Exclusive Deals & Trending Items

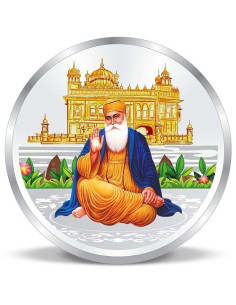

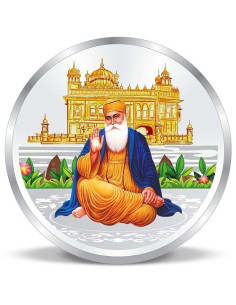

Precious Moments Color Shree Gurunanak Dev Ji BIS Hallmarked Silver Coin Of 50 Gram in 999 Purity / Fineness by ACPL

Shop Now

Muthoot Pappachan Swarnavarsham Gold Oval Lakshmi Pendant of 1 gms in 24 KT 999 Purity Fineness

Shop NowThe government has made a big change about sovereign gold bonds. They’ve stopped making new ones because of high costs and not much effect. If you invest in gold, you might be thinking about how this affects your plans.

The government faces tough times managing the costs of these bonds. With gold prices going up, they’re looking at new ways to handle government-backed gold bonds.

This change is big for investors and the gold market. As the government deals with these issues, it’s key to know how it affects your money.

Key Takeaways

- The government has halted new Sovereign Gold Bond issuances.

- Rising costs and limited impact are the primary reasons.

- This decision affects investors and the gold market.

- The government is re-evaluating its strategy for government-backed gold bonds.

- Investors should be aware of the implications for their gold investments.

The Recent Announcement on Gold Bond Suspension

The Finance Ministry recently announced a pause in Sovereign Gold Bond (SGB) issuances. This news has caused a stir in the investment world. Investors have been watching the SGB scheme closely since it started.

Details of the Finance Ministry’s Decision

The Finance Ministry has decided to stop SGB issuances. This move has raised many questions. The government-backed gold bonds were a hit with investors because of their good interest rates and tax perks. But, the increasing costs might have led to this choice.

Timeline and Official Statements

The announcement and the Finance Ministry’s statements give us clues about their thinking. They say the pause is to look at the SGB scheme again. This is to see how it affects the government’s finances.

| Key Points | Details |

|---|---|

| Decision Maker | Finance Ministry |

| Reason for Halt | Rising costs and limited impact |

| Impact on Investors | Reassessment of gold investment strategies |

For investors, it’s important to understand how this pause affects your gold investment plans. The government’s move shows a bigger plan to handle its money better.

What Are Sovereign Gold Bonds and Why They Matter to You

Thinking about investing in gold? Sovereign Gold Bonds (SGBs) are a smart choice. They are backed by the government and let you invest in gold safely and wisely.

Core Features and Benefits

SGBs are based on one gram of gold and can be cashed in at maturity. They come with a 2.5% annual interest rate, making them a great investment. The RBI issues them on behalf of the Government of India.

The main benefits of SGBs are:

- Secure investment option

- Protection against gold price fluctuations

- Earns a 2.5% annual interest rate

- Redeemable in cash at maturity

How They Protected Your Investment from Gold Price Fluctuations

SGBs shield your investment from gold price ups and downs. You invest in gold without owning it physically. The bonds’ value is tied to gold prices, and you can cash them in at the market rate at maturity.

Here’s how SGBs compare to other gold investments:

| Investment Option | Security | Returns | Liquidity |

|---|---|---|---|

| Sovereign Gold Bonds | High | 2.5% annual interest + capital gains | High (redeemable at maturity) |

| Physical Gold | Low | Capital gains (dependent on gold price) | Low (dependent on market) |

| Gold ETFs | Medium | Capital gains (dependent on gold price) | High (can be traded on exchanges) |

Investing in SGBs lets you enjoy gold’s benefits while avoiding the risks of owning physical gold.

The Journey of Sovereign Gold Bonds in India Since 2015

In 2015, Sovereign Gold Bonds were introduced in India. This was a big step in gold investment. The government wanted to cut down on physical gold and reduce imports.

Launch Under the Gold Monetization Scheme

The Gold Monetization Scheme was launched to use gold from homes and institutions. Sovereign Gold Bonds were a key part of this plan. They offered a bond in grams of gold, making it a good choice instead of physical gold.

Subscription Trends Across Different Series

Since their launch, SGBs have seen different trends in subscriptions. Gold prices, interest rates, and how people feel about investing have all played a role. Here’s a table showing the trends in different SGB series:

| Series | Subscription Amount (in ₹ crores) |

|---|---|

| 2015-16 Series I | 1,540 |

| 2016-17 Series I | 2,320 |

| 2017-18 Series I | 3,060 |

| 2018-19 Series I | 4,230 |

The amounts subscribed have gone up over time. This shows more people are interested in SGBs as an investment.

Financial Advantages That Made SGBs Popular Among Indian Investors

Sovereign Gold Bonds (SGBs) have become a favorite among Indian investors. They offer a mix of benefits that make them a great choice for diversifying portfolios.

The 2.5% Annual Interest Benefit

One major advantage of SGBs is the 2.5% annual interest rate they provide. This interest is paid twice a year, giving investors a steady income. The interest rate is especially appealing when interest rates are low, making SGBs a solid choice for financial security.

Capital Gains Tax Exemptions at Maturity

Another big plus of SGBs is that they are exempt from capital gains tax if held until maturity. This can save investors a lot of money, as it avoids the tax that usually comes with selling gold or other investments.

No GST Unlike Physical Gold

Investing in SGBs also means you don’t have to pay the Goods and Services Tax (GST) that physical gold buyers do. This makes SGBs a more affordable way to diversify your investment portfolio without extra taxes.

In short, SGBs are popular in India for good reasons. They offer a 2.5% annual interest, tax exemptions at maturity, and no GST. These perks not only provide a safe investment but also help maximize returns.

- Earn a 2.5% annual interest rate

- Benefit from capital gains tax exemptions at maturity

- Avoid GST on your gold investment

Understanding the Government’s Cost Concerns

The government’s choice to stop new Sovereign Gold Bond issues has sparked debate. It’s important for investors to grasp the financial impact on the government’s budget.

Interest Payment Burden on the Exchequer

The main worry is the interest payment load on the government. Sovereign Gold Bonds offer a 2.5% annual interest rate. This rate is appealing to investors but increases the government’s spending. Over time, the total interest paid has grown significantly.

Administrative Costs of Regular Issuances

There are also administrative costs with each bond issue. These include marketing, distribution, and management expenses for government-backed gold bonds. These costs add up with each new issue.

Impact on India’s Fiscal Planning

Stopping Sovereign Gold Bonds issuances is part of the government’s fiscal planning. With gold prices rising, the bonds’ costs have too. This change helps the government manage its finances better.

Understanding the costs of gold investment is key for investors. It helps them make better choices.

Why the SGB Scheme Fell Short of Expectations

The SGB scheme aimed to boost gold investment and cut down on gold imports. It was designed to encourage people to invest in gold-backed securities. But, it hasn’t seen the participation it hoped for.

Limited Uptake Among Retail Investors

Many retail investors haven’t joined the SGB scheme. This lack of interest has hurt its performance. People might not know about it or prefer traditional ways of investing in gold.

Failure to Significantly Reduce Gold Imports

The SGB scheme aimed to lower India’s gold imports. But, it hasn’t made a big difference. The demand for physical gold keeps imports high.

Comparison with Initial Government Targets

The government had big hopes for the SGB scheme. But, it hasn’t met those expectations. Here’s a comparison of what was hoped for and what happened.

| Parameter | Initial Targets | Actual Performance |

|---|---|---|

| Retail Investor Participation | High | Limited |

| Reduction in Gold Imports | Significant | Minimal |

| Overall Uptake | Substantial | Moderate |

The table shows the SGB scheme didn’t meet the government’s goals. There are many reasons for this. A deep look is needed to figure out how to do better next time.

Current Status of Your Existing Sovereign Gold Bonds

Your Sovereign Gold Bonds are still a key part of your investment mix. The government’s choice to stop new bonds doesn’t change what you already own. These bonds are still valid and offer great benefits.

Validity and Redemption Options

Existing SGBs stay good until they mature. You have many ways to cash them in. You can sell them early, on certain dates, or wait until they’re due.

Getting your money back is easy. You can get gold or cash. This is great if you need cash or want to sell at a good price.

Secondary Market Trading Possibilities on NSE and BSE

You can also trade your bonds on the NSE and BSE. This lets you sell your bonds before they’re due. It’s a good way to get cash if you need it.

| Redemption Option | Description | Benefit |

|---|---|---|

| Premature Redemption | Redeem bonds before maturity on specific dates | Liquidity when needed |

| Holding Until Maturity | Keep bonds until the maturity date | Maximized returns with 2.5% annual interest |

| Secondary Market Trading | Trade bonds on NSE and BSE | Flexibility to sell before maturity |

Knowing these options helps you make smart choices with your Sovereign Gold Bonds. They can keep being a secure investment in your portfolio.

How This Suspension Affects Your Investment Portfolio

The sudden stop in issuing new sovereign gold bonds means you need to look at your investment mix. It’s time to think about how this change affects your financial safety.

Immediate Considerations for Your Financial Planning

First, check how much gold and related investments you have. Think about how the pause changes your expected gains and your portfolio’s mix. “The recent changes in the sovereign gold bond market show the need to be flexible in your investment strategy,” experts say.

To update your financial plan, you might look into other gold investments or spread out your money across different types of assets. This could mean gold ETFs, mutual funds, or digital gold sites.

Long-term Strategy Adjustments You Should Consider

In the long run, it’s important to diversify your investment portfolio to reduce risks from market ups and downs. You might think about moving some of your money to other investments or looking into global markets.

Keeping a balanced portfolio is vital for financial security. Regular checks and tweaks will help you meet your financial targets, even with the pause on sovereign gold bonds.

Market Response to the Halt of Sovereign Gold Bonds

The sudden stop in Sovereign Gold Bond (SGB) sales has shaken the Indian financial market. This move has made investors rethink their gold investment plans and what they expect.

Gold Price Movements in Indian Markets

The pause in SGB sales has changed how gold prices move in India. Without SGBs, investors are looking at other ways to invest in gold. This could increase demand and prices.

Here’s a snapshot of the recent gold price movements:

| Date | Gold Price (₹/10g) |

|---|---|

| 2023-01-01 | 55,000 |

| 2023-02-01 | 56,000 |

| 2023-03-01 | 57,500 |

Reactions from Financial Institutions and Bullion Traders

Financial institutions and bullion traders have mixed feelings about the SGB pause. Some see it as a chance to look into other gold investment options.

Gold Investment Alternatives for Your Portfolio

With the halt on new Sovereign Gold Bond issuances, you might look into other gold investment options. Diversifying your portfolio is key, and gold is a top choice for security. Now, you have many gold investment alternatives to explore.

Gold ETFs on Indian Exchanges

Gold ETFs (Exchange-Traded Funds) are a simple way to invest in gold. They trade on stock exchanges like NSE and BSE, tied to gold prices. Gold ETFs are flexible and liquid, appealing to many investors.

Gold Mutual Funds from Indian AMCs

Gold mutual funds invest in gold or gold-related items. Managed by experts, they aim to match gold’s performance. They offer a diverse portfolio and are great for those who prefer not to manage their investments.

Digital Gold Platforms Like Paytm and PhonePe

Digital gold platforms let you invest in gold online. Paytm and PhonePe allow you to buy and sell gold digitally, with the option to get physical gold. This modern gold investment is popular for its convenience.

Traditional Options: Jewelry, Coins, and Bars

Traditional gold investments include jewelry, coins, and bars. These options are tangible but come with costs like making charges for jewelry and storage issues for bars and coins. Yet, they are still a favorite among investors.

Exploring these alternatives can help you diversify your portfolio and keep your finances secure. It’s important to choose based on your financial goals and how much risk you can handle.

Comparing Your Options: SGBs vs. Other Gold Investments

When looking at Sovereign Gold Bonds and other gold investments, it’s key to make smart choices. You need to know about the returns, costs, how easy they are to sell, and taxes.

Returns and Cost Analysis

Sovereign Gold Bonds give a 2.5% annual interest, which is great for regular income. But, other gold investments like Gold ETFs or digital gold don’t offer this. The costs of SGBs, like interest, can also affect the government’s expenses.

It’s important to look at the administrative costs of SGBs. Compare these to the costs of physical gold or Gold ETFs.

Liquidity and Accessibility Factors

Liquidity differs a lot among gold investments. Sovereign Gold Bonds can be traded on stock exchanges, but with some rules. Gold ETFs, however, are more liquid and can be bought and sold easily on stock exchanges.

Tax Implications Under Indian Tax Laws

Taxes on gold investments in India change based on the type. SGBs are tax-free if held until maturity, which is good for taxes. Gold ETFs, however, face capital gains tax, based on how long you hold them.

Knowing these differences helps you make your gold investment portfolio better. It ensures your financial security.

The RBI and Finance Ministry’s Perspective on the Decision

The RBI and Finance Ministry have made a big move by stopping new Sovereign Gold Bond issuances. This has caught the attention of investors and economists. It’s part of a bigger look at the government’s financial plans, especially with gold investments.

Economic Factors Behind the Timing

Several economic factors led to this decision. The rising costs of the SGB scheme and its small effect on gold imports are key. The government is checking if it’s worth keeping the SGB issuances going.

Alignment with Broader Monetary Policies

This move fits with the RBI’s wider monetary policies. It aims to control inflation and keep the currency stable. It shows the RBI and Finance Ministry working together to tackle economic issues.

International Gold Market Considerations

Global gold market trends are also important. Changes in gold prices worldwide can make SGBs less appealing to investors. The government is likely thinking about these trends to make sure its gold policies are good for investors.

| Factor | Impact on SGB Issuance |

|---|---|

| Economic Costs | Rising costs led to reevaluation |

| Monetary Policies | Alignment with inflation control |

| Global Gold Prices | Influencing investor attractiveness |

Expert Insights from India’s Financial Sector

With the government stopping new SGBs, experts are sharing their thoughts on gold investment and financial security. The move has caused mixed feelings. Some worry about fewer investment choices, while others are hopeful for the gold market’s future.

Views from Top Investment Advisors

Investment advisors have different views on the halt. Some think it’s just a short-term issue. Others believe it’s a chance to look into other gold investment paths.

- Some advisors suggest looking into Gold ETFs and digital gold platforms.

- Others recommend traditional options like gold jewelry and coins.

Perspectives from Gold Industry Associations

Gold industry associations worry about the halt’s impact on India’s gold market. They stress the need for new investment products to replace SGBs.

“The halt in SGB issuances highlights the need for new gold investment products that meet different investor needs.”

Analysis from Economic Think Tanks

Economic think tanks are studying the decision in the context of economic policies and financial security. They’re looking at how it might affect gold prices and how investors will react.

Experts’ insights are crucial for investors trying to understand the changing gold investment scene in India.

Potential Revival Scenarios for Sovereign Gold Bonds

The government might bring back Sovereign Gold Bonds if some conditions are met. They could make the scheme more appealing to investors. Or they could tweak the economic factors that affect gold prices.

Possible Modifications to Make the Scheme Viable

To get investors back, the government is looking at a few changes:

- Increasing the interest rate on Sovereign Gold Bonds

- Lowering the minimum investment needed

- Improving how easily investors can sell their bonds

Economic Triggers That Could Restart Issuances

Several economic signs could lead to the government starting government-backed gold bonds again. For example, if global gold prices drop or the Indian rupee stabilizes.

Alternative Gold-Backed Securities Being Considered

The government is also thinking about other gold investment options. This includes gold ETFs and digital gold platforms to draw in investors.

By updating the Sovereign Gold Bonds scheme and introducing new gold investment choices, the government hopes to regain investor interest. They aim to cut down on gold imports and encourage saving.

Managing Your Existing Gold Bond Investments Effectively

With new Sovereign Gold Bonds not being issued, it’s crucial to manage what you have well. This means making smart choices to keep your investments on track with your financial goals. It’s all about making the most of what you have.

Strategic Hold vs. Sell Decisions

Deciding to hold or sell your Sovereign Gold Bonds depends on your financial situation and goals. If you want financial security, keeping your bonds might be best, especially if they offer a fixed return. But, selling could be better if you need cash or see other good investment chances.

Also, think about the interest rate your bonds offer compared to today’s rates. If your bond’s rate is much higher, it’s wise to hold. But, if rates have gone up, selling might be smart, keeping in mind any capital gains tax you might face.

Tax-Efficient Liquidation Approaches

When selling your Sovereign Gold Bonds, do it in a way that saves you money on taxes. Holding until they mature can help avoid capital gains tax. If you must sell early, plan to offset gains with losses from other investments.

It’s also important to know the tax laws and any recent changes that could affect your investments. Talking to a tax advisor can help you make smart choices.

Portfolio Rebalancing Recommendations

With no new Sovereign Gold Bonds, rebalancing your portfolio is key. You might need to adjust your mix of investments to keep your risk level right. This could mean moving some money to other gold investment alternatives like Gold ETFs or mutual funds.

Rebalancing also lets you diversify your investments. You could put money into other areas that don’t move with gold as much. This can help spread out risk and possibly increase your returns.

Conclusion: Navigating Your Gold Investment Strategy in a Changing Landscape

The halt in Sovereign Gold Bond issuances has changed the gold investment scene in India. As an investor, you need to adjust to this new situation. This means looking at your gold investments differently and finding new ways to reach your financial goals.

There are other ways to invest in gold, like Gold ETFs, Gold Mutual Funds, or digital gold platforms. Each has its own benefits, like being easy to sell, saving on taxes, and being simple to invest in. It’s important to pick the right one for you, based on what you want to achieve and how much risk you can take.

Spreading out your investments is a smart move to reduce risks and increase gains. When you change your gold investment plan, make sure it fits with your bigger financial picture. This way, you can still enjoy the benefits of gold investments, even without Sovereign Gold Bonds.