX prices act as a guide for physical gold sellers and jewelers. When MCX prices change, it affects physical gold prices too.

Regional Price Variations in Indian Gold Market

MCX’s influence on gold prices is widespread, but there are local price differences. These differences come from local demand, supply chain issues, and taxes. For example, gold prices in big cities like Mumbai and Delhi might vary slightly.

It’s important to understand these factors for smart gold market decisions. By watching the gold price prediction and live prices on MCX, investors and buyers can make better choices.

Interrelationship Between COMEX, LBMA, and MCX

COMEX, LBMA, and MCX are key players in the global gold market. Their connection affects how gold prices are set. These exchanges work together through price links, arbitrage, and global trading hours.

Price Transmission Mechanisms

Price changes on one exchange can affect prices elsewhere. For example, a big change in COMEX gold futures prices can change LBMA spot prices. This then impacts MCX prices. This ensures gold prices stay similar across markets.

Arbitrage Opportunities Between Exchanges

Arbitrage happens when prices differ between COMEX, LBMA, and MCX. Traders make money by buying low and selling high. This helps prices match up across exchanges.

Trading Hours and Global Price Continuity

COMEX, LBMA, and MCX trading hours overlap. This ensures prices stay stable worldwide. COMEX and MCX trade at specific times, while LBMA sets a benchmark twice daily.

How Indian Trading Hours Align with Global Markets

MCX’s hours match international markets, especially COMEX. This integration helps prices adjust in real-time. For Indian investors, the gold price today on MCX is influenced by global events.

Understanding COMEX, LBMA, and MCX is key for global gold market investors. By looking at the gold price chart and staying updated on gold price forecast, investors can make better choices.

Current Gold Price Trends and Analysis

The world of gold trading is always changing. It’s key for investors to keep up with these changes. Knowing the trends can help you make smart choices in the gold market.

Recent Price Movements Across Exchanges

Gold prices have seen big swings on big exchanges like COMEX, LBMA, and MCX. For example, COMEX gold futures have gone up a lot because of world economic worries.

What’s causing these changes? A few big things include:

- Economic signs and global tensions

- What central banks do and how interest rates change

- How currencies, especially the US dollar, move

Technical Analysis of Gold Price Charts

Looking at gold price charts shows us important trends. Patterns and tools like moving averages and Relative Strength Index (RSI) help guess future prices.

Recent charts show a few things:

“The gold price is trying to break through key levels, which could mean a big change or a turn.”

Key Support and Resistance Levels

Finding key support and resistance levels is vital for traders. Right now, gold faces resistance at about $2,050 per ounce. It has support at $1,950 per ounce.

Gold prices often follow seasonal patterns. Some months, like September and October, see higher prices because of more demand.

Knowing these patterns can help investors buy and sell at the best times.

How Exchange Data Affects Your Gold Investments in India

For Indian investors, understanding exchange data is crucial. It helps in making smart gold investment choices. Data from COMEX, LBMA, and MCX gives insights into gold price changes.

Interpreting Price Signals from Different Exchanges

Exchange data shows how gold prices work. By looking at the live gold price and trends on COMEX, LBMA, and MCX, investors can predict gold prices better. This is key for the right time to buy or sell.

“Being good at reading exchange data can really help investors in the gold market,” says a top financial expert.

Strategies for Indian Investors

Indian investors can use exchange data for different strategies. Knowing the current gold price and trends on MCX helps decide between physical and digital gold.

Tax Implications for Gold Investments

Investors should also think about taxes on gold investments. For example, digital gold faces capital gains tax like other investments.

Digital Gold vs. Physical Gold in India

Choosing between digital and physical gold depends on many things. These include investment goals, how much risk you can take, and taxes. Digital gold is easy to buy and store, but physical gold is seen as more real.

By keeping up with exchange data and its effects, Indian investors can make better gold investment choices. This can lead to better results for their investments.

Future of Gold Price Discovery and Exchange Dynamics

The future of gold price discovery is set for big changes. The gold market, key to global finance, is ready for a tech-driven revolution. This will come from new tech and trends in exchange operations.

Technological Innovations in Gold Trading

New tech is changing gold trading. Digital platforms are making gold easier for more investors to get into. This boosts market participation and liquidity. Also, Artificial Intelligence (AI) and Machine Learning (ML) are making price discovery faster and clearer.

Emerging Trends in Exchange Operations

Exchanges are adapting to market needs. The rise of electronic trading platforms is key. They offer quick price quotes and fast trade execution. This digital shift is expected to grow, with exchanges investing in tech.

Blockchain and Gold Trading

Blockchain is changing gold trading. It offers a secure and transparent way to track transactions. This could make gold trading more efficient and trustworthy.

India’s Growing Influence in Global Gold Markets

India, a big gold consumer, is becoming more important in global markets. The MCX, India’s top commodity exchange, plays a big role in gold price setting. As India’s economy grows, so will its impact on global gold markets.

| Exchange | Trading Volume | Influence on Gold Price |

|---|---|---|

| COMEX | High | Significant global influence |

| LBMA | Very High | Benchmark for global gold prices |

| MCX | High | Significant influence on Indian gold prices |

It’s important for investors to understand these changes. By watching gold price charts and staying updated, investors can make better choices.

Conclusion

Knowing how gold prices are set is key for investors, especially in India. The COMEX, LBMA, and MCX are important in setting global gold prices. COMEX leads in setting prices, while LBMA’s benchmarks guide the industry. MCX, a major Indian exchange, influences local prices.

To invest wisely, watch the current gold price, its chart, and live updates. Understanding trends and forecasts helps predict prices. Looking at historical data also offers insights into market behavior.

When thinking about investing in gold, it’s crucial to understand the role of these exchanges. By keeping up with price analysis and predictions, you can make better choices. This way, you can stay ahead in the market.