Exclusive Deals & Trending Items

Divine Solitaires Diamond Pendant for Women 18kt Gold Sol. Diamond 0.10 carats BIS Hallmark Certified

Shop Now

Muthoot Pappachan Swarnavarsham BIS Hallmarked Gold Heart Bracelet of 8 gms in 22 KT 916 Purity Fineness

Shop Now

BRPL Bangalore Refinery Mangalyaan / Mars Orbiter Gold Coin Of 5 Grams in 24 Karat 999 Purity / Fineness

Shop Now

Muthoot Pappachan Swarnavarsham Gold BIS Hallmarked Ganesh Frame Pendant of 2 gms in 22 KT 916 Purity Fineness

Shop NowGold is a solid choice for diversifying investments and safeguarding wealth. When deciding between gold bars and coins, physical gold is a straightforward way to begin. This guide compares these options to help you choose based on your goals. Whether you prefer investing in gold bars for long-term storage or coins for their flexibility, we’ll cover the cost, storage, and liquidity differences.

Key Takeaways

- Gold bars cost less upfront, closer to the spot price, making them ideal for long-term holds.

- Coins cost more due to designs and collectible value but are easier to store at home.

- Coins can be sold in small amounts to avoid capital gains tax in some cases.

- Smaller gold bars (1–10g) are flexible but may have higher costs when buying multiples.

- Coins often gain extra value from limited editions, beyond their base metal worth.

Understanding Gold as an Investment Asset

Gold has been a symbol of wealth for over 5,000 years. It has been used as a gold bar investment or coin for stability. Its value remains strong, even in tough times.

For today’s investors, gold protects against inflation and currency changes. It’s a key part of a well-rounded portfolio.

The Historical Value of Gold

“Gold is the only ‘money’ never defaulted on.” – Warren Buffett

Gold has always been valuable, thanks to its durability and rarity. It kept its worth through wars, recessions, and currency failures. Today, central banks hold 17% of global gold reserves, showing its trustworthiness.

Why Gold Remains Relevant in Modern Portfolios

- Acts as a hedge against inflation and stock market volatility

- Global above-ground gold stock: 212,582 tonnes (2023)

- 45% of this gold exists as jewelry, while 22% is in gold bar investment and coins

Investors put 5-10% of their money in gold to balance risks. Its low link with stocks means it gains when stocks fall.

Gold’s Role in Indian Investment Culture

In India, gold is more than just an asset. It’s part of traditions. Weddings, festivals, and family wealth transfers use gold.

While jewelry is big (45% of demand), gold bar investment options like 10-gram bars offer quick cash. The LBMA’s Good Delivery certification ensures these bars are real, important for avoiding fake ones.

Gold Bars: The Cornerstone of Physical Gold Investment

Gold bars, or gold bullion bars, are the purest form of owning physical gold. These rectangular blocks of unprocessed metal give investors direct access to gold’s value. They don’t have design or numismatic premiums, making them a top choice for wealth building through metal.

What Defines a Gold Bar

A gold bar is a solid block of 99.9%+ pure gold, cast into standardized shapes. Unlike coins or jewelry, these bars lack artistic details, focusing purely on metal content. Major producers like the Perth Mint or PAMP SÉNBARAKAYA stamp their marks to guarantee authenticity. This makes them ideal for tracking gold’s spot price without extra costs.

Common Sizes and Weights of Gold Bars

| Size (Grams) | Best For |

|---|---|

| 1g-10g | New investors testing the market |

| 20g-100g | Medium-term portfolio diversification |

| 500g-1kg | High-net-worth investors |

Purity Standards and Hallmarking

All gold bars sold in India must meet Bureau of Indian Standards (BIS) requirements. Look for hallmarks verifying 24K purity (99.95%+ gold). Bars lacking these marks risk being counterfeit. Larger gold bars often display purity grades like 99.99% to appeal to institutional buyers.

Buying gold bullion bars means prioritizing purity and certification over convenience. Their bulk sizes offer cost savings but demand careful storage planning. Always confirm refinery authenticity before purchasing.

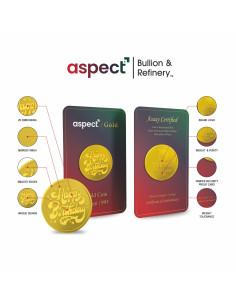

Gold Coins: Traditional Investment with Collector Appeal

Gold coins are a mix of investment and collectible charm. Unlike gold bars, they offer more flexibility. They come in various sizes, from 0.5 grams to 100 grams, making them easier to handle.

Their status as legal tender adds trust. This is a big plus over privately made gold bars.

- Divisible into smaller units for partial sales

- Legal tender status ensures wide recognition

- Potential for numismatic gains beyond spot price

Coins like the United States Bicentennial or British Royal Mint’s Queen’s Beasts series are rare and valuable. Their premiums over spot price show their collectible worth. While buy gold bars for bulk, coins are great for liquidity or cultural interest.

Coins have a story and value beyond their metal. Their design and history, like India’s 10-gram Ashoka Pillar coin, add to their appeal. If you want versatility or cultural significance, coins are a good choice.

Though coins cost more, their demand can make up for the initial price. Compare their benefits to gold bars to find what suits your goals.

Key Differences Between Gold Bars and Coins

When deciding between gold bars and coins, consider practical aspects like cost and use. Let’s explore their main differences to help you with your gold bar investment plans.

Manufacturing Process Comparison

- Gold bars are made by casting or minting, focusing on purity and simplicity.

- Coins, on the other hand, need detailed minting with engravings and security features. Bars are usually 99.99% pure, while coins might mix metals for strength (often 22k or 24k).

Pricing Structure Differences

Bars are more cost-effective. Their simple making process means lower premiums (3-5% over gold’s spot price). Coins, however, have higher premiums (8-16%). For instance, a 10g bar might cost ₹5,000 with a 3% premium, while a coin of the same weight could add ₹400-800 extra.

Liquidity Considerations

Bars are better for liquidity. They are easily sold at near-spot prices by dealers and banks. Coins, though, have varying liquidity: common coins like the ₹2,000 Sovereign sell well, but rare ones might need appraisal. Also, coins take up more space than bars.

| Aspect | Gold Bars | Coins |

|---|---|---|

| Purity | 99.99% (24k) | 22k or 24k |

| Premiums | 3-5% of value | 8-16% of value |

| Liquidity | Quick resale at market rates | Depends on design popularity |

For most gold bar investment goals, bars are simpler and save money. Coins, however, offer collectibility but might need research to get the best value.

Premium Over Spot: Understanding the Real Cost

Every gold purchase has a markup over the spot price. This premium increases the final cost of gold bar prices or coins. Understanding premiums is key to making smart investment choices.

Why Gold Bars Usually Have Lower Premiums

Bars are more cost-effective:

- Simple designs mean lower minting costs, keeping premiums at 3–5%.

- Most buyers focus on gold content, not artistic details.

- Large-scale production lowers per-unit expenses.

When Coin Premiums Might Be Worth Paying

Coin premiums can reach 5–15%+, but they can be worth it:

- Collector demand: Limited-issue coins can increase in value over time.

- Historical value: Coins with cultural themes often gain value beyond their metal worth.

- Investor-friendly designs: Some coins combine investment and collectible appeal.

| Factor | Gold Bars | Gold Coins |

|---|---|---|

| Production Complexity | Minimal (basic shapes) | High (detailed engravings) |

| Premium Range | 3–5% of spot price | 5–15% or more |

| Main Value Driver | Weight and purity | Design and rarity |

Storage Considerations for Your Gold Investment

When you invest in gold bars or coins, picking the right storage is key. Gold bars are bigger than coins, so they need different storage. Let’s look at your choices to keep your gold safe and easy to get to.

- Home storage: Use a fireproof safe with burglar-resistant features for small quantities.

- Bank lockers: Ideal for larger holdings, offering 24/7 surveillance but limited access hours.

- Professional vaults: Third-party services provide insured storage with real-time tracking for high-value gold bars.

| Storage Option | Pros | Cons |

|---|---|---|

| Home Safe | Immediate access, low monthly cost | Risk of theft, limited space |

| Bank Locker | High security, verified by institutions | Access during banking hours only |

| Third-Party Vault | 24/7 monitoring, insurance coverage | Monthly fees apply |

Always invest in gold bars with storage costs in mind. Don’t keep big gold bars at home—choose bank lockers or vaults. Places with controlled climate stop corrosion. Keep all receipts and proof of authenticity for insurance.

Do regular checks and store in secret places (like hidden wall spots) to lower risks. Remember, long-term storage costs can affect your returns. Choose insured options to keep your investment safe over time.

Where to Buy Gold Bars in India: Trusted Sources

Choosing the right place to buy gold bars is important. It ensures you get real gold at a fair price. Banks, government-certified dealers, and online platforms each have their own benefits. Here’s how to pick the best one:

Banks and Financial Institutions

Start with trusted banks like ICICI, HDFC, and SBI. They sell gold bars with BIS certification. You can order online and pick up at a branch. Their security is top-notch, but prices might be a bit higher.

Government-Approved Dealers

MMTC-PAMP and BIS-certified retailers offer good prices. Their gold bars are 24K and pure. Look for dealers with tamper-proof packaging and buyback guarantees.

Online Marketplaces and Their Reliability

Platforms like SafeGold and Paytm Gold deliver gold bars to your door. eBullion lets you own digital gold starting at ₹100. Make sure sellers are BIS certified and offer secure payment options.

| Factor | Banks | Government Dealers | Online Marketplaces |

|---|---|---|---|

| Purity | 24K, BIS Hallmark | 24K, BIS Hallmark | 24K, BIS Hallmark |

| Pricing | Higher premiums | Competitive | Competitive |

| Delivery | Branch pickup | In-store pickup | Doorstep delivery |

| Minimum Investment | ₹5000+ (10g bars) | ₹1000+ (1g bars) | ₹100+ (digital) |

| Ownership | Physical bars | Physical bars | Physical or digital |

- Verify BIS certification before finalizing any purchase.

- Check return policies for online platforms.

- Compare premiums across sources using price charts on official websites.

Always choose sellers with clear prices and third-party audits. For beginners, start small with online platforms. Whether you buy physical bars or digital units, make sure it’s authentic to protect your investment.

Authentication and Avoiding Counterfeit Gold

When you buy gold bars or gold bullion bars, it’s crucial to check their authenticity. Look for hallmarks, small marks on genuine items. These include purity (like 24K), BIS certification symbols, and the assayer’s code.

These hallmarks confirm your gold bullion bars meet India’s quality standards.

- Check hallmarks for BIS certification and purity details.

- Verify the weight and dimensions against official specifications.

- Perform a magnet test: Real gold isn’t magnetic.

At home, you can use a magnet test and look for smooth surfaces and sharp edges. For more detailed checks, labs use XRF (X-ray fluorescence) or ultrasonic scans. These tests detect metal composition or hidden flaws like tungsten cores.

Always ask for assay certificates and tamper-proof packaging from reliable sellers.

When buying gold bars, avoid sellers without certification. Choose banks, BIS-authorized dealers, or members of the India Bullion & Jewellers Association. Opt for new gold bullion bars from trusted sources, as pre-owned items without packaging are riskier.

Remember, counterfeiters might copy designs, but details are key. Look for weight discrepancies, blurry engravings, or dull finishes. These could be signs of fraud. Choose gold bullion bars that meet the London Bullion Market Association’s Good Delivery Standard for international trustworthiness.

Gold Bar Prices: What Influences Their Value

Changes in gold bar prices come from both global and local factors. Understanding these helps you make better choices in the market. Let’s explore what drives these prices.

International Market Factors

Global trends set the base for gold bar prices. Shortages or mining issues can raise costs. When interest rates drop, investors often buy gold, increasing prices.

Geopolitical tensions, like conflicts in the Middle East, also raise demand. The London Bullion Market Association (LBMA) updates prices twice a day, affecting global standards.

Local Premiums in the Indian Market

In India, buyers face extra costs due to taxes and demand. GST and import duties add to the price. Brands like Valcambi and PAMP Suisse charge more for higher purity and reputation.

A 1kg Valcambi bar costs more than smaller sizes. PAMP’s 99.99% pure bars are pricier than lower purity ones.

Seasonal Variations in Gold Pricing

- During festivals like Diwali or Akshaya Tritiya, demand surges drive up gold bar prices.

- Wedding seasons in India also create short-term price jumps due to increased buying.

- Track seasonal trends to buy when prices dip post-festival.

Watching these trends helps you time purchases. Use apps or financial news to stay updated on shifts in gold bar prices. Seasonal lows can offer better deals if you plan ahead.

Tax Implications of Gold Investment in India

When you think about gold bar investment, taxes are a key factor in your earnings. Here’s what you need to know to follow the rules and save money.

- Capital Gains Tax: If you sell gold bars you’ve had less than 3 years, you’ll pay income tax on the gains. But, if you hold them for 3+ years, you’ll only pay a flat 12.5% tax (after the 2024 budget changes).

- GST & Purchase Costs: Every time you buy gold bars or coins, you’ll add 3% GST to the cost. This is a rule for all purchases.

- Gifts and Limits: Gifts over ₹50,000 from people you’re not related to are taxed. Also, remember the ownership limits: 500g for married women, 250g for unmarried women, and 100g for men. These limits help you avoid trouble with the law.

The 2024 tax updates made things simpler: gold bar investment now has a 12.5% LTCG rate without indexation. SGBs held until maturity don’t face LTCG, but ETFs are taxed at 12.5% after 12 months. Always keep records like purchase invoices. For big transactions (over ₹2 lakh), you’ll need a PAN number.

When deciding between physical gold and other options like ETFs or bonds, think about the taxes. Planning well helps you only pay what you should and avoid surprises at tax time.

Best Gold Bars to Buy for First-Time Investors

Starting your gold journey? Choosing the best gold bars to buy depends on your budget and goals. Let’s simplify your options with trusted brands and sizes tailored to beginners.

Entry-Level: Start Small, Build Smart

Begin with 1-10g bars to test the waters. PAMP Suisse’s 1g Fortuna bar uses Veriscan anti-counterfeit tech and costs under ₹50,000. Valcambi’s 20g CombiBar splits into 2g pieces for easy selling. Both come with assay certificates, ensuring authenticity.

Mid-Range: Balance Cost and Liquidity

- 20-50g bars like the Perth Mint’s 10oz (31.1g) option offer better value. These start around ₹1 lakh and include tamper-proof packaging.

- Credit Suisse’s 50g bar, certified by Swiss experts, stays liquid in global markets.

- Auriz’s 25g bars, sold with assay cards, let you grow your portfolio without overspending.

High-Value Options: Long-Term Wealth Storage

For larger budgets, best gold bars to buy include Valcambi’s 1kg bar (₹5 lakh+) or Royal Canadian Mint’s 100g bullion. These have 999.9 purity and bank-grade security. Note: Smaller portions of these may be harder to sell partially.

“Stick to 99.99% pure bars from certified mints. Certification matters most for resale,” advises the World Gold Council.

Always check hallmark stamps and request assay cards. Cast bars (like PAMP’s) are better for long holds; minted bars (Perth Mint’s) appeal to collectors. Start small, verify authenticity, and grow gradually—your portfolio will thank you later.

24K Gold Bars vs. 22K Gold: Making the Right Choice

When picking between 24k gold bars and 22K gold, think about purity and purpose. 24K gold is almost 100% pure, at 99.9%. On the other hand, 22K gold is 91.6% pure. The difference comes from the metals mixed in 22K, like copper, which makes it stronger but less pure.

| Feature | 24K Gold Bars | 22K Gold |

|---|---|---|

| Purity | 99.9% (999 fineness) | 91.6% (916 fineness) |

| Use | Investment, trading | Jewelry, everyday wear |

| Resale Value | Higher due to purity | Lower, but popular in jewelry markets |

24k gold bars are great for investing because of their high purity. They keep their value close to global gold prices. They’re perfect for quick buying and selling. On the other hand, 22K gold is better for jewelry because of its durability. But it’s not as good for pure investment.

- Choose 24k gold bars for long-term wealth storage

- Pick 22K if you need jewelry that’s wearable and culturally preferred

- 24K avoids making charges, but 22K jewelry may cost more upfront due to craftsmanship

In India, many prefer 22K jewelry for cultural reasons. But for pure investment, 24k gold bars are better. Always choose based on your goals—whether it’s for investment or jewelry.

How to Create a Balanced Portfolio with Gold

Mixing gold with other assets is key to managing risk. Experts say gold should be 5–15% of your investments. This balance ensures safety and growth without risking too much.

Determine Your Ideal Gold Allocation

First, think about your goals. If you invest in gold bars, they can be a steady base. Advisors suggest holding gold for at least 10 years for the best results. Remember, physical gold like bars or coins costs more to store than digital options.

Combine Different Forms of Gold Investment

- Pair invest in gold bars with coins for diversification.

- Blend physical gold with ETFs or government bonds for flexibility.

- Choose smaller bars if you prefer liquidity over large purchases.

Diversify Beyond Gold

Gold is most effective when part of a larger mix. Include:

- Equities (stocks) for growth potential.

- Fixed income (bonds) for steady returns.

- Cash reserves for emergencies.

Gold’s value often moves opposite to stocks, so balancing both can smooth out market swings. Regularly review your portfolio to adjust allocations as markets change. Small steps today can build a safer financial future.

Special Considerations for Indian Investors

Gold is a big part of Indian culture, seen in weddings, festivals, and as a savings option. When picking gold bars or coins, cultural values play a big role. Many low-income families choose gold over bank accounts, seeing it as a safe way to save against inflation. But, how do you deal with taxes, timing, and rules?

- Seasonal trends: Demand peaks during Akshaya Tritiya and Dhanteras, sometimes driving prices up 10-15%.

- Tax smart: Hold gold bar investment for over 3 years to qualify for LTCG tax exemption up to ₹1 lakh. Use indexation to reduce capital gains.

- Buy wisely: 30% of investors allocate bonuses to gold, but check purity via HUID hallmarks. Avoid cash purchases—PAN is required for transactions above ₹2 lakh.

Jewellers sell 80-85% of gold offline, but online sales are growing. For tax breaks, Sovereign Gold Bonds offer 80C deductions. Remember, 30-40% of coin sales spike during festivals, making timing crucial. Whether you choose gold bars for liquidity or coins for gifting, match your choice with your goals and the market’s seasonal shifts.

Alternatives to Physical Gold Ownership

Storing gold bullion bars isn’t the only way to grow your gold investments. Explore these alternatives for a hands-off approach to building wealth with gold:

Gold ETFs and Mutual Funds

Gold ETFs let you own gold without holding physical gold bars. These funds track global gold prices and can be traded like stocks. Benefits include low costs and no storage worries. However, you won’t own actual gold bullion bars—only shares representing their value.

Sovereign Gold Bonds in India

- Issued by the Reserve Bank of India, these bonds pay 2.5% annual interest.

- No need to store gold bars—earn returns through paper certificates.

- Capital gains tax exemptions apply if held to maturity.

Digital Gold Options

Apps like SafeGold and Paytm Gold let you own fractions of gold bullion bars. You can buy small amounts (even ₹100) and sell anytime. Storage fees apply, but some platforms offer conversion to physical gold bars for a fee. Ideal for small investors.

Conclusion: Making Your Gold Investment Decision

When choosing between gold bars and coins, think about your goals. Gold bars are cheaper for big investments, like 1kg sizes, saving about 1% in costs. Coins are better for selling small parts without high fees, perfect for quick changes.

Start with small coins or entry-level bars (1–50g) if you’re new to investing. This lets you test the market. For bigger investments, bars save money because of their bulk sizes. Mixing both can be smart: bars for savings, coins for tax benefits.

Storage and safety are key. Coins are easy to hide or split, while bars need secure vaults. Buy from trusted dealers to avoid fakes. Physical gold is valuable but diversify with ETFs or Sovereign Gold Bonds to manage risk.

Choose based on your budget and lifestyle. Whether it’s bars for cost or coins for flexibility, your investment should match your financial goals. Gold is a good hedge against inflation, but make sure it fits your unique situation and market conditions.