Exclusive Deals & Trending Items

Muthoot Pappachan Swarnavarsham BIS Hallmarked Gold Ganesh Leaf Pendant of 2 gms in 22 KT 916 Purity Fineness

Shop NowYou know how important it is to spread out your investments. Precious metals investment, especially gold, is a proven way to balance risk and reward.

The World Gold Council says gold is crucial for long-term investments. It’s a key part of a diversified portfolio. Adding gold to your mix can make your investments more stable and less risky.

Key Takeaways

- Gold serves as a diversifier in investment portfolios.

- Precious metals investment can reduce reliance on single asset classes.

- A well-diversified portfolio can be more resilient to economic uncertainty.

- Gold has historically maintained its value over time.

- Strategic allocation to gold can be a key long-term investment strategy.

The Strategic Role of Gold in Modern Investment Portfolios

Global markets are getting more volatile, making gold’s role in investment portfolios more important. Adding gold to your portfolio can improve your diversification strategy. Gold is a liquid and rare asset that keeps its value over time.

Why Investors Turn to Gold in Uncertain Times

When the economy is shaky, investors look for safe places to put their money. Gold is often the top choice because it holds its value when other investments drop. Here’s why:

- Gold is easy to turn into cash, making it very liquid.

- Its rarity helps keep its value high.

- Gold isn’t someone else’s debt, making it a special kind of asset.

Adding gold to your portfolio can lower your risk and help your financial growth with gold in the long run.

Gold’s Unique Properties as an Asset Class

Gold stands out from other investments because of its tangible value and lack of correlation with other assets. This makes gold a great diversifier, helping to:

- Lower portfolio volatility

- Act as a shield against inflation and currency changes

- Make your portfolio more resilient

Knowing and using these traits can help you make smart choices about adding gold to your investment plan.

Understanding Portfolio Diversification Fundamentals

To reduce risk and find more opportunities, knowing about portfolio diversification is key. Diversification doesn’t promise you’ll make money or avoid losses, as J.P. Morgan points out. Yet, it’s a vital way to handle risk.

By diversifying, you spread your investments across different types. This way, you’re not relying too much on one investment. It helps you deal with market ups and downs and can even out your returns over time.

The Science Behind Risk Reduction Through Diversification

Diversification is based on the idea that different investments act differently in different markets. By mixing various assets, you lessen the effect of a single investment’s bad performance on your whole portfolio. Adding gold to your investment portfolio is especially useful because it doesn’t usually move with other assets.

Diversification doesn’t guarantee investment returns and doesn’t eliminate the risk of loss.

Correlation Coefficients and Their Importance

Correlation coefficients show how much two assets’ returns move together. Assets with low or negative correlation can lower your portfolio’s risk. For example, gold acts as a hedge against market volatility, as its value can change differently from stocks and bonds.

| Asset Class | Correlation with Stocks | Correlation with Bonds | Correlation with Gold |

|---|---|---|---|

| Stocks | 1 | 0.2 | -0.1 |

| Bonds | 0.2 | 1 | 0.1 |

| Gold | -0.1 | 0.1 | 1 |

Knowing these basics helps you make better investment choices. It includes seeing the benefits of adding gold to your portfolio.

Gold as a Portfolio Diversifier: Historical Performance Analysis

Gold’s history shows it’s a solid choice in tough economic times. As an investor, knowing how gold performs in downturns and its link to other assets is key.

Gold’s Performance During Major Market Downturns

Gold is seen as a safe-haven asset, attracting investors in uncertain times. For example, during the 2008 crisis, gold prices went up as people looked for safe places to invest. Gold’s price also rose with inflation, acting as a hedge.

“Gold is often viewed as a safe-haven asset, and its price movements during times of economic stress are closely watched by investors and policymakers alike.”

Looking at gold’s past performance in downturns shows its value as a diversifier. Below is a table that highlights gold’s performance in major economic downturns since 1980.

| Event | Year | Gold Price Change (%) |

|---|---|---|

| Recession | 1980-1982 | +23.5% |

| Dot-com Bubble | 2000-2002 | +14.2% |

| Global Financial Crisis | 2007-2009 | +25.1% |

| COVID-19 Pandemic | 2020 | +24.6% |

Long-term Correlation Between Gold and Traditional Asset Classes

It’s important to know how gold relates to traditional assets over time. Gold has a low link to stocks and bonds, making it a great diversifier. Adding gold to your portfolio can lower risk.

Gold’s performance is not closely linked to traditional assets, offering diversification benefits. By adding gold to your strategy, you can improve returns and protect against market ups and downs.

Case Study: The 2008 Financial Crisis and Gold’s Protective Role

The 2008 financial crisis tested investment portfolios, showing gold’s protective role. As the crisis hit, investors saw a big change in how assets performed. Gold became a key stabilizer during this time.

Portfolio Performance With and Without Gold Allocation

Portfolios with gold did better during the 2008 crisis than those without. Data shows that gold’s negative correlation with US large cap stocks helped reduce losses. A study found that portfolios with gold had lower volatility and better returns.

A financial expert noted,

“Gold acted as a safety net, cushioning the impact of the financial downturn on investment portfolios.”

This shows why adding gold to a diversification strategy is key for financial growth.

Recovery Patterns Post-Crisis for Gold-Inclusive Portfolios

After the 2008 crisis, portfolios with gold recovered better. The mean returns of US large cap stocks were highest with the highest standard deviation. Gold helped stabilize the portfolio, reducing risk.

A well-diversified portfolio, with gold, can handle financial storms better. When planning your investments, think about how gold can protect your assets in downturns.

Case Study: COVID-19 Market Volatility and Gold’s Response

The COVID-19 pandemic started in early 2020, causing big market swings. This affected investors all over the world. Markets went up and down a lot, testing how strong different investment plans were.

Initial Market Shock and Gold Price Movements

At the start of the pandemic, gold prices went up fast. Adding gold to an investment portfolio was a smart move. It helped reduce losses when markets fell. Gold often does well when world tensions rise, making it a good gold hedge against market volatility.

As the pandemic grew, people watched gold’s price closely. Its performance showed its worth as a way to diversify a portfolio.

Portfolio Resilience Data from March 2020 to Present

Looking at portfolio resilience from March 2020 on, we see gold helped. Portfolios with gold were more stable. Gold’s performance balanced out losses in other investments. This study shows why adding gold to your portfolio is key during market ups and downs.

The COVID-19 pandemic taught investors about gold’s value. By adding gold to their plans, investors can make their portfolios stronger. This helps them handle market shocks better and do better overall.

Quantitative Analysis: Optimal Gold Allocation Percentages

To get the most out of your investments, knowing the right amount of gold is key. Gold helps diversify your portfolio, making it stronger against financial downturns. But how much gold should you include?

Risk-Adjusted Returns at Various Gold Allocation Levels

Adding gold to your portfolio can boost its performance. Research shows that gold helps improve risk-adjusted returns. For example, a study found that portfolios with 5-10% gold had better Sharpe ratios, showing a good balance between risk and reward.

Experts tested different gold amounts against past market data. They found that too little gold doesn’t help much, while too much can hurt returns. So, finding the perfect amount is important.

The 5-15% Sweet Spot: Data-Backed Recommendations

Data suggests that the best gold allocation is between 5% and 15% of your portfolio. This range can reduce volatility while keeping returns good. For instance, in 2008, a 10% gold allocation helped portfolios stay strong when others faltered.

The right gold amount depends on your risk level and goals. But the 5-15% range is a good starting point for those looking to benefit from gold’s diversification.

Gold Investment Vehicles for Indian Investors

Indian investors can diversify their portfolios with gold through various vehicles. The gold market in India has grown, offering more than just physical gold.

Sovereign Gold Bonds: Features and Benefits

Sovereign Gold Bonds (SGBs) are backed by the government. They are in grams of gold and issued by the RBI. SGBs offer tax-free returns at maturity and the interest earned is taxable. They are great for those who want to invest in gold without physical storage.

Gold ETFs and Gold Mutual Funds in India

Gold ETFs are traded on stock exchanges and backed by physical gold. They make investing in gold easy without storage worries. Gold Mutual Funds invest in gold-related assets like ETFs or mining stocks. Both are good for those who want gold exposure without physical gold.

Digital Gold Platforms: Accessibility and Considerations

Digital gold platforms let investors buy, sell, and store gold online. They offer small gold purchases, reaching more investors. But, be aware of fees and choose reputable providers.

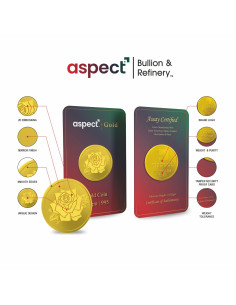

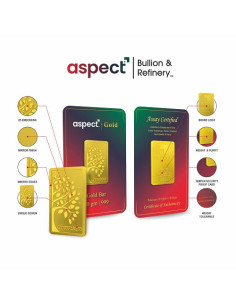

Physical Gold: Jewelry, Coins, and Bars

Investing in physical gold is a favorite among Indians. It includes jewelry, coins, and bars. Physical gold offers security but has storage and security risks, and jewelry has making charges.

Each gold investment has its own benefits. Choose wisely based on your financial goals, risk tolerance, and time frame.

The Indian Context: Cultural Significance and Investment Implications

In India, gold is more than just a metal. It’s a big part of our culture, affecting how we invest. Gold holds deep cultural and emotional value, making it a special asset for both cultural and financial reasons.

Gold’s Dual Role as Cultural Asset and Investment Vehicle

Gold has a big role in Indian culture. It’s used in jewelry, coins, and bars, valued for its beauty and as a sign of wealth. This cultural importance boosts demand, especially during festivals and weddings, making it key to our traditions.

As an investment, gold is a gold hedge against market volatility. It offers a safe place to invest during tough economic times.

Understanding gold’s dual role can help you. It serves as a store of value and a hedge against inflation. Its cultural importance also ensures it stays liquid and in demand, leading to financial growth with gold. This makes gold a great choice for diversifying your investments.

Seasonal Patterns in Indian Gold Demand and Pricing

Gold demand in India follows clear seasonal patterns, driven by festivals and religious events. Demand goes up during Diwali and Akshaya Tritiya, which can push prices higher. Knowing these trends can help you invest wisely, buying low during slow seasons and selling high when demand rises.

- Peak demand seasons: Diwali, Akshaya Tritiya, and wedding seasons.

- Opportunities to buy at lower prices during off-peak seasons.

- Importance of tracking cultural and religious calendars for investment timing.

By understanding these patterns and gold’s role in Indian culture, you can improve your investment strategy. Gold can be a key part of your portfolio.

Tax Implications of Gold Investments for Indian Investors

As an Indian investor, knowing about gold investment taxes is key to getting the most out of your money. Adding gold to your portfolio is not just about spreading out your risk. It also means you have to deal with some taxes.

Short-term vs. Long-term Capital Gains on Gold

The time you hold onto your gold matters a lot for taxes. Short-term capital gains happen if you sell your gold in less than three years. These gains are taxed based on your income tax rate.

Long-term capital gains kick in after three years. They’re taxed at a flat 20% rate, with benefits from indexation. This makes holding onto gold for longer a better deal for taxes.

Tax Efficiency Comparison Across Gold Investment Options

Gold investments come with different tax rules. For example, Sovereign Gold Bonds (SGBs) don’t face capital gains tax if held until maturity. But, gold ETFs and mutual funds face the same tax as other stocks.

Knowing these tax rules helps you make smarter choices with your gold investments. This way, gold can stay a strong part of your investment mix.

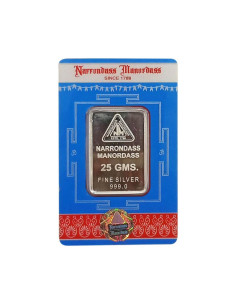

Gold vs. Other Precious Metals as Portfolio Diversifiers

Gold has always been a key part of investment portfolios. But, other precious metals like silver, platinum, and palladium also bring their own benefits. It’s important to know how these metals compare to each other and to traditional assets.

Comparative Analysis: Gold, Silver, Platinum, and Palladium

Each precious metal has its own market dynamics. Gold is often seen as a safe-haven asset, like silver. Both tend to do well when the economy is uncertain. Platinum and palladium, however, are more tied to industrial demand, especially in cars.

Comparing them shows gold and silver usually move together. But, platinum and palladium can have different price movements because of their industrial uses. This difference can help diversify a portfolio.

Diversification Benefits of a Multi-Metal Approach

Adding multiple precious metals to a portfolio can improve diversification. By investing in gold, silver, platinum, and palladium, investors can lower risk and possibly increase returns.

A multi-metal strategy lets investors benefit from each metal’s unique traits. For example, gold and silver might do well in economic stress. Meanwhile, platinum and palladium could shine in times of industrial growth.

Implementing a Gold Diversification Strategy: Practical Steps

Starting a gold diversification strategy needs careful planning. As an investor, you must think about several things to add gold to your portfolio well.

Assessing Your Current Portfolio’s Vulnerability

First, check how your current portfolio handles market ups and downs. Look at your asset mix and find out where you might be at risk. Think about your risk level and adjust your gold share. If you’re okay with risk, you might put less gold in your portfolio. But if you’re cautious, you might put more.

Dollar-Cost Averaging vs. Lump Sum Gold Investments

When buying gold, you can choose between dollar-cost averaging or investing a big sum all at once. Dollar-cost averaging means investing a set amount regularly, no matter the market. It can lessen the effects of market swings. Investing a big sum at once might be better if you have a lot of money and think gold will do well over time.

Rebalancing Strategies for Gold-Inclusive Portfolios

Keeping your gold share right is key. This means checking your portfolio often and tweaking your gold holdings to match your goals. A good plan is to rebalance every quarter or year, based on how long you plan to invest and how much risk you can take.

When to Increase or Decrease Your Gold Allocation

It’s important to know when to add or subtract gold from your portfolio. If you think the market will drop or get more shaky, add more gold. But if the market is up and you’ve hit your goals, you might cut back on gold. Always keep an eye on the market and tweak your plan as needed.

| Market Condition | Recommended Gold Allocation |

|---|---|

| Market Downturn | Increase Allocation |

| Market Stability | Maintain Current Allocation |

| Market Growth | Decrease Allocation |

By following these steps, you can set up a gold diversification strategy that fits your goals and risk level. Always check and adjust your portfolio to keep it on track for growth with gold.

Common Misconceptions About Gold as an Investment

Many investors think twice about adding gold to their portfolios. They believe it doesn’t help with returns. But, these doubts can be cleared up, showing gold’s worth in a well-rounded investment plan.

Addressing the “Gold Doesn’t Generate Income” Argument

Some think gold doesn’t earn income like stocks or bonds. But, gold’s real value is in protecting against market ups and downs and inflation. It keeps its worth over time, making it a solid value keeper. Adding gold to your portfolio doesn’t just add an asset; it also boosts your risk management.

Gold Storage and Security Concerns: Separating Fact from Fiction

Storing and securing gold is a real concern. But, these worries are often too big. You can lessen these risks by using trusted storage services or bank lockers. Banks and specialized companies offer safe places for gold, with insurance against loss or theft.

By taking these steps, you can enjoy gold’s benefits without worrying about its safety. When thinking about adding gold to your investment portfolio, consider these points and make a smart choice.

Future Outlook: Gold in an Era of Digital Assets and Inflation Concerns

In today’s world, where digital innovation and economic uncertainty are common, gold’s value is being looked at again. It’s important to know how gold fits into your investment plans in this new setting.

The growth of digital assets, like cryptocurrencies, has raised questions about their place alongside gold. You might be thinking if these digital assets are taking gold’s place or working together in investment portfolios.

Gold vs. Cryptocurrencies: Complementary or Competing Assets?

The bond between gold and cryptocurrencies is intricate. Both are seen as alternative investments, but they differ greatly. Gold is a tangible asset with a rich history as a safe value, while cryptocurrencies are digital and have more unpredictable prices.

Key differences between gold and cryptocurrencies:

- Physical vs. digital nature

- Historical context and adoption

- Supply mechanisms

Gold and cryptocurrencies might not be rivals but rather serve different roles in a diversified portfolio. You could choose to invest in both, based on your risk level and goals.

Central Bank Gold Reserves and Their Impact on Global Markets

Central banks’ gold reserves are key in the global gold market. Their actions can sway gold prices and market mood.

Recent trends indicate central banks are still adding to their gold reserves. This shows gold’s importance as a reserve asset. Such demand from central banks could help stabilize gold prices, reducing the risk of big drops.

As you explore the changing investment scene, grasping these points can aid in deciding whether to include gold in your portfolio.

Conclusion: Balancing Your Portfolio with the Timeless Stability of Gold

Gold plays a special role in today’s investment world. It offers a way to balance your investments, protecting them from market ups and downs.

Adding gold to your portfolio can boost your financial growth. Studies show gold does well when markets are tough. This makes it a key asset for managing risks.

Think about putting some of your money into gold. A mix of investments, including gold, can help you stay stable in uncertain times. It’s a smart way to secure your financial future.