Exclusive Deals & Trending Items

MMTC PAMP Silver Coin Laxmi Ganesh of 10 Gram in 999.9 Purity in Certicard & Capsule as per availability/Fineness

Shop Now

Kundan Lakshmi Gold Bar Of 2 Grams + Kundan Logo Gold Coin Of 0.5 Grams 24 Karat in 999.9 Purity COMBO SET

Shop Now

Muthoot Pappachan Swarnavarsham Gold Hallmarked Rose Coin of 8 gms in 22 KT 916 Purity Fineness

Shop Now

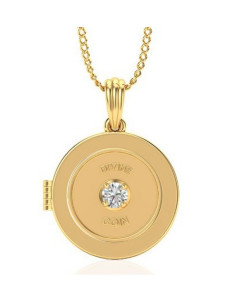

Divine Solitaires 10Kt Gold Jacket with 0.14 carats EF VVS Diamond Studded in 2gm 22kt Gold Coin

Shop Now

Buying Gold in India is more than just a financial move. It’s a mix of tradition and timing. Cultural beliefs and market trends are both important in finding the best time to buy. For example, festivals like Akshaya Tritiya or Diwali/Dhanteras are seen as lucky times.

January is also a good time because Gold prices tend to be lower. This is because demand drops after the festivals. But, timing isn’t just about luck. It’s about strategy.

Auspicious days like Ugadi, Navratri, or Thursdays are chosen for their astrological significance. Thursdays and Pushyami are also favored for their planetary influences. On the other hand, Tuesdays and Rahukaal hours are avoided.

Keeping an eye on inflation, global events, and market changes is also crucial. This adds another layer to smart buying.

Key Takeaways

- Akshaya Tritiya and Diwali/Dhanteras are top auspicious days for buying gold.

- January often offers the lowest Gold price in India after festive seasons.

- Thursdays are preferred over Tuesdays due to astrological beliefs.

- Track inflation and global markets to time purchases effectively.

- Cultural days like Ugadi and Navratri blend tradition with investment strategy.

The Cultural and Economic Significance of Gold in India

Gold is deeply rooted in India’s culture and economy. It’s not just a metal; it’s a part of weddings, festivals, and religious rituals. Families treasure jewelry as heirlooms, and events like Diwali or weddings sparkle with gold ornaments. This strong cultural connection keeps the Indian Gold market thriving.

The Indian Gold market also boosts the economy. India buys over 895 tonnes of gold each year, leading global demand. The industry supports 2.5 million jobs and adds over $30 billion to the economy. Even small savings often turn into gold, making it a common household item—8% of daily expenses go toward it.

- 77% of Indians bought gold in 2013, often multiple times.

- 53% view it as jewelry, while 75% see it as a safe investment.

- Recycling rates jumped 29% in 2009 as a response to price hikes.

“Gold is the one asset that never leaves you,” say investors who rely on it during crises.

Buying gold in India connects you to a tradition that also protects wealth. During tough times, like the 2013 rupee crisis, gold prices remained steady. This shows its reliability. Government policies, like the 80-20 rule and tax changes, influence demand. Gold stands as a symbol of trust and heritage, whether for festivals or savings.

Understanding the Factors That Influence Gold Prices in India

To grasp the Gold price in India, we must look at both global and local factors. These elements shape the Indian Gold market trends. Knowing them helps you decide when to buy or hold gold.

“Gold is viewed as a safe haven and hedge against economic uncertainty.”

International Market Trends and Their Impact

Global demand and supply changes from mining areas impact prices. For instance, geopolitical tensions can increase international buying. This raises import costs.

- Rising global demand drives Gold price in India higher.

- Supply shortages in major mining countries increase costs.

- Market speculation amplifies volatility during crises.

The Role of the US Dollar and Global Economy

A strong US dollar makes gold cheaper in dollars, lowering the Gold price in India. When the rupee weakens, imports become pricier, raising local prices.

- Inverse relationship between dollar strength and gold value.

- High global interest rates may reduce gold’s appeal.

- Inflation or recession often boost gold’s value as a hedge.

Domestic Factors Affecting Indian Gold Prices

Rural incomes, festivals, and seasonal demand shape the Indian Gold market. Here’s how local factors interact:

| Factor | Impact |

|---|---|

| Festival Seasons | Prices peak during Diwali and weddings, dropping post-festivals. |

| Monsoon Outcomes | Good rains boost rural incomes, raising demand and prices. |

| Wedding Seasons | Accounts for 50% of annual demand, causing seasonal highs. |

Government Policies and Import Duties

Import duties and schemes like Sovereign Gold Bonds alter supply dynamics. Higher taxes increase costs, while policies like gold monetization schemes can stabilize prices. For example, in 2023, a 10% demand dip followed rising tariffs. Always track policy changes to anticipate shifts in the Indian Gold market.

Seasonal Patterns in Gold Buying Across India

Seasonal trends play a big role in when people in India buy gold. Festivals, weddings, and local traditions cause demand to go up and down. This affects prices and how easy it is to find gold. Knowing these patterns can help you make smarter choices when buying.

“Gold’s value rises with tradition—buying at the right time ensures both luck and savings.”

Festival Season: Diwali and Dhanteras

Diwali and Dhanteras are great times to buy gold. Dhanteras starts Diwali and leads to a big increase in gold imports in August. Prices usually go up 3.7% in August and 2.8% in September, reaching their peak by October. Buying early or using online platforms like Purchase Gold ornaments online can help you avoid high prices later on.

Wedding Season Gold Demand

During wedding months, there’s a lot of demand for gold jewelry. Prices go up as more people want to buy. It’s smart to plan ahead and buy months before. Online platforms show clear prices, helping you find good deals without paying too much.

Akshaya Tritiya: The Auspicious Gold Buying Day

Akshaya Tritiya is a day for buying gold to symbolize endless wealth. Prices can go up to 5% on this day. But, online sellers might offer discounts before the day. This day also increases imports, so it’s good to compare prices online to get the best deal.

Regional Variations in Gold Buying Seasons

Regional festivals like Pongal (January, Tamil Nadu) and Onam (August–September, Kerala) create local buying waves. North India’s Durga Puja in October also adds to the demand. To understand these trends, consider buying Gold ornaments online. This way, you can explore deals from all over the country.

The Best Months to Buy Gold in India Based on Historical Data

Looking at gold price in India history, we find good times to save. January and December are the best months, with average gains of 1.6% and 1.5% respectively. These periods see lower demand after weddings and festivals, which helps keep prices down.

- January: 1.6% average return

- December: 1.5% average return

- May: 1.3% average return

- September: 1.2% average return

From October to March, wedding seasons can drive prices up. But, after the wedding rush in January, prices drop. April and May usually see prices around ₹73,000–80,000/kg, influenced by local and global factors.

Watch out for 2024’s June elections, as they might change gold price in India. 2023 saw a big growth, but always check current prices. After picking the best month, look for reliable places to buy gold in India for real value and fair prices.

How to Buy Gold in India: Different Forms and Their Advantages

Choosing the right gold form depends on your goals. You might want to Buy pure Gold bars, invest in Gold coins India, or look for Gold jewelry online. Each option has its own benefits and drawbacks. Let’s explore your choices.

Opt for gold coins if you’re purely investing, but if you want to sparkle in gold, choose jewelry with gemstones. They retain value and cover making charges.

Physical Gold: Jewelry, Coins, and Bars

Physical gold gives you real ownership. Gold coins India (like Sovereign or 24K coins) are easy to sell and have 99.5% purity. Buy pure Gold bars through platforms like MMTC-PAMP for hassle-free storage. For tradition, Gold jewelry online platforms let you compare prices and designs without hidden fees. Jewelry’s added design costs may reduce resale value, but it’s perfect for cultural events like weddings or festivals.

Digital Gold and Gold ETFs

Apps like Paytm or Zomato Gold let you own fractions of gold digitally, starting at ₹1. Gold ETFs (e.g., SBI Gold BeES) trade on exchanges, offering liquidity. These options save you storage costs but lack physical possession.

Sovereign Gold Bonds: A Government Alternative

Issued by RBI, these bonds pay 2.5% annual interest and are tax-free. They’re safer but lock funds for 8 years. Available via banks like HDFC, they’re ideal for risk-averse investors.

Gold Mutual Funds and Futures

For advanced investors, mutual funds (e.g., UTI Gold Fund) pool money into gold assets. Futures are risky but let you profit from price swings. Best for seasoned traders.

Whether you prioritize liquidity, safety, or tradition, align your choice with your financial goals. Mix forms for a balanced portfolio—aim for under 10% of total assets in gold.

Analyzing Gold Price Trends: Tools and Resources You Can Use

Tracking the gold price in India needs good tools to spot trends and make smart choices. Start with real-time platforms like RBI’s official portal or Bloomberg for live rates and market updates. Use apps like MyGoldPrice or ET Gold Rate to get instant notifications when prices hit your target range.

- Check technical indicators like moving averages and RSI charts on MoneyControl or LiveMint.

- Monitor inflation and currency trends via World Bank or Reserve Bank of India reports.

- Subscribe to Gold Price India newsletters for expert insights and market forecasts.

Combine technical analysis with fundamental factors like US dollar movements and import duties. Tools like o3-mini integrate AI-driven data to predict trends using historical and macroeconomic data. Always cross-reference with professional advice to avoid relying solely on automated tools.

Knowing when to buy gold in India means staying informed. Use these resources to spot dips in prices and align purchases with your financial goals. Stay alert to seasonal trends without missing out on long-term value opportunities.

Where to Buy Gold in India: Physical Stores vs Online Platforms

Deciding where to buy gold in India depends on what you value most. Do you like the hands-on experience of a jewelry store or the ease of purchase gold ornaments online? This guide will help you explore options like banks, online sites, and exchanges. It aims to find the where to buy gold in India that fits your needs.

“Gold is a timeless investment, but where you buy it matters just as much as when you buy it.” – Financial Advisors

| Option | Pricing | Storage | Convenience |

|---|---|---|---|

| Traditional Jewelers | Varies by store, 20-30% making charges | Customer-managed | In-person visits |

| Online Retailers | Uniform pricing nationwide | Secure vault storage | 24/7 access |

| Banks (SGB) | Fixed rates | Govt vaults | Requires KYC |

| ETFs | Market-driven | No physical storage | Demat account needed |

Traditional Jewelers and Their Offerings

Family-run stores often provide where to buy gold in India with customization. Look for BIS hallmarks and compare making charges (20-30%) before buying. Brands like Tanishq and PCJ offer assurance.

Bank Gold Products: What you should know

- Sovereign Gold Bonds (SGB) from RBI offer 2.5% annual interest, lock-in 5-8 years.

- Banks like HDFC sell certified coins/bars with no make charges.

Online Gold Retailers: Benefits and Precautions

- Purchase gold ornaments online via platforms like PhonePe or Paytm for fractional ownership.

- Verify BIS certification and check return policies before buying.

Gold Exchanges and Commodity Markets

Gold ETFs (e.g., HDFC Gold BeES) trade on exchanges, letting you invest via demat accounts. Ideal for liquidity but requires market monitoring.

Compare options based on budget, storage needs, and tax considerations. Whether you choose a local jeweler or digital platforms, always verify authenticity to protect your investment.

How to Verify Gold Purity Before You Purchase

When you’re looking to Buy pure Gold bars or Gold coins India, checking purity is key. It makes sure you’re getting real gold. Here’s how to tell if it’s genuine and avoid scams:

- Check BIS Hallmarks: Look for three marks: the BIS triangle, purity number (like 22K916), and a 6-digit HUID code. These prove certification from certified labs.

- Use the BIS Care App: Scan the HUID with the free BIS Care app to confirm authenticity. Compare the app details with the physical markings.

- Test at Home: Use a magnet (gold isn’t magnetic) or a nitric acid test (done by jewellers). Avoid DIY acid tests at home).

- Request Certificates: Ask for a lab certification slip. Legit sellers provide this for every purchase, even for small coins or bars.

Old hallmarks with assay centre codes were phased out by July 2021. All new items must have the updated 6-digit HUID. For Gold coins India, insist on seeing the hallmark on the edge or face of the coin. Always weigh the item yourself before paying—avoid trusting displayed weights blindly.

“A proper invoice must list weight, purity, and price per gram. Keep this as proof for resale or insurance.”

Stick to BIS-certified jewellers or licensed online platforms like Tanishq or Karatbars International. Never skip these steps—your investment’s value depends on it.

Tax Implications and Documentation for Gold Purchases in India

Buying gold is more than picking the right price. It also means understanding tax rules and paperwork. Whether you’re investing in jewelry or ETFs, knowing the legal requirements is key. It keeps your purchases compliant and cost-effective.

KYC Requirements for Gold Buying

When you buy gold in India, sellers must verify your identity. For purchases over ₹3 lakh, you’ll need Aadhaar, PAN, or voter ID. Married women can hold up to 500g, unmarried women 250g, and men 100g without declaring excess holdings. Always keep receipts to track your purchases.

Income Tax Considerations

Selling gold before 36 months attracts short-term capital gains taxed under your income slab. Hold it longer, and gains are taxed at 20.8% with indexation benefits. If you reinvest sale proceeds in a house within a year, you can avoid taxes. Keep records like purchase invoices and transaction statements for proof.

GST and Other Taxes

- Physical gold attracts 3% GST on its value, while making charges face an extra 5% GST.

- Purchases over ₹1 lakh require a 1% Tax Deducted at Source (TDS).

- Imported gold now has a 10% customs duty, down from 12.5%.

Stay updated with changes in the Indian Gold market to maximize savings. Consult a tax advisor to align your strategy with your goals when you buy gold in India.

Long-term vs Short-term Gold Investment Strategies

When deciding between long-term or short-term Buying Gold bullion strategies, think about your financial goals. Long-term investors look for steady growth over years. Short-term buyers try to make quick profits from price changes tied to the Gold price in India.

| Strategy | Focus | Tools | Best For |

|---|---|---|---|

| Long-term | Inflation protection | Sovereign Gold Bonds, Gold ETFs | Retirement savings, wealth building |

| Short-term | Price fluctuations | Gold Futures, MCX trading | Market timing, quick gains |

“Gold acts as a shield against economic storms and a sail for rising markets.” – RBI Advisor

Long-term plans, like buying Gold ETFs monthly, can help manage price swings. Short-term traders focus on the Gold price in India during festivals or global crises. For instance, gold prices on MCX hit 90,700-91,000 in 2023 due to geopolitical events.

- Long-term: Aim for 10-15% of your portfolio

- Short-term: Have clear entry and exit points

- Both: Keep an eye on Gold price in India trends

Gold prices have increased 15 times in 20 years, making it a reliable long-term investment. Short-term gains require watching for events like US rate cuts or rupee depreciation. Start with Sovereign Gold Bonds (SGBs) to test your strategy before investing more.

Common Mistakes to Avoid When Buying Gold in India

Buying gold can be tricky. Many buyers make avoidable errors that cut into savings. Here’s how to dodge these mistakes and get the best value for your money.

- Missing Making Charges: Design and labor costs add 15-30% to your gold’s price. Always ask for a breakdown of fees. Purchase Gold ornaments online often lists these charges upfront, saving you money.

- No Hallmark Check: Look for BIS certification (like 22K markings). Over 13,700 authorized stores and Gold jewelry online sellers ensure purity. Avoid unmarked pieces or studded jewelry, which lose resale value.

- Peak Season Rush: Prices jump up to 10% during festivals. Use Gold jewelry online to compare rates and buy when demand drops.

- Storage Neglect: Keep gold in secure vaults and insured. Uninsured items risk total loss if stolen or damaged.

Always ask for receipts for purchases over INR 50,000. Compare prices online and offline to find the best deals. Purchase Gold ornaments online platforms often show hallmarks and making charges clearly, helping you avoid hidden costs.

The Future of Gold Markets in India: Trends to Watch

The Indian Gold market is changing fast. New tech like blockchain and digital platforms are changing how gold is bought and sold. This could make buying gold easier and cheaper for you.

“Gold prices in India face support near ₹87,340-₹87,080 per 10g and resistance at ₹87,710-₹87,900,” says Rahul Kalantri of Mehta Equities Ltd.

Global events affect the Gold price in India. Things like world tensions and a weak US dollar make gold more appealing. Experts at ANZ think gold could hit $3,200 per ounce by September 2025.

Prices can drop quickly, like the March 26 fall to ₹8,945/gram for 24K gold.

- Blockchain tech verifies gold purity and origins

- Rising use of sovereign gold bonds and ETFs

- Younger buyers favor digital gold over physical jewelry

Keep an eye on these things to plan better:

- US inflation and dollar trends

- Indian wedding and festival seasons

- Government policies on import duties

Prices recently hit a high of ₹88,890/10g on MCX. But Manoj Kumar Jain says to book profits before key FOMC meetings. Watch global news like US tariffs and Middle East conflicts that impact Gold price in India.

Gold prices have grown steadily, from ₹28,623/10g in 2016 to ₹71,510/10g in 2024. Watch weekly changes (₹7,395-₹7,021/gram) and use price charts to spot trends.

How to Create a Personal Gold Buying Calendar

Plan your Buying Gold bullion purchases with a personalized calendar. This tool balances cultural traditions, market trends, and personal goals. Start by noting key dates and align your strategy with both financial goals and cultural significance.

| Event | Date in 2025 |

|---|---|

| Makar Sankranti | January 15 |

| Akshaya Tritiya | May 10 |

| Navratri | October 3–11 |

| Dhanteras/Diwali | October 29–November 1 |

Track these dates to time purchases during auspicious periods. Pair them with market analysis—March often has lower prices. Use these windows to Buy Gold in India at favorable rates.

Budgeting tips:

- Set monthly savings goals for steady progress.

- Use dedicated gold savings accounts or apps to track progress.

Dollar-cost averaging:

- Buy small amounts regularly to reduce price fluctuation risks.

- Spread purchases across months like March and non-festival periods.

Mark preferred days (Monday, Tuesday, Thursday, Sunday) and combine them with cultural events. Adjust your calendar to match income cycles or life events like birthdays. A well-planned calendar turns tradition into a smart investment strategy.

Conclusion: Making Informed Decisions for Your Gold Investments

Buying Gold in India is a mix of tradition and smart money moves. You can pick physical jewelry, Sovereign Gold Bonds, or Gold ETFs. Each has its own perks. For example, Gold ETFs have been growing at 12.4% CAGR over five years.

When you decide where to buy Gold in India, look at different places. Zerodha is great for ETFs, and trusted jewelers offer BIS hallmarks for purity and safety.

Timing is key. Use Moneycontrol to track market dips and buy during festivals when demand is high. But, also keep an eye on global trends like US dollar movements. Physical gold has tax rules, like 30% for short-term gains, but long-term gains are better after three years.

Gold is loved in India for generations. But, with tools like dollar-cost averaging or online gold apps, investing is smarter than ever. Whether you want liquidity, safety, or cultural value, always check certifications and know the tax rules. By mixing tradition with market knowledge, every purchase can help your financial future. Start looking into options today—your journey to wealth starts with smart choices.