Exclusive Deals & Trending Items

You’ve probably heard about digital gold investment becoming more popular. It’s a new way to invest in gold that’s easy and convenient. Unlike traditional gold investment, it doesn’t require physical storage.

Digital gold lets you buy and sell gold online. You don’t need to worry about storing it physically. This makes it a great choice for those who want to add digital assets to their portfolios.

When thinking about investing in digital gold, it’s important to know the good and the bad. You need to understand the risks and the benefits. This includes how it fits into the world of cryptocurrency investment and your overall strategy.

Key Takeaways

- Digital gold offers a convenient and accessible way to invest in gold.

- It eliminates the need for physical storage, reducing logistical challenges.

- Investors can diversify their portfolios with digital assets.

- Understanding the risks and opportunities is crucial.

- Digital gold is part of a broader cryptocurrency investment landscape.

What is Digital Gold?

Digital gold is a new way to buy, sell, and own gold. It’s easier and more convenient than traditional gold investment. Thanks to blockchain technology and online platforms, you can invest in gold without holding it physically.

Definition and Basic Concept

Digital gold is a digital version of gold, perfect for online transactions and storage. It’s like online gold trading but backed by real gold. When you invest in digital gold, you’re buying a digital asset that’s tied to real gold.

Evolution of Gold as an Investment

Gold has always been a solid investment choice. It protects against inflation and market ups and downs. Now, investing in gold has changed, moving from physical coins and bars to digital gold investment. This change has made gold more available to more people.

Digital Gold vs. Traditional Gold

Digital gold and traditional gold differ in form and trading. Digital gold is only digital and traded online. Traditional gold is physical and needs storage. Digital gold is easier to trade and store, appealing to those who want to invest in gold without the hassle of physical gold.

The Digital Gold Market in India

The digital gold market in India is growing fast. More people are choosing online gold trading. This is because digital gold is easy to use, accessible, and safe.

Current Market Size and Growth

The Indian digital gold market has grown a lot lately. More people know about it and use digital payments. This growth is expected to keep going as more look for safe investments.

Understanding the market can help you. The demand for gold is up, and digital platforms make it easy to invest.

Major Players in the Indian Market

Big names lead the Indian digital gold market. MMTC-PAMP, SafeGold, and Paytm Gold offer various services. They make investing in gold safe and clear.

Choosing a digital gold platform is important. Look at what they offer, their fees, and how secure they are.

Consumer Adoption Trends

More people are choosing digital gold. It’s easy to invest and you can buy small amounts. Many prefer digital gold over physical gold for its convenience and lower costs.

Knowing these trends can help you invest wisely. The move to digital gold will likely keep growing as technology improves and more learn about its advantages.

How Digital Gold Works

Digital gold is an investment that lets you own gold without having it physically. You can buy it online through easy-to-use platforms. This makes investing in gold simple and accessible.

Purchase and Storage Mechanisms

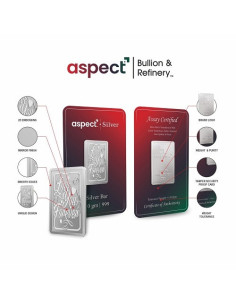

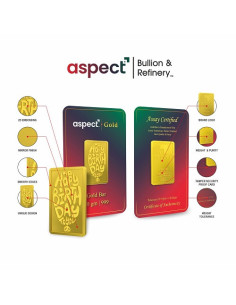

You can buy digital gold online and it’s stored in safe vaults. These vaults are run by trusted companies. Blockchain technology makes sure your gold is safe and its ownership is clear.

After buying digital gold, you get a digital certificate. This shows you own it. Companies work with refineries and vaults to make sure the gold is real and pure.

Pricing and Transparency

Digital gold’s price is always clear. It’s set by the current gold market price. Many sites show the price in real-time, helping you make smart choices.

A financial expert says, “Transparency in pricing is crucial for investor confidence.”

Redemption Options

Many platforms let you turn your digital gold into physical gold or cash. The steps to do this vary by site. Some might ask for extra fees or have special rules.

For example, some sites let you get physical gold sent to you. Others might let you sell your digital gold for cash.

Popular Platforms for Investing in Digital Gold

You can now invest in digital gold through many online platforms. These sites make it easy and safe to buy, store, and manage your gold investments.

MMTC-PAMP

MMTC-PAMP is a partnership between MMTC Ltd. and PAMP Group. It offers a solid platform for digital gold investment. It provides certified gold and is easy to use for investors.

SafeGold

SafeGold is a well-known platform for digital gold investment. It has easy redemption and flexible investment options. This makes it a favorite among investors.

Paytm Gold

Paytm Gold is from Paytm, a leading digital payments company. It lets users invest in gold with minimal entry barriers. It also offers a smooth user experience.

PhonePe Gold

PhonePe Gold is on the PhonePe platform. It has competitive pricing and transparent transactions. This makes it a great choice for investors.

When picking a platform for digital gold, look at fees, storage options, and redemption processes. Here are some important things to consider:

- Platform reputation and credibility

- Fees for buying, storing, and redeeming gold

- Ease of use and user interface

- Customer support and service

By knowing what these platforms offer, you can choose the best place to invest in digital gold.

Benefits of Investing in Digital Gold

Digital gold brings a new spin to a classic investment, offering many benefits. If you’re looking to diversify your portfolio, knowing the perks of digital gold is key.

Accessibility and Convenience

Digital gold is easy to access and use. You can invest from anywhere, at any time, through digital platforms. This means no need to deal with physical gold, making it a simple choice.

“The ease of investing in digital gold is unmatched,” say experts. It’s a big plus for those wanting to invest in gold without the hassle of physical gold.

Lower Entry Barriers

Digital gold investment platforms are easier to start with than traditional gold. You can begin with a small amount of money. This makes it open to more investors.

Purity Assurance

Digital gold ensures the gold’s purity. It’s backed by physical gold stored safely. This gives you confidence that your gold is of high quality.

Purity assurance is a big plus. It ensures your investment’s value. With digital gold, you know your gold is pure and verified.

Liquidity Advantages

Digital gold also offers quick buying and selling. You can easily adjust your investments based on market changes or personal needs. This is a big plus compared to other gold investments.

Being able to quickly sell your assets is important. Digital gold lets you do this, making it a great choice for those who value quick access to their money.

Potential Risks and Challenges

Digital gold has many benefits, but it also comes with risks. It’s important to know these risks before investing. This way, you can make smart choices.

Platform Risks

One big risk is the platform itself. Platform risks include fraud, technical issues, or even the platform going bankrupt. Always check the platform’s trustworthiness and security before you invest.

Regulatory Uncertainties

Regulatory uncertainties are another big risk. The rules for digital gold are still changing and differ by place. Changes in laws can affect your investment’s value and how easy it is to sell.

Storage and Insurance Concerns

Even though digital gold is stored online, storage and insurance concerns still exist. Make sure the platform you choose has good storage and insurance. This will help protect your investment from loss.

Market Volatility

Market volatility is a risk for any investment, including digital gold. The price of digital gold can change quickly because of market and economic factors. Be ready for price changes and think about how much risk you can handle before investing.

Knowing these risks helps you deal with the digital gold market better. It’s key to stay updated and consider these challenges when planning your investment.

Digital Gold vs. Other Gold Investment Options

Digital gold is just one of many ways to invest in gold. Each option has its own benefits. Knowing the differences between digital gold and other gold investments is key.

Comparison with Physical Gold

Physical gold is a traditional choice, offering a real asset. Digital gold, however, provides the same benefits without the need for physical storage. You can buy digital gold online and have it stored safely by the seller.

This avoids risks like theft or damage that come with physical gold.

Gold ETFs and Mutual Funds

Gold ETFs and mutual funds are also popular. They let you invest in gold without holding the metal. Yet, they can be affected by market changes and have fees. Digital gold, backed by real gold, doesn’t have these fees.

Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) are government-issued, denominated in gold grams. They offer a fixed return plus gold’s value increase. While SGBs are a solid choice, they’re less liquid than digital gold, which is easier to buy and sell.

| Investment Option | Liquidity | Storage Risk | Fees |

|---|---|---|---|

| Digital Gold | High | Low | Minimal |

| Physical Gold | Medium | High | Storage and Insurance |

| Gold ETFs | High | Low | Management Fees |

| Sovereign Gold Bonds | Low | Low | None, but locked-in period |

Regulatory Framework for Digital Gold in India

The rules for digital gold in India are changing fast. If you’re thinking about investing in digital gold, knowing the current rules is key.

Current Regulations

The rules for digital gold in India aim to keep investments safe and fair. They make sure digital gold sites are open and honest.

Key aspects of current regulations include:

- Security measures to protect investments

- Transparency in pricing and transactions

- Compliance with anti-money laundering (AML) and know-your-customer (KYC) norms

| Regulatory Aspect | Description |

|---|---|

| Security Measures | Ensuring the safety of investments through robust security protocols |

| Transparency | Clear pricing and transaction processes |

| AML/KYC Compliance | Adherence to anti-money laundering and know-your-customer regulations |

Future Regulatory Developments

As digital gold grows, new rules might come to help more. These could include better protection for investors, stricter money rules, and clearer tax rules.

Regulatory bodies will keep updating the rules. They aim to tackle new challenges and chances in the digital gold world.

Tax Implications of Digital Gold Investments

Exploring digital gold investments means knowing about taxes. Like other investments, digital gold has its tax rules. These rules can affect your earnings.

Income Tax Considerations

Digital gold investments face the same tax rules as physical gold. Any profit from selling digital gold is taxed as capital gains tax. If you sell it within 36 months, it’s seen as short-term capital gains.

This type of gain is taxed based on your income tax bracket. Selling it after 36 months makes the profit long-term capital gains. These gains are taxed at 20% with indexation benefits.

GST and Other Applicable Taxes

Digital gold also faces Goods and Services Tax (GST). GST is charged on the premium or making charges. But, it’s not applied to the gold’s value itself. Always check with your platform for GST rates and other taxes.

Knowing these tax rules helps you make better choices with digital gold investments.

Security Aspects of Digital Gold

Exploring digital gold means knowing how it keeps your money safe. Digital gold sites use strong security to protect your investments. They offer a safe place for buying and storing gold.

Storage Security Measures

Digital gold is kept in vaults with top-notch security. This includes alarms, cameras, and strict access rules. These vaults are run by trusted companies that focus on metal storage.

The storage places are also insured. This adds more protection against loss or theft.

Transaction Security

Buying and selling digital gold is safe thanks to encryption and secure connections. This keeps your deals safe from hackers. Digital gold sites also use two-factor authentication and other safety steps to stop scams.

Insurance Coverage

Many digital gold sites offer insurance for the gold in their vaults. This means you’re covered if something bad happens to your gold. The insurance gives you extra peace of mind when you invest in digital gold.

Learning about digital gold’s security helps you invest with confidence. You know your money is safe thanks to strong security measures.

Digital Gold vs. Cryptocurrency Investments

When looking at investment options, it’s key to know the difference between digital gold and cryptocurrency. Both are digital assets but have different uses and features.

Risk-Return Profile Comparison

Digital gold and cryptocurrency have different risk-return profiles. Digital gold is seen as a stable investment, backed by gold’s value. This makes it less likely to swing wildly in value. Cryptocurrencies, however, are known for their big swings, offering big potential gains but also big risks.

Think about your risk tolerance and goals before choosing. If you want a safe spot during tough times, digital gold might be better. But if you’re okay with taking big risks for big rewards, cryptocurrency could be the way to go.

Regulatory Differences

The rules for digital gold and cryptocurrency are different. Digital gold follows the rules of gold trading, making things clearer. Cryptocurrencies, though, face a less clear regulatory path, with governments still figuring out how to handle them.

This difference in rules can affect your choice. Digital gold’s clearer rules might give you a sense of security and stability.

Creating a Digital Gold Investment Strategy

To invest in digital gold, you need a solid plan. This plan should match your financial goals. It’s important to consider several key points to make sure your investment in digital gold works well.

Setting Investment Goals

Having clear investment goals is key to a good digital gold strategy. You should decide what you want to achieve, like growing your wealth or protecting it from inflation. Clear goals help guide your investment decisions and keep your investments on track with your financial plans.

- Identify your financial goals and risk tolerance.

- Consider your investment horizon and liquidity needs.

- Assess how digital gold fits into your overall investment portfolio.

Determining Allocation in Portfolio

Finding the right amount of digital gold in your portfolio is important. You need to look at your financial situation, how much risk you can take, and your investment goals. A diversified portfolio with different types of investments can help lower risks. The amount of digital gold should match your personal financial situation and goals.

“Diversification is the only free lunch in finance.” – Harry Markowitz

It’s a good idea to talk to a financial advisor to figure out the best amount for you.

Timing Your Investments

When you invest in digital gold can affect how much you make. It’s important to know about market trends and economic signs that can change gold’s price. While it’s hard to always time the market right, using a disciplined investment approach can help. Methods like dollar-cost averaging can lessen the effect of market ups and downs.

- Monitor market trends and economic indicators.

- Consider using dollar-cost averaging to reduce timing risks.

- Stay informed about regulatory changes that could impact digital gold.

Common Mistakes to Avoid When Investing in Digital Gold

To get the most from digital gold, knowing what not to do is key. It’s a smart way to spread out your investments. But, you must think carefully about a few important things.

Platform Selection Errors

Choosing the wrong place to invest in digital gold is a big mistake. There are many options like MMTC-PAMP, SafeGold, Paytm Gold, and PhonePe Gold. It’s important to look at their security, how easy they are to use, and their customer service. Picking a trusted platform can protect your money and make your experience better.

Ignoring Terms and Conditions

Many investors skip reading the fine print of digital gold platforms. This can lead to unexpected problems. It’s important to know how to get your money back, any storage fees, and other costs. Reading the terms and conditions carefully helps you avoid trouble and make better choices.

Overlooking Fees and Charges

Not paying attention to fees can reduce your profits. Digital gold platforms have fees like storage, transaction, and redemption costs. Knowing these can help you pick the best option and increase your earnings. Always consider these costs when you’re thinking about your potential gains.

Knowing these common mistakes helps you invest in digital gold wisely. As Rakesh Jhunjhunwala, a famous Indian investor, said,

“The stock market is a device for transferring money from the impatient to the patient.”

This quote shows why patience and smart choices are crucial in investing, including in digital gold.

Future of Digital Gold Investments in India

Digital gold investments in India are set to grow, thanks to technological advancements. The country is moving towards digital payments and online investments. This means more people will be interested in digital gold, which could be good for you if you’re thinking about investing.

Technological Advancements

The future of digital gold in India will be shaped by new tech. We’ll see better security, easier-to-use websites, and faster transactions. For example, new encryption and safe storage will protect your gold investments.

Here’s a look at what’s changing in digital gold platforms:

| Feature | Current | Future |

|---|---|---|

| Security | Basic Encryption | Advanced AI-driven Security |

| User Interface | Standard UI | Personalized User Experience |

| Transaction Speed | Standard Processing | Real-time Transactions |

Market Expansion Predictions

The market expansion of digital gold in India is expected to grow. More people will learn about its benefits, like easy investment and guaranteed purity. This will make the market bigger.

Expect the digital gold market to expand as new platforms start and old ones grow. This growth will come from clearer rules and new tech. Digital gold will become a more appealing choice for investors.

Conclusion

Digital gold investment is a modern way to invest in gold. It’s easy to get into and offers many benefits. These include lower entry costs, guaranteed purity, and easy access to your gold.

But, it’s important to know the risks too. These include risks from the platform, unclear regulations, and market ups and downs. Knowing these risks helps you make better choices when investing in digital gold.

The digital gold market is growing and changing. New technologies and more market players are coming. With the right approach and knowledge, you can take advantage of these changes.

In the end, investing in digital gold can add value to your portfolio. It combines the traditional value of gold with the convenience of modern technology.