Exclusive Deals & Trending Items

Muthoot Pappachan Swarnavarsham Gold Oval Ganesha Pendant of 5 gms in 24 KT 999 Purity Fineness

Shop Now

Muthoot Pappachan Swarnavarsham Gold Hallmarked Rose Coin of 8 gms in 22 KT 916 Purity Fineness

Shop NowHave you seen how gold prices have skyrocketed in the last year? They’ve gone up over 40% since late 2023, hitting $3,000 per ounce in mid-March 2025. For a long time, gold has been a safe choice for both private investors and central banks.

This big jump in price is due to changes in why people buy gold. As the world faces more economic worries, gold becomes more attractive. It’s important to understand what’s behind this rise, especially with sanctions and the dollar’s role.

Key Takeaways

- The price of gold has surged over 40% since late 2023.

- Gold remains a critical asset for investors amid global uncertainties.

- Sanctions and dollar dependence are key drivers of gold demand.

- Central banks and private investors are major players in the gold market.

- Global gold trends indicate a shift towards safer assets.

The Evolving Role of Gold in the Global Economy

The role of gold in the global economy is changing. This change is due to many factors like politics and economics. Understanding these factors is key to grasping gold’s importance today.

Gold’s Historical Significance as a Store of Value

Gold has been valuable for centuries. Its rarity, durability, and beauty make it special. In the past, gold backed currencies, keeping wealth stable.

Gold’s key traits as a store of value are:

- Rarity and scarcity

- Durability and resistance to corrosion

- Ease of verification and authentication

- Universal acceptance and value

The Transition from Gold Standard to Fiat Currencies

The move from the gold standard to fiat currencies changed the world. Fiat currencies don’t rely on physical goods but on government rules. This change has reshaped gold’s role in the economy.

| Year | Event | Impact on Gold |

|---|---|---|

| 1971 | Nixon Shock – US abandons gold standard | Gold prices became flexible, and gold’s role evolved |

| 2008 | Global Financial Crisis | Increased investment in gold as a safe-haven asset |

| 2020 | COVID-19 Pandemic | Gold prices surged due to economic uncertainty |

Gold in Geopolitics: A Framework for Understanding Modern Power Dynamics

The world is seeing gold’s role grow in geopolitics. As nations deal with global power struggles, gold is key in their economic and political plans.

Gold as a Strategic National Asset

Gold is now seen as a strategic national asset. It helps a country’s economy and its global standing. China and Russia are adding to their gold, making their economies stronger and less dependent on the US dollar.

Gold’s value as a national asset is clear. It helps:

- Diversify national reserves

- Stabilize the economy

- Support currency values

How Countries Use Gold to Project Economic Power

Countries use gold to show their economic strength. They manage their gold reserves wisely. This boosts their economic position and lets them shape global economic trends.

| Country | Gold Reserves (Tonnes) | % of Total Reserves |

|---|---|---|

| United States | 8,133.5 | 74.6% |

| Germany | 3,363.4 | 71.7% |

| Italy | 2,451.8 | 69.4% |

Looking at gold reserves shows how countries use gold. It’s a strategic tool for economic power and financial stability in a changing world.

The Resurgence of Central Bank Gold Purchases

Central banks are now buying gold at a rate never seen before. This move is part of a larger plan to diversify their reserves away from the US dollar. It’s a response to global uncertainties and a search for financial stability.

Recent Trends in Global Gold Reserves

For several years, central banks have been buying gold. But lately, they’ve been doing it faster. The World Gold Council reports that in 2022, they bought 456 tons of gold. This is a big jump from before.

This increase is because they want to lessen their reliance on the US dollar. They also aim to protect themselves from economic downturns.

The data shows a clear shift towards gold as a preferred reserve asset. Below is a table that highlights the gold reserves of various countries.

| Country | Gold Reserves (Tons) | Percentage of Total Reserves |

|---|---|---|

| United States | 8,133.5 | 73.5% |

| Germany | 3,363.4 | 71.3% |

| Italy | 2,451.8 | 69.4% |

| France | 2,437.0 | 65.9% |

| China | 2,168.0 | 4.3% |

Data Analysis of Central Bank Purchases

The data reveals that central banks are diversifying their reserves by adding more gold. This trend is likely to keep growing as countries try to lessen their US dollar exposure.

Key Countries Leading the Gold Buying Spree

Countries like China, Poland, and India are leading the gold buying spree. China, in particular, has been steadily increasing its gold reserves. This shows a strategic move towards diversifying its assets.

Motivations Behind Reserve Diversification

The reasons for this diversification are varied. They include reducing dollar dependence, hedging against economic uncertainties, and enhancing financial stability. By holding more gold, countries can better manage risks from currency fluctuations and geopolitical tensions.

Sanctions as a Catalyst for Gold Accumulation

Sanctions have led to a rise in gold purchases by nations wanting financial freedom. As global tensions grow, gold’s value as a safe asset increases. It also helps countries avoid financial limits.

Case Studies: Russia, Iran, and Venezuela

Countries like Russia, Iran, and Venezuela have turned to gold due to sanctions. Russia, for example, is boosting its gold reserves. It sees gold as a key asset for financial independence.

Iran is also adding to its gold reserves. It uses gold to ease trade and financial dealings limited by sanctions.

“Gold has become a critical component in our financial strategy, allowing us to maintain economic stability in the face of external pressures.” This shows the importance of gold for many sanctioned nations.

How Gold Helps Circumvent International Sanctions

Gold is a key asset for sanctioned countries. It helps them trade and finance internationally without direct sanctions impact. Gold transactions are harder to track, making them less affected by sanctions.

For instance, a sanctioned country can sell gold to get foreign currency. This currency can then buy vital goods or services. This approach keeps the economy going and supports the currency and financial stability.

Dollar Dependence and the Search for Alternatives

With rising tensions, countries are looking for new options instead of the dollar. Gold is becoming a key player. It’s important to understand the dollar’s role and the move towards de-dollarization in global trade.

The Dollar’s Dominance in International Trade

The US dollar is a key player in international trade. It’s widely accepted as a medium of exchange and a store of value. Its dominance comes from the United States’ economic and military strength, making it the go-to currency for global deals.

But, this dominance also makes countries dependent on the dollar. This makes them vulnerable to US monetary policies and sanctions.

De-dollarization Efforts and Their Impact on Gold Demand

Many countries are now trying to reduce their dollar dependence. They want more economic freedom and less risk from US sanctions. This push for de-dollarization is driving up gold demand.

Gold is seen as a safe asset, not linked to any currency or country’s economy. This makes it a popular choice as countries look for alternatives to the dollar.

BRICS Nations and Their Gold Strategies

Gold is key in the economic plans of BRICS nations. They want financial security and freedom. Each country has its own way of using gold reserves.

China’s Gold Reserves and Strategic Objectives

China, the world’s second-largest economy, has grown its gold reserves over 20 years. It now holds over 2,168 tonnes of gold. China aims to diversify its reserves and lessen its US dollar reliance.

Russia’s Gold Accumulation in Response to Western Sanctions

Russia is building up its gold reserves to counter Western sanctions. It now holds over 2,300 tonnes of gold. This move is part of Russia’s plan to protect its economy and gain financial freedom.

India’s Position Within BRICS Gold Policies

India plays a big role in BRICS and has a special bond with gold. Its gold reserves are large but not as big as China or Russia’s. India’s gold policies are shaped by its love for gold and its economic goals.

| Country | Gold Reserves (Tonnes) | Strategic Objective |

|---|---|---|

| China | 2,168 | Diversification of foreign exchange reserves |

| Russia | 2,300 | Hedge against Western sanctions |

| India | 794 | Economic and cultural significance |

India’s Unique Relationship with Gold: Cultural Heritage and Economic Reality

In India, gold is more than just a precious metal. It’s a key part of the nation’s culture and economy. Gold’s role in Indian society touches many areas of life, from cultural practices to economic choices.

Cultural and Religious Significance of Gold in Indian Society

Gold is highly valued in Indian culture. It stands for prosperity, good fortune, and marital happiness. In many homes, gold is a crucial part of weddings and is given as gifts to brides.

Gold jewelry and ornaments are not just for show. They also hold value. This cultural love for gold boosts demand, especially during festivals.

The religious side of gold is also important. Hindu deities are often shown wearing gold. Temples collect a lot of gold through donations. This adds to the demand for gold during special times.

India’s Gold Market Structure and Dynamics

India’s gold market is huge and complex. It has both formal and informal parts. The market is shaped by government policies, global gold prices, and local demand.

The Indian gold market loves physical gold. Much of it is used in jewelry and ornaments.

| Year | Gold Imports (Tonnes) | Gold Demand (Tonnes) |

|---|---|---|

| 2020 | 900 | 800 |

| 2021 | 1000 | 900 |

| 2022 | 1100 | 1000 |

How Global Geopolitical Trends Affect Indian Gold Prices

Global events greatly affect Indian gold prices. Trade tensions, currency changes, and sanctions can make prices swing. Investors see gold as a safe choice, which increases demand and prices.

India’s gold prices also follow global trends. The country relies heavily on gold imports.

The mix of global trends and India’s gold market shows the importance of keeping up with news. This helps investors understand how gold prices might change.

Gold as a Hedge Against Currency Volatility and Inflation

Global economic conditions are getting more unpredictable. Gold’s role as a hedge against currency volatility and inflation is becoming more important. You might wonder how gold can safeguard your investments in uncertain times. Gold has always been a reliable safe-haven asset, keeping its value when others drop.

How Political Instability Affects Currency Values

Political instability can greatly affect currency values, causing market volatility. When a country’s politics are shaky, investors doubt its currency, leading to a drop in value. For example, during political unrest, investors turn to gold to protect their wealth. This is evident when political tensions rise, and currency values fluctuate, making gold a preferred choice.

Gold’s Performance During Currency Crises

Gold has always been a strong performer during currency crises. It acts as a hedge against inflation and currency devaluation. For instance, during the 2008 financial crisis, gold prices soared as investors sought safe assets. Understanding this history can help in making better investment choices.

To show gold’s performance during currency crises, consider the following table:

| Currency Crisis | Gold Price Before Crisis | Gold Price After Crisis |

|---|---|---|

| 2008 Financial Crisis | $800/oz | $1,200/oz |

| 2011 European Debt Crisis | $1,050/oz | $1,895/oz |

| 2020 COVID-19 Pandemic | $1,500/oz | $2,065/oz |

In conclusion, gold’s past performance during currency volatility and inflation makes it a solid choice for investors. By grasping how gold behaves in uncertain times, you can make smarter investment choices.

The Technology Factor: Digital Gold and Cryptocurrencies

Technology is changing how we invest in gold, introducing digital options. It’s important to understand digital gold and cryptocurrencies in this new landscape.

Comparing Physical Gold to Digital Alternatives

Physical gold has long been a safe investment. But now, digital gold and cryptocurrencies offer new ways to invest. These digital options make buying and storing gold easier.

Physical and digital gold differ in key ways:

| Characteristics | Physical Gold | Digital Gold |

|---|---|---|

| Storage | Requires physical storage | Stored digitally |

| Transaction Ease | Can be cumbersome | Easy to transact |

| Security | Risk of theft | Dependent on digital security |

Central Bank Digital Currencies and Their Relationship to Gold

Central banks are looking into digital currencies. This raises questions about how they might affect gold demand. It’s important to think about how these currencies could change the gold market.

The link between central bank digital currencies (CBDCs) and gold is complex. While CBDCs might cut down on the need for physical money, their effect on gold reserves is still being studied.

- CBDCs could lower gold demand if they become a common store of value.

- But gold’s long history and role as a safe asset might keep its demand high.

Gold Price Movements in Response to Geopolitical Events

Geopolitical events greatly affect gold price movements. It’s important for investors to understand this link. Gold prices often change with global tensions, showing its value as a safe investment during uncertain times.

Historical Price Patterns During Political Crises

Throughout history, geopolitical events have caused big changes in gold prices. Looking at past crises helps us predict how gold might react in future tensions.

The 2008 Financial Crisis and Gold

In 2008, gold prices went up as investors looked for safe places to put their money. Gold prices jumped from about $800 per ounce to over $1,900 per ounce by 2011.

COVID-19 Pandemic Impact on Gold Markets

The COVID-19 pandemic also greatly affected gold markets. As the world locked down and uncertainty grew, gold prices hit over $2,000 per ounce in 2020. This was due to economic support, fears of currency value drops, and a desire for safety.

Predicting Gold’s Response to Current Geopolitical Tensions

By studying price patterns from past crises, we can guess how gold will react to today’s tensions. As geopolitical events keep happening, investors watch gold closely. They see it as a way to protect against rising conflicts and economic troubles.

By looking at past trends and current market conditions, you can make better choices about investing in gold. Whether buying gold bullion, ETFs, or shares in gold mining companies, knowing how gold price movements and geopolitical events are connected is crucial. It helps you navigate these complex markets.

Investment Strategies for Indian Investors in the Current Geopolitical Climate

Indian investors are now looking at gold as a safe place to put their money. With global issues affecting markets, gold’s value as a safe asset is growing. This section will help you understand how to invest in gold, including how much to put in and the different ways to do it in India.

Portfolio Allocation Recommendations Based on Risk Tolerance

Your risk tolerance is key when investing in gold. If you’re cautious, you might put up to 20% of your portfolio in gold. But if you’re more daring, 5-10% could still help stabilize your investments. It’s important to think about your financial goals and how much risk you can handle before investing.

Rajesh, a financial advisor, says, “Adding gold to your portfolio can reduce risks from other investments.” Gold can act as a shield against global issues and economic downturns.

Different Ways to Invest in Gold in India

In India, you can invest in gold in many ways. These include physical gold, paper gold, and gold mining stocks. Each option has its own benefits and characteristics.

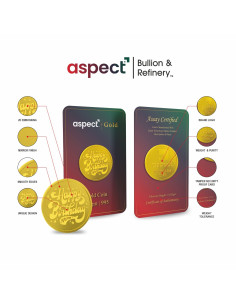

Physical Gold: Jewelry, Coins, and Bars

Buying physical gold, like jewelry, coins, and bars, is a common choice. Buying gold coins or bars from trusted sources ensures they are real and of good quality. But, remember, there are costs for storing and keeping it safe.

Paper Gold: ETFs, Sovereign Gold Bonds, and Digital Gold

Paper gold investments, like ETFs, Sovereign Gold Bonds, and digital gold, are alternatives to physical gold. ETFs are easy to buy and sell on stock exchanges. SGBs offer a good interest rate and can be exchanged for physical gold. Digital gold lets you buy and sell gold online, with the option to get it in physical form.

Gold Mining Stocks and Mutual Funds

Investing in gold mining stocks or mutual funds focused on gold mining is another option. These investments might offer higher returns, tied to the mining companies’ success. But, they also carry more risks, like operational costs and geopolitical issues.

When planning your investment strategy, weigh the pros and cons of each gold investment option. This way, you can make choices that fit your financial goals and risk level. As

“The best investment is in the tools of one’s own trade.” – Benjamin Franklin

, gold can be a smart addition to your investment mix, offering protection against uncertainty and market ups and downs.

The Environmental and Social Impact of Increased Gold Mining

Gold mining is growing, but it raises big concerns about the environment and society. Before you invest in gold, it’s key to know how mining affects us all.

Sustainability Challenges in Gold Production

Gold mining harms the environment a lot. It leads to deforestation, water pollution, and soil damage. The process uses harmful chemicals like cyanide, hurting local nature.

Some big challenges in gold mining are:

- Managing waste and tailings to prevent environmental contamination

- Reducing water and energy consumption

- Minimizing the impact on local biodiversity

Ethical Considerations for Gold Investors

As a gold investor, you can help make mining better. Look at the mining company’s social and environmental record.

Important ethical points are:

- Make sure mining respects local communities’ rights and interests

- Support companies that follow strict environmental rules

- Encourage openness in mining operations and supply chains

By thinking about these points, you can choose investments that match your values. This helps make the gold industry more sustainable.

Future Trends: Where Is the Gold Market Heading?

The gold market’s future is closely tied to central banks’ strategies around the world. Knowing the trends that will shape the gold market is key for smart investment choices.

Emerging Patterns in Central Bank Behavior

Central banks are buying more gold, which is driving the gold market’s future. They want to diversify their assets and not rely too much on the US dollar. Expect this trend to keep going, with more gold purchases by central banks, especially in emerging markets.

This trend points to a world where gold is more important in finance. It shows a move towards a more balanced world. More gold purchases by central banks mean they see gold as a valuable asset for the long term.

Long-term Outlook for Gold in a Multipolar World

In a world with many powers, gold’s role will grow. Countries want to avoid being tied to one currency or economy. Gold’s value as a safe place to put money and a protection against currency changes will keep demand high.

Think about how a multipolar world affects your investments. Gold’s importance means understanding global changes is crucial. The outlook is good for gold, making it a key part of a well-rounded investment portfolio.

How Geopolitical Risks and Gold Market Movements Will Affect Your Financial Future

Geopolitical risks and gold market dynamics are key to your financial security. As global tensions grow and economies link more, knowing these factors is crucial. It helps you make smart investment choices.

Short-term Investment Considerations for Indian Investors

Indian investors need to watch global events closely. Sanctions, trade wars, and political instability can quickly change gold prices. Keeping up with these news is key to making quick investment moves.

It’s wise to spread your investments across different assets. Gold exchange-traded funds (ETFs) and gold mutual funds are good choices. They let you invest in gold easily, without owning physical gold.

| Investment Option | Short-term Potential | Risk Level |

|---|---|---|

| Gold ETFs | High | Medium |

| Gold Mutual Funds | High | Medium |

| Physical Gold | Medium | Low |

Long-term Strategic Positioning in Gold Markets

For long-term planning, understanding gold demand trends is essential. Central banks’ gold reserves are growing. This shows a move towards diversifying away from traditional currencies. This trend is likely to keep going, thanks to global uncertainty and the search for financial safety.

“The role of gold in the global monetary system is evolving. Central banks are increasingly looking to gold as a diversifier and a hedge against geopolitical risks.” –

Indian investors can profit from this trend by investing in gold. Gold has done well when the economy is shaky. It’s a solid part of a well-rounded investment plan.

Conclusion

Gold is key in today’s world politics. Central banks are buying more gold, and countries use it to deal with sanctions and dollar issues. Knowing this helps investors make better choices.

Gold’s value is growing as a national asset and a way to avoid sanctions. It’s important for a strong investment plan. Adding gold to your portfolio can protect against currency and political risks.

When thinking about investments, remember how world events affect gold prices. Keeping up with central bank gold buying and gold’s role in the world economy is smart. Gold has shown it can protect against political risks, making it a good choice for your investments.

One Response

Interesting breakdown—especially the role sanctions play in driving up gold purchases. Makes you wonder how long the dollar can remain the default reserve currency when so many nations are looking for alternatives.