Exclusive Deals & Trending Items

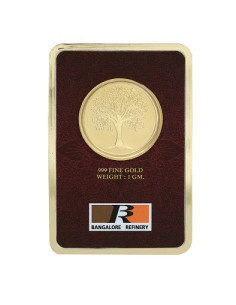

BRPL Bangalore Refinery Banyan Tree Gold Foil Coin Of 1 Grams in 24 Karat 999 Purity / Fineness

Shop NowIndia’s gold market is changing fast, thanks to digital platforms. The market is worth $50 billion and uses 1,000 tonnes of gold every year. Online sales have grown a lot, from 0.5% to over $3 billion by 2019.

Startups like BlueStone and CaratLane are leading this change. BlueStone wants to offer 30,000 styles of designs. CaratLane combines online shopping with six physical stores. They use 3D printing and real-time pricing to offer clear prices.

High-end jewellery still makes up 60% of sales, mostly in stores. But, online sales of cheaper items are growing. The online market is expected to double its share by 2025. Yet, 80% of low-priced items are still bought in stores.

Key Takeaways

- Online gold sales grew from 0.5% to over $3 billion by 2019, driven by tech and convenience.

- BlueStone and CaratLane use 3D printing and virtual tools to boost customization and reach.

- Gold market trends show online platforms offering transparency with real-time pricing and doorstep delivery.

- Traditional stores still dominate high-value jewellery, but online channels are gaining ground in budget-friendly options.

- India’s gold market is blending innovation with cultural preferences, creating a hybrid shopping experience.

The Enduring Allure of Gold in Indian Culture

Gold is more than just metal in India. It’s a big part of daily life and heritage. It shapes gold consumption in india through traditions that have lasted for generations. Let’s see how these traditions influence choices today.

Gold’s Historical Significance in Indian Traditions

Gold has been sacred for over 5,000 years. It marks important life events. Festivals like Akshaya Tritiya and weddings are big for gold demand analysis. These events alone make up 50–60% of annual gold purchases, showing deep cultural loyalty.

The Emotional Value Behind Gold Purchases

Gold is more than an asset; it’s a family treasure. Many view it as a safety net. For example, weddings often include gold as a bride’s “wealth shield,” a tradition based on financial security.

| Category | Impact |

|---|---|

| Wedding/Festivals | 50–60% of annual demand |

| Investment | 25–30% of total demand |

| Inflation Impact | 0.5–1% demand rise per 1% inflation |

Regional Preferences in Gold Jewellery Designs

Regional styles tell unique stories. In the South, temple-inspired jewellery is common. Meanwhile, Rajasthan’s meenakari enamel work is famous. These preferences make gold consumption in india diverse.

- South India: Temple motifs, heavy chains

- Rajasthan: Colorful enamel designs

- Punjab: Elaborate jhumkas and maang tikka

Understanding these traditions helps us see why cultural ties are key to India’s gold story.

Current State of India’s Gold Market

India’s gold market trends are a blend of old traditions and new ideas. In 2024, gold demand hit 802.8 tonnes, a 5% increase from 2023. This growth came from more investment and the rise of digital gold.

Let’s look at the numbers that define today’s market:

| Year | Gold Demand (tonnes) | Value (₹ Crore) |

|---|---|---|

| 2023 | 761 | 393,000 |

| 2024 | 802.8 | 5,15,390 |

Investment demand soared 29% to 239.4 tonnes in 2024, a 12-year peak. Yet, jewellery demand fell 2% to 563.4 tonnes. This change shows how tastes are evolving.

Festivals like Diwali still boost offline sales. But, gold demand analysis reveals online sales now account for 0.5% of the market. This is expected to grow to $3 billion by 2029. Online sales spike during Dhanteras, showing how technology is changing traditions.

RBI’s gold reserves grew from 16 to 73 tonnes in 2024, showing policy changes. Despite a 4% drop in imports, prices rose to ₹85,800/10gms in early 2025. Domestic production could reach 100 tonnes by 2030, saving ₹1.2 billion in forex.

The sector plans to create 25,000 jobs and see investment grow from ₹1,000 crore to ₹15,000 crore in six years.

These numbers show a market that’s finding a balance between old and new. Whether you’re following gold demand analysis or looking at 2030 goals, these changes are important for all buyers and investors.

Understanding Gold Consumption Patterns in India

Gold consumption in India is a mix of old traditions and new trends. In cities, people look for design and convenience, often buying online. In rural areas, trust in local jewelers is key, and gold is seen as a safe investment.

Gold price predictions suggest that higher prices are making people buy gold for important life events like weddings. This is more than just a financial investment.

Urban vs Rural Buying Differences

In cities, online sales of gold have risen by 14%. This is because city dwellers are tech-savvy and like curated collections. On the other hand, 70% of gold sales happen in rural areas, where people trust physical stores.

Retailers say that up to a third of their sales involve exchanging old jewelry for new designs. This shows a desire for fresh looks.

Seasonal Buying Spikes

- Wedding seasons boost demand, with Q4 sales up 18% compared to other quarters.

- Festivals like Dhanteras see 30% higher purchases, often linked to cultural beliefs.

- Gold ETF inflows hit ₹19.8 billion in February, showing investment spikes during market dips.

Who’s Buying Gold Today?

Young professionals now make 40% of new buyers, choosing smaller, modern pieces. NRIs contribute 12% of total demand, favoring digital platforms. Women’s purchasing power grew by 25% in 2024, reshaping gold consumption in india trends.

As gold prices hit ₹85,800/10g, brands like Tanishq and Karan Cutts expand in tier II cities. Expect gold price prediction models to influence buying waves, balancing tradition with digital innovation.

The Traditional Brick-and-Mortar Gold Shopping Experience

In India, gold shopping is a personal affair. For years, local stores have been the heart of family celebrations. But, new gold trading strategies are changing the game, even as 80-85% of gold is still bought in person.

Benefits of In-Person Gold Shopping

Shopping for gold in person offers many perks:

- Touch and judge craftsmanship firsthand

- Negotiate prices directly with sellers

- Verify purity through in-store testing

- Experience rituals like festival purchases

“My grandfather bought my wedding set here; I’ll do the same for my daughter,” says Meera, a repeat customer at Mumbai’s Sarvottam Jewels.

Challenges with Conventional Jewellery Stores

Despite their charm, stores face challenges:

- Limited inventory options

- High operational costs (rent, staff salaries)

- Time-consuming visits for busy urban buyers

| Metric | 2007 | 2023 | 2027 Forecast |

|---|---|---|---|

| Organized Retail Share | 6% | 37% | 42% |

| Physical Store Market Share | 90%+ | 80-85% | ? |

The Role of Trust and Relationships in Gold Purchasing

Long-standing relationships with jewelers keep customers coming back for big events. Yet, younger buyers are looking for clearer prices. Still, 37% of the growth in the organized sector shows that traditional stores are adapting to meet both old and new needs.

The Digital Revolution in Gold Jewellery Retail

India’s gold market trends are changing fast with technology. Startups like BlueStone and CaratLane are at the forefront. They are backed by investors and have big growth plans. Now, you can try on virtual jewellery and get design ideas from chatbots.

- AR/VR lets you see jewellery in real-time, making online and offline shopping closer.

- Chatbots offer 24/7 help, giving you personalized advice and guiding your choices.

- Blockchain ensures ethical and authentic purchases, making online shopping as reliable as stores.

- AI suggests designs based on your tastes, and 3D printing creates custom pieces for you.

Online sites like Voylla and Jaypore support independent designers, offering more choices. Brands use IoT and RFID to track inventory, speeding up deliveries. These changes are not just trends; they’re changing how we shop for gold.

As technology meets tradition, you’ll see stores that mix online and offline shopping. Data and digital tools make sure your preferences shape the future of gold market trends. This means every purchase is smarter and more tailored to you.

How Online Gold Shopping is Transforming Consumer Habits

Online platforms are changing how we find and buy gold. They mix convenience with new tools. The future of gold in india now offers smooth experiences that connect the physical and digital worlds.

Convenience Factors Driving Change

- 24/7 access lets you shop anytime, from anywhere—whether at midnight or during lunch breaks.

- Doorstep delivery now serves 20% of India’s population, with growth expected to 50% by 2026.

- Compare 100+ designs in seconds, reducing the need to visit multiple stores.

Technology Redefining Choices

AR try-on tools let you “wear” jewelry virtually, while 360° views eliminate guesswork. Customization options let you tweak designs—like gem placements or chain lengths—before finalizing. These tools align with gold trading strategies that prioritize transparency and personalization.

Trust-Building Support Systems

Live video consultations with gemologists and instant certification checks make high-value purchases feel secure. Chatbots answer questions instantly, while return policies mirror those of physical stores. This builds confidence for first-time online buyers.

“Digital platforms are not just selling gold—they’re redefining how Indians interact with this timeless asset.”

From tier-2 cities to NRIs, online access has expanded markets. With the sector growing at 28% CAGR, this shift reflects the future of gold in india as tech and tradition converge.

Price Transparency: Online vs Physical Stores

Looking to buy gold jewelry? Knowing about gold price prediction begins with comparing online and offline prices. Online sites clearly show gold investment opportunities costs. But, physical stores might hide fees, making it hard to compare.

Let’s look at the numbers. Online shops save money by not paying for rent or staff. They pass these savings to you. They also offer price alerts and discounts. Physical stores, on the other hand, might charge more but let you check the quality right away. Here’s how they compare:

| Aspect | Online Stores | Physical Stores |

|---|---|---|

| Price Breakdown | Clear lists of making charges, GST, and wastage | Fees often bundled into total price |

| Average Savings | Up to 10% lower than physical stores | Higher margins for location and service costs |

Technology is crucial. The Electronic Gold Receipt (EGR) ensures prices are traceable. The Indian International Bullion Exchange (IIBX) works to standardize rates across the country. Now, over 80% of buyers trust digital tools for fair gold price prediction. With 70% preferring digital payments, online shopping fits today’s trends.

Pro tip: Use online tools to track prices before you go to a store. Compare making charges (5-25% of the total cost) across different sites. Remember, it’s not just about the price—it’s about knowing what you’re paying for.

The Future of Gold in India: Digital and Physical Convergence

Imagine a world where you can browse online and then pick up your items in-store. This mix of digital and traditional methods is changing the

Top jewellers are combining online and offline experiences. They want to make shopping easy and trustworthy. Here’s how it’s happening:

Omnichannel Approaches by Leading Jewellers

- CaratLane has 6+ physical stores and an online shop. You can order online and pick up locally.

- Tanishq uses digital catalogues in stores to show off their collections. Kalyan Jewellers tracks your preferences across platforms with loyalty programs.

- Apps like Airtel-Bajaj’s gold loan apps combine financial tools with buying options. This boosts gold investment opportunities for tech-savvy buyers.

Try-at-Home Services Gaining Popularity

You can now get curated collections to try at home before buying. This is perfect for wedding sets. With 2022 seeing a 265-tonne demand, it’s a big hit. Retailers like CaratLane deliver pieces for you to try at home, combining online ease with hands-on inspection.

Virtual Try-On Technologies

Augmented reality apps let you try on jewellery virtually. Just scan a necklace with your camera to see how it fits. This tech is growing online sales by 15-20% yearly. Even small retailers are using AR filters to show off designs, blending tech with tradition.

This mix of digital and physical isn’t just a trend. It’s your way to safer, smarter gold ownership. Whether you buy online or try in-store, the best choices come from where digital and physical meet.

Gold Investment Opportunities in the Digital Age

Investing in gold has changed. You don’t need to buy jewelry or physical bars anymore. Now, digital platforms offer gold investment opportunities for everyone. Apps like Paytm Digital Gold work with trusted names like MMTC-PAMP.

They let you buy gold in small amounts, starting at just ₹1. This makes investment in gold easy, even with a small budget.

Digital Gold vs Physical Gold: Key Differences

Physical gold needs storage and security. Digital gold lets you own fractions of gold without holding it. Here’s how they compare:

- Cost: Digital platforms charge clear fees. Physical storage adds extra costs.

- Liquidity: Sell digital holdings instantly via apps. Physical sales often take longer.

- Convenience: Track holdings on your phone versus visiting a store.

Exploring Gold ETFs and Sovereign Gold Bonds

Government-backed options like Sovereign Gold Bonds (SGBs) and gold ETFs offer tax benefits. SGBs pay interest while tracking gold prices. ETFs let you invest indirectly in gold markets.

Both are safer than physical storage and great for long-term growth.

Managing Your Gold Portfolio Online

Online tools make tracking your gold holdings easy. Paytm’s app lets you set up SIPs to invest weekly or monthly. The MoneyForLife Planner helps you figure out how much gold you need for goals like weddings or emergencies.

Plus, a single ID secures all transactions, ensuring safety and ease.

Gold Prices Forecast: What to Expect in Coming Years

Tracking gold prices forecast is key for smart buying or investing. Prices have jumped from $1,224.53 in 2010 to $1,934.86 in 2023. This shows global and local trends. Today’s gold price prediction considers inflation, currency changes, and world risks.

Looking ahead, 24-karat gold might move between Rs. 7,021 and Rs. 7,395 per gram. Meanwhile, 22-karat gold could stay around Rs. 6,830. These changes come from:

- USD/INR exchange rate movements

- Central bank policies

- Global supply-demand balances

Experts like Bloomberg and Goldman Sachs have different views. Bloomberg sees $1,913.63–$2,224.22 per ounce for 2024. Goldman expects an average of $2,050, linked to US interest rates. JP Morgan guesses $2,175 yearly, with ING foreseeing a Q4 peak of $2,100. These gold prices forecast ranges show the market’s uncertainty.

Looking further ahead, prices might reach $7,000 by 2030 and $10,000 by 2050. This is due to inflation and the need for safe havens. Analysts at the World Bank and others stress watching these factors. This helps match your buying plan with gold price prediction trends. Stay updated to make choices that fit your financial aims.

How Global Factors Are Shaping India’s Gold Market Trends

Global changes are affecting gold buying in India. Trade rules and currency movements play big roles.

“Gold prices will rebound to Rs 75,000–77,000 per 10 grams, driven by geopolitical tensions and central bank demand.” – Dr. Renisha Chainani, Head Research, Coinbazaar – Gold For All

| Factor | Impact | Example |

|---|---|---|

| Trade Policies | Import duties and tariffs | A 7% price drop after 2024 duty cuts boosted physical demand |

| Currency Movements | USD strength raises local costs | Rupee weakness in 2024 pushed prices to record highs |

| Sustainability Push | Younger buyers favor ethically sourced gold | Brands now highlight eco-friendly supply chains |

Currency changes are key. When the rupee falls against the dollar, gold market trends change. Central banks buying gold worldwide, like China and Turkey, push prices up. For investment in gold, keeping up with global policies is crucial.

- India’s 2024 gold imports hit a record $100 billion, driven by festive demand and duty cuts

- U.S. election uncertainty and Middle East tensions fueled $500 million in gold ETF inflows in Q3 2024

- Over 30% of urban buyers now ask about supply chain ethics before purchasing

When you buy gold online or in stores, remember: global factors affect prices. Keep up with trade news and currency changes to make better choices. The future rewards those who watch both local and global markets.

Security Considerations: Protecting Your Gold Purchases

When buying gold, safety is paramount. As gold consumption in India grows, making sure transactions are safe is crucial. Whether you’re shopping online or in-store, follow these steps to safeguard your investment and feel secure.

- Choose websites with HTTPS and secure payment gateways like net banking or UPI.

- Check for physical addresses, business registrations, and read reviews from other buyers.

- Always review return policies and look for platforms backed by the Reserve Bank of India (RBI) for added trust.

In-store precautions include:

- Verify the dealer’s license and ensure jewellery has BIS hallmarks and authenticity certificates.

- Transport gold purchases in secure packaging and consider using trusted couriers for delivery.

Store gold safely at home using a locked safe or deposit it in bank vaults. Digital gold investors should opt for RBI-regulated platforms that store gold in insured vaults and provide digital certificates for ownership. Always ask for proof of purity—check for 22K, 24K, or 916 purity markings.

By combining smart gold trading strategies with knowledge of gold consumption in India trends, you can ensure your purchases are secure. Whether online or offline, making informed choices protects your investments for future generations.

Hallmarking and Authentication: Ensuring Quality in Both Channels

Buying gold is a big deal. It’s important to know its purity to protect your investment and gold price prediction accuracy. In India, the Bureau of Indian Standards (BIS) has strict rules to prevent fraud. Now, over 40 crore jewellery items have BIS certification.

Each genuine piece has three marks: the BIS logo, purity code (like 22K916), and a unique HUID number. To check, scan the HUID with the BIS CARE app or visit an authorized center. This system stops counterfeits and keeps your gold’s value, key for gold trading strategies.

- BIS Logo: Official seal proving compliance with purity norms

- Purity Mark: 916 = 22K, 750 = 18K

- HUID: Unique ID traceable via app or website

Digital tools like QR codes and blockchain track gold’s journey. Here’s how to stay safe:

- Check for all three BIS symbols

- Test with a magnet (pure gold isn’t magnetic)

- Reject items without a visible HUID

Counterfeiters fake hallmarks, but ignoring these steps risks buying fake gold. Always verify with BIS tools. A study found 30% of unmarked gold is underweight. Knowing these checks protects your investment and ensures accurate gold price prediction for resale.

Customization Options: How Technology is Personalizing Gold Jewellery

Imagine designing a necklace with your favorite gemstones or adjusting a bracelet’s pattern to fit your style. Technology is changing gold market trends by making personalized jewellery easy to get. From 3D printing to AI tools, innovation is changing how we choose our jewellery.

Now, online platforms let you customize every detail. 3D design tools let you see intricate patterns before they’re made. 3D printing turns your ideas into gold pieces quickly. Even complex designs like floral motifs or geometric shapes are affordable.

For weddings, couples can mix traditional symbols with modern twists. This makes each piece truly unique.

- AI Design Assistants: Algorithms suggest styles based on your preferences, saving time.

- Virtual Try-On: AR lets you see rings or earrings on your hands in real time.

- Blockchain Tracking: Verify your gold’s origin and ensure ethical sourcing with a scan.

| Traditional Methods | Technology-Driven Options |

|---|---|

| Fixed designs from jewellers | Custom designs via 3D modeling |

| Limited engraving options | Personalized text or symbols added instantly |

| Long production timelines | Rapid prototyping with 3D printing |

These changes are more than trends—they’re shaping the future of gold in India. Whether it’s a personalized mangalsutra for a wedding or a unique pendant for a milestone, tech ensures your jewellery tells your story. Expect more brands to use AI and 3D tech, offering both creativity and speed. Your next gold purchase could be as unique as you are.

Making the Right Choice: When to Shop Online vs In-Store

Choosing where to buy gold depends on your needs. Let’s break down when each option works best.

For gold investment opportunities, online platforms shine. Digital options like PhonePe or Tanishq’s e-store let you compare gold prices forecast trends instantly. Investors prefer Gold ETFs on exchanges like MCX, while HDFC Bank offers Sovereign Gold Bonds for secure holdings. These choices save time and offer flexible investment sizes.

| Online Shopping | In-Store Shopping |

|---|---|

| 24/7 access, competitive pricing | Physical inspection, instant possession |

| Risk of fraud without certifications | Higher prices, limited designs |

| Secure payment options | Immediate customization |

When buying for weddings or festivals, visiting stores ensures quality. For example, tanishq.com lets you view designs online before visiting showrooms. For routine investments, online platforms like Paytm offer 24/7 access to gold prices forecast data. Always verify BIS hallmarks—online or offline.

- Online works best for small investments (Paytm Gold.

- In-store is ideal for large purchases (wedding sets, heirlooms) needing tactile verification.

Create your strategy: Start online to research gold investment opportunities and compare prices. Visit stores for final checks on high-value items. Use hybrid steps like ordering online and collecting in-store for peace of mind.

Conclusion: Embracing the Changing Landscape of Gold Shopping in India

The future of gold in india is all about mixing old traditions with new tech. Sites like V-Gold are leading the way, offering safe online shopping and investment tools. Soon, blockchain and AI will change how we buy and value gold, making it easier and more personal.

Physical stores are still key for big events and rural areas, where 40% of gold sales happen. But digital platforms are great for the younger crowd. With rules like hallmarking and products like Sovereign Gold Bonds, trust is growing. Tools like ETFs and real-time data help you choose between physical and digital gold.

It’s smart to use both online and offline methods. Look up prices and invest online, but visit jewelers for special items. By staying open to new ideas, you can enjoy gold’s lasting value in Indian culture.