Exclusive Deals & Trending Items

As a gold investor, knowing about commodity supercycles is key. A commodity supercycle is when prices keep going up for more than five years. This is different from usual trends.

Commodity supercycles have greatly influenced the value of many commodities, like gold. By understanding these cycles, you can improve your gold investment strategies. This can help you get better returns.

Key Takeaways

- Commodity supercycles are periods of sustained price increases lasting at least five years.

- Gold has historically been a key player in commodity supercycles.

- Understanding commodity supercycles can help refine gold investment strategies.

- Recognizing patterns in commodity supercycles can aid in making informed investment decisions.

- Commodity supercycles can significantly impact the value of gold.

Understanding Commodity Supercycles

Investors need to know about supercycles in commodity markets. These are long periods where prices of many commodities, like gold, change a lot.

What Defines a Commodity Supercycle

A supercycle is long and affects many commodities. The Bank of Canada says there have been four big ones since the 1900s. These cycles have big price swings across different commodities.

Historical Patterns of Commodity Supercycles

Global economic trends, new tech, and world events shape supercycles. Knowing these patterns helps investors guess what the market will do next.

“Commodity supercycles are driven by fundamental changes in the global economy, and understanding these cycles is crucial for making informed investment decisions.”

The Four Phases of a Typical Supercycle

A supercycle goes through four main phases:

1. Demand starts to rise, prices go up slowly,

2. Demand grows fast, but supply can’t keep up, prices jump,

3. Demand slows down, prices stabilize,

4. Supply outpaces demand, prices fall.

| Phase | Characteristics |

|---|---|

| Initial Expansion | Increased demand, gradual price rise |

| Rapid Expansion | Supply constraints, rapid price increase |

| Slowdown | Decelerating demand growth, stabilizing prices |

| Contraction | Supply exceeds demand, prices decline |

Knowing these phases helps investors decide when to invest in gold and other commodities.

The Relationship Between Commodity Supercycles and Gold

Gold’s performance during commodity supercycles is key for investors looking to diversify. As commodity prices swing, gold shows unique behaviors. These insights are valuable for investors.

How Gold Performs During Different Cycle Phases

Commodity supercycles last 10 to 35 years, with ups and downs. Gold’s performance changes a lot during these times. In the early stages, gold lags behind other commodities when prices are rising. But, as the cycle matures and uncertainty grows, gold becomes a safe haven.

For example, during high inflation or currency devaluation, gold shines. Investors seeking gold investment opportunities often turn to it, boosting its price.

Gold’s Unique Position Among Commodities

Gold is different from other commodities. It’s seen as a store of value and a hedge against uncertainty. This makes gold’s price movements unique.

A comparative analysis of gold with other commodities during supercycles shows interesting patterns.

| Commodity | Performance During Supercycle Upswing | Performance During Supercycle Downswing |

|---|---|---|

| Gold | Moderate Gains | Strong Safe-Haven Demand |

| Oil | Significant Gains | Sharp Decline |

| Copper | Strong Gains Due to Industrial Demand | Decline Reflecting Reduced Industrial Activity |

Why Gold Often Moves Counter to Other Commodities

Gold’s counter-cyclical behavior is due to its safe-haven role. In economic downturns or uncertainty, investors seek gold. This drives up its price, even as other commodities fall.

This pattern is seen in historical data. It’s crucial for investors studying gold market analysis reports.

Understanding the link between commodity supercycles and gold helps investors. They can make better decisions, capitalizing on gold’s unique opportunities during different cycle phases.

Current State of the Commodity Cycle

Many investors are curious about the current state of commodity prices. Analysts believe we’re starting a new supercycle. Prices for metals, gas, coal, and food have risen sharply in 2021.

Where We Are in the Present Cycle

Prices for different commodities have gone up a lot. This rise is due to several reasons. These include problems in supply chains, more demand, and changes in global policies.

Key Indicators to Watch

To track the commodity cycle, we need to watch certain signs. These include price indexes, supply and demand, and global economic trends.

| Indicator | Current Status | Trend |

|---|---|---|

| Commodity Price Index | High | Increasing |

| Supply Chain Disruptions | Significant | Stable |

| Global Economic Growth | Recovering | Positive |

Expert Opinions on Cycle Progression

Experts have different opinions on the commodity cycle. Some think it’s just starting, while others see a slowdown coming. This could be due to changes in global policies and better supply chains.

If you’re thinking about investing in commodities like gold, knowing the cycle is key. You might want to buy gold online as part of your strategy. Keep an eye on the gold price forecast to make the most of your investments.

Factors Driving the Current Commodity Supercycle

The current commodity supercycle is complex. It’s shaped by many factors. The global economy is changing, affecting commodity markets deeply.

Global Economic Policies

Global economic policies are key in the current supercycle. Monetary policies, like interest rates and quantitative easing, impact prices. Central banks’ changes in policy affect global liquidity and demand for commodities.

Supply Chain Disruptions

Supply chain disruptions are common in this supercycle. Events like natural disasters and the pandemic have caused big problems. These issues lead to price volatility and higher costs for some commodities.

Technological Demand

The world is moving towards more electric and renewable energy. This means more demand for lithium, copper, and gold. These commodities are crucial for new energy technologies.

India’s Role in Global Commodity Markets

India is becoming a big player in global commodity markets. Its growing economy and demand for commodities affect prices worldwide. India’s gold demand has a big impact on the global gold market.

| Factor | Impact on Commodity Supercycle | Relevance to Gold Investors |

|---|---|---|

| Global Economic Policies | Influences commodity prices through monetary policies | High |

| Supply Chain Disruptions | Leads to price volatility and increased costs | Medium |

| Technological Demand | Drives demand for critical commodities | High |

| India’s Role | Influences global commodity prices through demand | High |

Knowing these factors is key for investors in the current supercycle. When looking at best gold stocks or gold ira accounts, staying informed is crucial.

Gold’s Historical Performance During Economic Shifts

Investors often look to gold as a safe place to put their money when the economy changes. But how well gold does can really vary. It’s key to know how gold acts in these times to make smart choices.

Gold During Inflationary Periods

Gold has usually done well when prices go up. When money loses value, gold becomes more appealing. For example, in the 1970s, when prices were high, gold’s value soared.

“Gold is often seen as a hedge against inflation, as it tends to perform well when inflation rises.” This is because gold’s worth isn’t linked to any single currency. It’s a solid choice when the economy is shaky.

Gold During Recessionary Periods

Gold’s performance in downturns is a bit tricky. It’s seen as a safe spot, but demand can drop, which might lower its price. Yet, gold has sometimes done well in recessions, especially when money policies are relaxed or there’s global tension.

“In times of economic stress, investors flock to safe-haven assets like gold, driving up its price.”

Gold’s Performance During Previous Supercycles

Looking at gold’s past in supercycles gives us clues for today. Gold has thrived when commodity demand goes up and the economy grows. As prices for goods rise, so does the economy, making investors more confident in gold.

By studying gold’s past in different economic times, investors can better understand today’s market. This helps them make smarter choices about investing in gold.

Opportunities for Gold Investors in the Current Supercycle

Gold investors have unique chances to diversify their portfolios in the evolving commodity supercycle. Gold is a trusted hedge against economic uncertainty. Yet, it comes with risks. It preserves value but doesn’t earn income like stocks or bonds.

To make the most of these chances, understanding the market dynamics is key. Here are important points for gold investors in the current supercycle:

Timing Investment Decisions

Timing is everything when investing in gold. Knowing the current phase of the commodity supercycle and its effect on gold prices is crucial. Monitoring economic indicators and market trends helps investors make smart choices.

- Watch inflation rates, as they often increase gold prices.

- Follow central bank policies, especially on interest rates and quantitative easing.

- Stay updated on geopolitical tensions that can affect market stability.

Portfolio Allocation Strategies

Deciding the right amount of gold in your portfolio is essential. Diversification helps manage risk. Investors should think about their financial goals, risk tolerance, and investment time frame when choosing gold investments.

- Use a core-satellite strategy, with gold as a core holding.

- Regularly check and adjust your portfolio to meet your investment goals.

- Look into different gold investment options, like gold ETFs, sovereign gold bonds, or digital gold platforms.

Risk Management Approaches

Managing risk is crucial when investing in gold. Investors should know the risks, like price volatility and currency changes. Diversifying and using hedging strategies can reduce these risks.

By grasping the current supercycle and using smart investment tactics, gold investors can seize market opportunities. Whether you’re experienced or new, staying informed and adjusting your strategies is vital as the market changes.

Gold Investment Opportunities in India’s Market

Investors in India have many ways to invest in gold. Each option has its own benefits. The Indian gold market offers a wide range of products for different needs and tastes.

Physical Gold Investments

Physical gold is a classic choice in India. You can buy coins, bars, or jewelry. It’s important to think about where to store it and its purity.

Gold Sovereign Bonds

Gold Sovereign Bonds (GSBs) are backed by the government. They are a safe choice. GSBs let you invest in gold without worrying about storage.

Gold ETFs in India

Gold ETFs (Exchange-Traded Funds) trade on stock exchanges. They let you invest in gold without owning it physically. Gold ETFs are known for being liquid and transparent.

Digital Gold Platforms

Digital gold platforms let you invest in gold online. You can buy, sell, and store gold digitally. It’s a convenient option. Digital gold investments are often backed by real gold.

| Investment Option | Liquidity | Storage Concerns | Returns |

|---|---|---|---|

| Physical Gold | Medium | Yes | Market-dependent |

| Gold Sovereign Bonds | Low | No | Fixed Interest + Capital Gains |

| Gold ETFs | High | No | Market-dependent |

| Digital Gold | High | No | Market-dependent |

Investing in gold through stocks of companies like Hindustan Copper or Vedanta is another option. You can buy gold online through various platforms. This makes it easier to diversify your portfolio.

How to Buy Gold Online in India

Buying gold online has become popular in India. It’s convenient, transparent, and secure. Many investors are now adding gold to their portfolios online.

Reputable Platforms for Indian Investors

Several trusted platforms let Indian investors buy gold online. These include:

- MMTC-PAMP: A joint venture between MMTC Ltd. and PAMP, a leading precious metals refining and minting company.

- SafeGold: A digital gold platform that allows users to buy, sell, and store gold securely.

- GoldCoin: Offers a range of gold products, including digital gold and gold coins.

When picking a platform, think about storage security, authenticity, and customer service.

Security Considerations

Security is key when buying gold online. Trusted platforms use encryption and secure storage. They keep gold in vaults that are insured and audited often.

“The security of your gold investment is paramount. Look for platforms that offer insured storage and transparent auditing processes.”

Tax Implications for Indian Residents

It’s important for Indian investors to know about gold tax rules. The tax on gold depends on the type and how long you hold it. For example, digital gold is taxed as a capital asset.

| Type of Gold | Tax Treatment |

|---|---|

| Physical Gold | Capital Gains Tax |

| Digital Gold | Capital Gains Tax |

| Gold ETFs | Capital Gains Tax |

Comparing Online vs. Traditional Gold Purchases

Buying gold online has many benefits. It’s convenient, cheaper, and offers more flexibility. But, there are also risks and no physical gold to hold.

Whether to buy online or traditionally depends on your investment goals and preferences.

Best Gold Stocks to Consider in the Current Market

Exploring gold investment means finding the best gold stocks. The current market offers a chance to invest in gold through different stocks.

Major Gold Mining Companies

Major gold mining companies are key in gold investment. They have a solid track record and are safer than junior mining stocks. Some top companies include:

- Barrick Gold

- Newmont Corporation

- Agnico Eagle Mines Limited

These companies are big players in the global gold market. They are known for being efficient and financially strong.

Junior Mining Stocks

Junior mining stocks are riskier but can offer big rewards. These companies are in the early stages of exploration and development. They can provide big returns if they find large gold deposits.

- Eldorado Gold

- Yamana Gold

- Kinross Gold

Investing in junior mining stocks needs careful research. They can be more unpredictable.

Gold Streaming Companies

Gold streaming companies finance mining operations in exchange for gold at a set price. This model lets investors get into gold without owning mines.

- Franco-Nevada

- Wheaton Precious Metals

- Streaming companies offer a unique way to invest in gold, which can be safer than mining stocks.

Indian Gold Company Stocks

In India, there are gold company stocks worth considering. These include mining, refining, and jewelry companies.

Some notable Indian companies include:

| Company Name | Market Cap (Crores) | Current Price (₹) |

|---|---|---|

| Vedanta Limited | 63,419 | 245 |

| Hindustan Zinc Limited | 1,43,919 | 275 |

| Titan Company Limited | 2,31,419 | 2,450 |

Investing in gold stocks can be a smart move. It’s important to diversify and look at market trends and company performance.

Also, consider gold ira accounts as a part of your investment strategy. Gold IRA accounts can protect against inflation and market ups and downs.

Gold Bullion Investing: A Practical Guide for Indian Investors

If you’re an Indian investor looking to diversify, learning about gold bullion is key. Gold is deeply rooted in Indian culture, especially during festivals and weddings. But it’s also a solid investment choice.

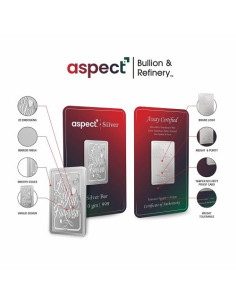

Types of Gold Bullion Available in India

In India, you can invest in gold bars and gold coins. These are offered by trusted mints and assaying centers. The Bharat Gold Coin is a favorite among investors for its quality and purity.

Storage Solutions

After investing in gold bullion, keeping it safe is essential. You can choose bank lockers or specialized vaults for security. Some Indian banks offer safe deposit lockers for valuable items like gold.

Authentication and Purity Considerations

It’s crucial to check the authenticity and purity of your gold. Look for products with a hallmark or certification from known assaying centers. This ensures the gold’s quality and authenticity.

Hallmarking Standards in India

Hallmarking proves the purity of gold jewelry and bullion. In India, the Bureau of Indian Standards (BIS) handles hallmarking. Make sure your gold bullion has a BIS hallmark for its purity.

Understanding these gold bullion investing aspects helps you make smart choices. Whether you’re new or experienced, gold bullion can strengthen your investment portfolio.

Gold Market Analysis: Trends and Patterns

Understanding the gold market means looking at many factors that shape its trends and patterns. Gold is a valuable resource and investment, with complex market dynamics. These are influenced by technical, fundamental, and seasonal factors.

Technical Analysis of Gold Prices

Technical analysis of gold prices looks at past price movements to guess future trends. It uses charts and indicators to spot patterns. These patterns can show when it’s a good time to buy or sell. For investors, this method can help in making the right timing for their investments.

Fundamental Factors Affecting Gold

Several fundamental factors, like economic indicators, interest rates, and currency changes, affect gold prices. When there’s economic uncertainty or inflation, gold often goes up. This is because investors look for safe assets. Knowing these factors helps investors make better choices.

Seasonal Patterns in Gold Trading

Gold trading has seasonal patterns, with trends that repeat each year. For example, gold prices usually go up during the Indian wedding season and festivals like Diwali. Spotting these trends helps investors prepare for market changes.

Impact of Indian Festivals on Gold Prices

Indian festivals greatly influence gold prices because of gold’s cultural importance in India. Festivals like Diwali and Akshaya Tritiya see a big jump in gold demand. This often leads to higher prices. Investors should keep these demand peaks in mind when planning their strategies.

By grasping these factors and trends, gold investors can better understand the gold market. This knowledge helps them make more informed investment choices.

Gold Price Forecast: Short and Long-Term Outlook

Understanding gold prices is key in today’s complex market. Analysts say gold could hit $3,000 per ounce soon. This is due to the same demand that boosted prices before.

Short-Term Price Projections

Gold prices will be shaped by several short-term factors. These include global economic policies, supply chain issues, and tech demand. Investors need to watch these closely to make smart choices.

- Economic indicators like inflation and interest rates

- Geopolitical tensions and their market impact

- How tech changes affect gold demand

Long-Term Trends in the Gold Market

The future of gold will be influenced by structural factors. These include central bank actions, jewelry demand, and digital gold platforms. Gold will likely stay important in investment portfolios as the economy changes.

“Gold has historically performed well during periods of economic uncertainty, making it a popular choice for investors seeking to hedge against market volatility.”

Potential Disruptors to Watch

Several factors could change gold prices in the future. These include:

- Big changes in global monetary policies

- New gold mining technologies

- Changes in what people want to buy

Keeping up with these disruptors is key for investors.

India-Specific Factors Affecting Gold Prices

In India, gold prices are affected by unique factors. These include festival demand, wedding season purchases, and government policies. India’s big role in gold consumption can affect global prices.

Knowing these India-specific factors helps investors make better gold investment choices.

Gold IRA Accounts and Alternative Investment Vehicles

Investing in gold through an IRA can protect your wealth and grow it. It’s important to know how Gold IRA accounts work for your retirement.

Understanding Gold IRAs

A Gold IRA lets you invest in physical gold or approved metals. It adds diversity to your retirement portfolio, unlike stocks and bonds.

Indian Alternatives to Gold IRAs

In India, you can invest in Gold Sovereign Bonds or Gold ETFs. These options let you invest in gold without needing to store it physically.

Tax Benefits and Considerations

Gold investments can have tax benefits. Gold IRAs grow tax-deferred, while Gold ETFs might face capital gains tax. Knowing these tax rules helps you make smart choices.

Retirement Planning with Gold

Adding gold to your retirement plan can reduce market risk. It’s vital to see how gold fits into your investment strategy.

| Investment Vehicle | Physical Gold | Gold ETFs | Gold Sovereign Bonds |

|---|---|---|---|

| Storage Requirements | Physical storage needed | No physical storage needed | No physical storage needed |

| Tax Implications | Capital Gains Tax | Capital Gains Tax | Interest income tax-free |

| Liquidity | Can be less liquid | High liquidity | Can be traded on stock exchanges |

By looking at these points, you can decide wisely about adding gold to your retirement plan.

Conclusion: Navigating Gold Investments in the Current Supercycle

The emerging commodity supercycle is gaining strength. It’s driven by the global energy shift, geopolitical changes, and a rebound in demand after the pandemic. Gold investors need to stay updated to make smart choices.

Understanding the current commodity cycle and its effects on gold prices is key. Good gold investment strategies include timing your buys, spreading out your investments, and managing risks.

In India, there are many ways to invest in gold. You can buy physical gold, invest in gold sovereign bonds, or use gold ETFs and digital gold platforms. Online platforms make buying gold easy and safe. Investing in gold bullion gives you a real asset.

To get the most out of your investments, keep up with market trends and gold price factors. With a well-informed strategy, you can take advantage of the supercycle. This way, you can reach your investment goals.