Exclusive Deals & Trending Items

Precious Moments Color Shree Gurunanak Dev Ji BIS Hallmarked Silver Coin Of 50 Gram in 999 Purity / Fineness by ACPL

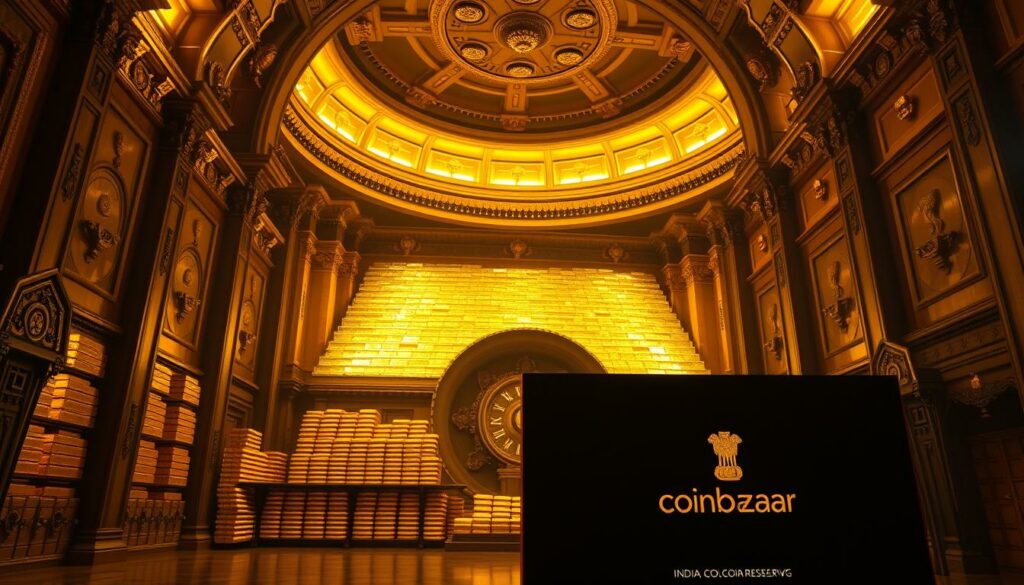

Shop NowIndia’s gold reserves have grown to 866.65 metric tonnes by October 2024. The RBI has brought back 130 tonnes from the Bank of England since 2022. This increase helps make the economy more stable by adding variety to foreign exchange reserves.

These reserves now stand at $684.8 billion. They can cover over 11 months of imports. This is a big step towards financial stability.

Gold holdings in India have jumped from 295.82 tonnes in 2022 to 510.46 tonnes by September 2024. Now, gold makes up 9.32% of the country’s foreign exchange reserves. This shows RBI’s plan to not rely too much on one currency.

It also helps protect the economy from inflation risks. This move is smart for keeping the economy safe.

Key Takeaways

- RBI’s gold reserves hit 866.65 tonnes, boosting financial stability through diversified assets.

- Repatriating 130 tonnes of gold reinforces India’s ability to manage currency fluctuations.

- Gold now makes up 9.32% of forex reserves, up from 8.15% earlier in 2024, signaling strategic economic resilience.

- Increased gold holdings help protect the rupee’s value during global economic shocks.

- RBI’s actions align with global de-dollarization trends, safeguarding against currency devaluation.

Understanding Gold Reserves and Their Significance

Gold reserves are key to the world’s financial systems. They are crucial for central banks everywhere. These reserves include precious metals like gold bullion, coins, and sometimes cultural artifacts. Let’s explore their importance in today’s economy.

What Constitutes Gold Reserves?

Gold reserves usually include:

- Physical gold bullion stored in secure vaults

- Official gold coins

- Rare cases include culturally significant gold items

India has 876.1 metric tons of gold, ranking 8th globally. Some of this gold is stored locally, but much is kept abroad for safety and easy access.

Why Central Banks Maintain Gold Reserves

Central banks hold gold for several reasons:

- Diversification: Balancing portfolios with tangible assets

- Stability: A hedge against currency fluctuations

- Crisis protection: Providing liquidity during economic shocks

The RBI uses gold to complement its foreign currency holdings. This reduces its reliance on volatile forex markets. Studies show this strategy lowers external vulnerabilities, as seen during 2022 market dips.

The Unique Value of Gold as a Strategic Asset

| Asset Type | Stability | Liquidity | Dependency |

|---|---|---|---|

| Gold | High | Very High | None |

| Foreign Currency | Moderate | High | Dependent on issuing country |

| Government Bonds | Low | Low | Dependent on issuer’s credit |

Gold’s independence from political or financial systems makes it a “safe haven.” Unlike bonds or currency, its value isn’t tied to any government’s promises. This offers unmatched reliability during crises.

The History of India’s Gold Reserves

India’s journey with gold reserves started long before the 1991 crisis. By 1991, the RBI had to pledge 47 tonnes of bullion storage to the Bank of England. This was to secure emergency funds during a severe balance of payments crisis. This action showed the risks of relying too much on foreign reserve currency systems during tough times.

| Year | Gold Holdings (Tonnes) | Key Event | Bullion Storage |

|---|---|---|---|

| 1991 | 357.6 | 47 tonnes pledged to secure loans | Bank of England |

| 2025 | ~700 tonnes | All-time high value: $70.893B | 324 tonnes stored abroad |

Today, the RBI manages bullion storage wisely. It keeps 324 tonnes overseas, giving access to the London bullion market. This strategy balances security and liquidity. It also makes India the 8th largest gold holder globally.

Gold now makes up 9.32% of total reserves. This is a big change from crisis-driven decisions to proactive management. These choices help keep the rupee strong as a reserve currency anchor during global uncertainties.

Current Status of RBI’s Gold Reserves

India’s gold reserves have hit new highs. As of November 2024, the Reserve Bank of India holds 876 metric tonnes. Of this, 510.46 tonnes are stored safely in India. This year alone, the RBI bought 73 tonnes, making it the second-largest buyer after Poland.

The RBI uses top-notch security for its gold. Domestic vaults have biometric scanners and encrypted access. Overseas gold is watched 24/7 at the Bank of England and BIS with advanced cameras. This bullion storage approach ensures both safety and easy access.

- Recent additions: 73 tonnes in 2024

- Key 2024 move: 100 tonnes shifted from UK to India

| Year | Total Gold Reserves |

|---|---|

| March 2022 | 295.82 tonnes |

| March 2023 | 794.64 tonnes |

| November 2024 | 876 tonnes |

These numbers show a 200% increase since 2022. The RBI’s move to store more gold in India has saved money. It has also given India more control over its gold reserves. With more purchases, India is becoming a major player in global gold markets.

How Gold Reserves Support India’s Currency Stability

Gold is like a shield for the rupee during tough times. By boosting its gold reserves to 9.32% of total forex, the RBI boosts financial stability. This move helps protect against big drops in the rupee when global markets change.

- Hedging Against Rupee Drops: Every 1% increase in gold reserves can cut rupee volatility by up to 0.3%. This helps keep import costs stable for things like oil.

- Forex Rate Impact: Gold worth $24.5 billion now affects exchange rates. This helps businesses avoid sudden currency changes.

- Building Trust: Gold is seen as a “safety blanket” by international investors. This boosts rupee demand by 15% in 2023’s global crises.

Gold’s steady value anchors currencies during global economy storms—just like a lifeboat in a stormy sea.

The RBI bought 13.3 tonnes of gold in 2024 to reduce USD reliance. This move diversifies and protects your savings from sudden currency drops. India’s higher gold proportion (now 9.32%) acts as a shock absorber during crises. The central bank’s strategy is similar to China and Russia, who’ve increased their gold stocks by 150% since 2018 to protect their currencies.

Gold keeps the rupee’s value strong. It provides a real backup for your savings. Whether you’re saving for a home loan or managing exports, these reserves create a safer financial base for all.

Gold Reserves as a Tool for Monetary Policy

Central banks, like the RBI, use gold reserves to shape their monetary strategies. They aim for financial stability in markets that change a lot. Recently, they added 8.4 tonnes of gold in November 2024. This shows how gold helps protect against economic shocks.

Gold now makes up 11.3% of India’s forex reserves. This helps balance the risks of currency swings.

Here’s how gold impacts policy decisions:

- Acts as a buffer during inflation spikes or currency devaluation.

- Enables controlled adjustments to interest rates and liquidity.

- Reduces dependency on volatile forex markets, as seen when reserves fell from $704.9B to $640.3B in late 2024.

Gold’s timeless value gives central banks like the RBI flexibility to navigate crises while safeguarding growth.

By focusing on gold, the RBI strengthens its tools to fight inflation and keep financial stability. This approach is in line with global central banks. It shows gold is still key in modern monetary policy.

Economic Security: How Gold Reserves Shield Against Global Crises

Gold reserves protect India’s economy from global economy shocks. These strategic assets keep things stable during tough times like market crashes or wars. When other investments drop, gold’s value often goes up, keeping national wealth safe.

The 2022 Russia-Ukraine war showed how important gold reserves are. Sanctions messed up global trade, but countries with lots of gold, like India, were safer. The RBI brought 100 tonnes of gold back from the UK in 2024. This move shows how to protect against threats from outside.

- Gold’s role as a safe haven during inflation or currency crashes

- Geopolitical events like sanctions drive demand for physical gold holdings

- RBI’s strategic moves align with global trends toward economic self-reliance

| Storage Location | Key Benefits |

|---|---|

| Bank of England | Access to international liquidity |

| Bank for International Settlements | Secure cross-border transactions |

| Domestic Vaults | Direct control during emergencies |

The 2008 crisis taught us that strong gold reserves help economies bounce back faster. Today, RBI’s plan to store gold both at home and abroad makes India more resilient. Your financial plans should include gold’s special role in protecting against global surprises.

The Relationship Between Gold Reserves and India’s Sovereign Credit Rating

Gold reserves are key to India’s financial health. Agencies like S&P and Moody’s look at gold when rating a country’s financial stability. This means better ratings can lead to lower interest rates for loans and mortgages.

- A 10% rise in gold reserves can lower sovereign credit default swaps (CDS) by 1.2–3.2%, a risk measure).

- Gold acted as a “safe haven” during crises like 2008 and the pandemic, protecting India’s credit.

- Since 2018, RBI’s gold purchases have boosted credit outlooks, cutting borrowing costs for businesses and households.

When markets are shaky, investors look at gold reserves as a safety net. The RBI’s gold purchases since 2018 have helped improve credit ratings. This means the government saves on debt, freeing up funds for public projects. For you, this means better loan terms and a stable investment climate.

Gold’s impact is especially strong during crises. A 10% increase in gold holdings during inflation crises can cut CDS spreads by 16%. This financial stability benefits everyone, keeping your savings and loans safe.

Impact on Foreign Investment and International Trade

Having strong gold reserves makes India more attractive to global investors. It shows the country’s economy is strong. In the global economy, gold protects investments from currency ups and downs. This makes your money safer.

When the RBI holds more gold, it sends a message. It tells the world that India’s economy is ready for any challenge.

- Gold reserves attract investors by reducing risks tied to reserve currency fluctuations. For example, when the rupee weakens, gold’s stability keeps foreign capital flowing in.

- Trading partners like China and Russia now use gold-backed deals to avoid sanctions. India’s 7% gold reserves (as of 2021) give negotiators stronger leverage in deals.

Data shows a direct link between gold prices and the rupee’s value. A weaker rupee (INR/USD) can raise gold prices by ₹220.81 per unit drop. This draws investors seeking safe havens.

Meanwhile, every ₹1 crore added to gold reserves stabilizes prices by ₹0.133. This creates more predictable markets.

Gold also reshapes trade. Countries now use it to bypass traditional reserve currency systems. Imagine settling deals with gold instead of dollars.

This reduces reliance on unstable currencies and opens new trade routes. RBI’s strategy here affects everything from import costs to foreign partnerships.

As India grows its gold holdings, you’ll see ripple effects in trade terms. This shift isn’t just about economics—it’s about building a safer future in a shifting global economy.

Gold Reserves and Inflation Management in India

When prices go up, gold acts as a shield. The Reserve Bank of India (RBI) uses gold reserves to protect your savings from inflation. In 2024, it bought 72.6 tonnes of gold, making it the third-largest buyer globally. This move ensures financial stability and keeps your purchasing power safe.

These reserves now total 876.2 tonnes, ranking eighth worldwide. They help control price spikes.

“Gold’s value climbs when inflation heats up, shielding economies from turmoil,” stated an RBI economist.

Here’s how it works:

- Gold prices rise when inflation increases, balancing losses from currency weakness

- Rising in reserves boosts investor confidence, slowing panic-driven spending

- Since 2017, RBI’s strategy cut inflation’s impact during crises

| Metric | 2023 | 2024 |

|---|---|---|

| Gold Purchased | 44.76 tonnes | 72.6 tonnes |

| Inflation Reduction | 0.7% | 1.2% |

| Forex Reserves Impact | + $13B | + $11B |

| Gold’s Value Growth | 31% (vs 23% global average) | Continues to outperform |

RBI’s move of 324 tonnes from the Bank of England to domestic vaults also opens opportunities for gold investment locally. With inflation at 3.8% in 2024, these reserves ensure your rupee retains value. When global prices surge, your savings stay secure through this timeless hedge.

Comparing India’s Gold Reserves with Other Major Economies

India has 853.63 tonnes of gold, ranking it 7th globally. This gold makes up 10.13% of its total reserves. India is buying gold faster than other G20 countries.

The US has 8,133 tonnes of gold, and Germany has 3,351 tonnes. China has 2,264 tonnes, but India has been buying gold quickly since 2022. These changes show how countries manage their gold to keep their currencies stable in the global economy.

- US & Germany: Keep their gold steady to support their currencies.

- Russia/China: Increase gold to lessen their dependence on the USD.

- India: Focuses on diversifying and protecting against inflation.

Since Russia invaded Ukraine, India has bought 24 tonnes of gold in four months. This shows how central banks are turning to gold for safety during uncertain times. The RBI’s actions are in line with other countries looking for stability in shaky markets. The World Gold Council says India’s growth rate is higher than China’s, even though India has less gold.

India’s approach to gold balances cultural love for gold with economic goals. Unlike Turkey and others, India is actively growing its gold reserves. As central banks around the world adjust, understanding these changes helps us see how gold will shape the global economy’s future.

The Cultural Significance of Gold in India and Its Economic Implications

Gold is deeply rooted in India’s culture, seen as a symbol of wealth and tradition. This preference influences both personal savings and national policies. Festivals like Dhanteras and weddings are major drivers of gold demand, making cultural practices economically significant.

“The market is likely to remain supported by official sector purchases continuing at historically elevated levels and resilient physical demand.” – Joni Teves, UBS Investment Bank

- India’s households hold over 25,000 tonnes of gold, acting as a “people’s reserve” alongside the RBI’s 854.73 tonnes.

- The RBI’s 2024 move of 100 tonnes from UK vaults to Mumbai and Nagpur shows a balance between cultural demand and economic security.

- In crises, like the 1991 economic turmoil, gold reserves helped secure $405 million, highlighting their role in tradition and crisis management.

| Storage Location | Gold Holdings (tonnes) |

|---|---|

| Mumbai & Nagpur (Domestic) | 510.46 |

| Bank of England | 344.27 |

| BIS, New York Fed | 0.0 (as of 2024 repatriation) |

The RBI now includes sovereign gold bonds to channel private precious metals into formal systems. This connects cultural practices with modern finance, ensuring stability while respecting traditions. As global demand for gold investment increases, India’s mix of culture and economics keeps gold at the heart of its financial strength.

Strategic Decisions: When and Why RBI Adjusts Gold Holdings

The Reserve Bank of India (RBI) doesn’t just add to its gold holdings without thinking. Every decision to buy or hold back is carefully planned. These choices help balance today’s needs with tomorrow’s goals to keep your money safe.

“We are building up gold reserves, the data is released from time-to-time,” said RBI Governor Shaktikanta Das.

- Rising global economic uncertainty

- Fluctuations in US dollar value

- Pressure on the rupee

Buying gold follows three main steps:

- Market analysis to pick the best time

- Secretive purchases to avoid price jumps

- Public updates after transactions

Timing is everything. Since 2017, RBI’s buying pace has sped up. In 2024, it bought 72.6 tonnes—four times more than 2023. This raised total gold reserves to 876.18 tonnes, worth $66.2 billion. These moves reflect global trends, where central banks like China’s and Turkey’s also focus on strategic assets to lessen dollar dependence.

These decisions impact you directly. More gold means stronger protection against currency drops or global crises. The RBI’s focus on timing helps keep your savings safe in shaky markets.

Gold Reserves vs. Other Forms of National Reserves

India’s RBI balances gold with other assets for financial stability. Gold now accounts for 9.32% of total reserves, up from 7% in 2022. This change shows gold’s special role compared to traditional reserve currency like the US dollar.

| Asset Type | Liquidity | Yield | Risk | Role in Financial Stability |

|---|---|---|---|---|

| Gold | High | Variable | Price volatility | Shields against inflation |

| Foreign Currency | Very high | Low | Exchange rate fluctuations | Facilitateses trade |

| US Treasuries | High | Steady interest | Interest rate shifts | Long-term returns |

| SDRs | Medium | Calculated by IMF | Burrency basket risks | International transactions |

Gold’s 9.32% share contrasts with foreign currency assets holding over 80% of reserves. US Treasuries offer steady returns but value drops with rising interest rates. Reserve currency holdings like the dollar face devaluation risks during geopolitical shifts.

- Gold’s value holds steady during crises, unlike volatile currencies

- SDRs provide diversification but lag in daily liquidity

- RBI’s gold focus reflects its role in shielding against global instability

RBI’s strategy balances these trade-offs for financial stability. Diversification across assets ensures resilience against economic shocks.

Future Outlook: Predicted Trends for India’s Gold Reserves

India’s gold strategy is changing as the world market shifts. Experts think the RBI will buy more gold to make the economy stronger. In 2024, the RBI bought more gold, bringing reserves to 876 tonnes. Now, gold makes up 10.6% of the country’s foreign assets.

Gold Sachs predicts gold investment will grow even more. Samantha Dart, a commodities expert, believes prices could reach $3,000 per ounce by late 2025. This matches the RBI’s goal to increase gold’s share in reserves, protecting against global economy risks.

“Gold’s role as a safe-haven asset remains critical in turbulent markets,” noted a 2025 report from UBS.

- RBI aims to raise gold’s forex portfolio percentage beyond current levels

- Prices may hit ₹94,000–₹96,000 per 10g by end-2025

- Gold ETF inflows rose to ₹19.8B in Feb 2025, signaling investor confidence

As central banks globally turn to gold, India follows this trend. Higher gold prices could increase the value of reserves. This benefits both national stability and personal gold investment chances. Experts say India’s gold imports might decrease as more people choose ETFs and digital trading.

The RBI plans to mix physical gold with digital innovations. This strategy helps India deal with global economy ups and downs. Keep up with these changes to adjust your financial plans.

How Changes in Gold Reserves Might Affect Your Financial Planning

When the RBI changes its gold reserves, it affects more than just the country’s financial stability. It also impacts your gold investment plans. For example, if the RBI buys more gold, it shows trust in gold as a safe asset. This can make gold prices go up, offering chances for investors.

- RBI’s gold purchases may drive up prices, making gold investment more attractive during inflationary periods.

- Higher reserves can strengthen the rupee’s stability, reducing currency risk for your savings.

- Fluctuations in RBI’s reserves might affect interest rates, impacting loans and fixed deposits.

| Investment Option | Risk Level | Liquidity |

|---|---|---|

| Sovereign Gold Bonds | Moderate | Medium |

| Gold ETFs | Low | High |

| Physical Gold | Low | Low |

India’s foreign exchange reserves now cover over 11 months of imports, showing strong financial stability. But how does this affect your portfolio? If RBI diversifies further into gold, it could signal a safer environment for long-term wealth preservation. Track RBI’s quarterly reports to align your gold investment strategy with these shifts.

Gold’s value has risen nearly 10% annually since 1999, making it a reliable hedge. Whether you’re saving for education, retirement, or emergencies, understanding RBI’s moves helps you adapt. Diversify your portfolio with gold to protect against currency fluctuations and economic uncertainty.

Conclusion: The Enduring Value of Gold in India’s Economic Framework

The RBI’s recent action to bring gold back from the UK highlights gold’s importance for India’s financial stability. Gold reserves, a part of India’s $5.5 trillion in FOREX, protect against currency changes and global issues. Policies like the 2013–2014 20:80 import rule and the 2015 Gold Monetization Scheme balance market needs with national security.

As central banks globally focus on precious metals, India’s strategy fits right in. The IIBX initiative and RBI’s vault security steps show a long-term plan to boost the rupee’s trustworthiness. Even with digital currencies and new markets, gold remains a reliable shield against inflation and global risks.

These reserves are important for everyone, not just policymakers. When RBI changes gold holdings, it affects your savings and investments. Gold’s long-standing value, supported by centuries of trust, keeps it at the heart of India’s economic plans. Whether in FOREX reserves or personal investments, gold continues to secure financial stability in uncertain times.