Exclusive Deals & Trending Items

Global central banks have been buying gold at a record pace. The World Gold Council reports they bought 1,200 tonnes in 2023. This is the most in over 55 years.

This rise in gold buying is more than a trend. It’s a sign that could affect your investments. As central banks add gold to their reserves, it’s key to grasp the global economy’s implications and your financial choices.

The role of gold in central banks’ reserves is crucial. It protects against economic risks and currency changes. Knowing this trend can guide your investment choices.

Key Takeaways

- Global central banks bought a record 1,200 tonnes of gold in 2023.

- Gold reserves serve as a safeguard against economic uncertainties.

- Understanding central banks’ gold buying trends can inform your investment decisions.

- The surge in gold buying is a significant signal for the global economy.

- Central banks’ diversification of reserves can impact currency fluctuations.

The Gold Rush Among Central Banks

Central banks around the world are buying a lot of gold. This has greatly increased their gold reserves of central banks. This change is big and important for everyone who watches the gold market.

Recent Statistics on Central Bank Gold Purchases

Central banks have been buying gold fast. Countries like China and Russia are leading this trend. China has grown its gold reserves by over 75% since 2009, becoming the sixth-largest gold holder.

Russia’s central bank has bought over 2,000 tonnes of gold since 2008. This has greatly increased its gold reserves.

| Country | Gold Reserves Increase | Year Started Buying |

|---|---|---|

| China | 75% | 2009 |

| Russia | Over 2,000 tonnes | 2008 |

The Acceleration of Gold Acquisition Since 2020

2020 was a big year for central bank gold purchasing trends. Since then, the speed of gold buying has gone up. Many central banks are adding gold to their reserves to diversify.

This change is because of economic uncertainty and the need to spread out investments.

Historical Perspective: Central Banks and Gold

It’s important to know how central banks and gold have interacted over time. This knowledge helps us understand today’s financial world. The story of central banks and gold has changed a lot, from the gold standard to today’s gold reserves.

The Gold Standard Era

The gold standard linked currencies to gold. This meant that money’s value was tied to gold’s value.

How Gold Backed Currencies Worked

Under the gold standard, you could exchange money for gold at a set rate. This made the money system stable and trustworthy, since it was based on something real.

The Bretton Woods System

In 1944, the Bretton Woods System was created. It was a new gold standard, but with a twist. The US dollar was the global reserve currency, backed by gold. Other countries tied their money to the dollar, making the international money system stable.

The Shift Away From and Back To Gold

But, the gold standard and Bretton Woods System faced big challenges. This led to big changes in how central banks deal with gold.

Nixon Shock and Its Aftermath

The Nixon Shock in 1971 was a big change. The US stopped making dollars exchangeable for gold. This move had big effects on the world’s finance.

The 21st Century Gold Renaissance

In the 21st century, central banks have started to value gold again. They see it as a way to keep their finances stable and diverse.

Looking back at central banks and gold shows a complex story. This story is key to understanding today’s finance. Knowing this history helps us see why central banks are buying more gold now.

Central Banks Buying Gold: The Current Trend

Central banks are buying gold like never before, with 2023 being the biggest year yet. This isn’t just happening in a few places; it’s happening all over the world. In 2023, they bought a record 1,200 tonnes of gold, showing how important gold is in their plans.

Record-Breaking Purchase Volumes

In 2023, central banks bought more gold than ever before. This is part of a trend that started in 2020. The record-breaking purchase volumes show a big change in how money works globally, with gold playing a key role.

Which Countries Are Leading the Gold Buying Spree

China and India are leading the charge in gold buying. They’re not just buying gold; they’re also driving up demand worldwide.

Emerging Markets vs. Developed Economies

Emerging markets like China and India are buying gold fast. They might be doing this to lessen their reliance on the US dollar. Developed economies are also buying gold, but at a slower pace.

Surprising New Entrants to Gold Markets

Some countries are surprising everyone by buying a lot of gold. These newcomers are adding to the demand for gold, which is making prices go up.

| Country | Gold Purchases in 2023 (Tonnes) | Change from 2022 |

|---|---|---|

| China | 250 | +50% |

| India | 200 | +25% |

| Other Emerging Markets | 300 | +30% |

| Developed Economies | 650 | +10% |

Central banks are likely to keep buying gold. They want to diversify their reserves and protect against economic risks. It will be fascinating to see how countries adjust their gold buying plans as this trend continues.

Why Central Banks Are Stockpiling Gold Now

As economic uncertainty grows, central banks are turning to gold. They see it as a reliable store of value. Several key factors are driving this move, changing the global financial scene.

Economic Uncertainty and Inflation Hedging

Central banks buy gold to protect against economic uncertainty and inflation. Gold has always been a safe asset, keeping its value when others fall. With inflation rising and the economy unstable, they’re adding more gold to their reserves.

“Gold is a unique asset that has a proven track record of maintaining its value over time, making it an attractive hedge against inflation and economic uncertainty.”

The current economic situation, with geopolitical tensions and possible downturns, makes gold more appealing. Central banks are actively managing their reserves to avoid risks.

De-dollarization Efforts

Another reason for gold purchases is the de-dollarization trend. Countries want to lessen their US dollar dependence. Gold is seen as a good alternative for their reserves.

| Country | Gold Reserves (Tonnes) | % of Total Reserves |

|---|---|---|

| United States | 8,133.5 | 75.1% |

| Germany | 3,363.4 | 75.6% |

| Italy | 2,451.8 | 71.6% |

This shift aims to boost financial independence and lessen dollar market exposure.

Portfolio Diversification Strategy

Gold is also part of central banks’ diversification strategy. It helps them spread their investments, making their reserves more stable.

By diversifying with gold, central banks can manage risks better. This improves the performance of their reserve assets.

The Geopolitical Dimension of Gold Hoarding

Central banks’ gold accumulation is a subtle yet powerful force in redefining global power dynamics. As nations stockpile gold, they are not only diversifying their reserves but also navigating the complex geopolitical landscape. This trend is particularly significant in the context of shifting global economic and political alignments.

East vs. West: Shifting Power Dynamics

The accumulation of gold by central banks, particularly in emerging markets and BRICS nations, signals a shift in global power dynamics. Countries are seeking to reduce their dependence on Western economies and the US dollar. This realignment is driven by a desire for economic sovereignty and resilience in the face of geopolitical tensions.

Key Players in the Gold Rush

| Country | Gold Reserves (Tonnes) | Change in Reserves (2020-2023) |

|---|---|---|

| China | 2,168 | +300 |

| Russia | 2,300 | +500 |

| India | 754 | +100 |

Gold as a Tool for Financial Independence

Gold is increasingly being viewed as a tool for achieving financial independence. By holding significant gold reserves, countries can mitigate the impact of economic sanctions and reduce their vulnerability to fluctuations in the global financial system.

Sanctions Resistance Through Gold Reserves

Nations accumulating gold are better positioned to withstand economic sanctions. Gold provides a financial safety net, allowing countries to maintain economic stability even under pressure.

Creating Alternative Payment Systems

The accumulation of gold is also facilitating the development of alternative payment systems. By diversifying their reserves, countries are laying the groundwork for financial systems that are less dependent on traditional currencies and payment networks.

You are witnessing a significant shift in how gold is perceived and utilized in the global economy. As central banks continue to accumulate gold, understanding the geopolitical implications of this trend is crucial for navigating the evolving economic landscape.

BRICS Nations and Their Gold Strategies

The BRICS countries are focusing on gold as a key reserve asset. These nations include Brazil, Russia, India, China, and South Africa. Together, they hold over 20% of the world’s gold, making them big players in the gold market.

Russia and China’s Gold Accumulation

Russia and China are aggressively adding to their gold reserves. They’ve been doing this for over a decade, with a big jump since 2020. They see gold as a way to protect against economic risks and diversify their assets. China, for instance, has been the largest gold buyer among central banks in recent years, significantly boosting its gold reserves.

India’s Position in the Global Gold Market

India is a key member of the BRICS bloc. It has a special place in the global gold market. Gold is deeply rooted in Indian culture, playing a big role in its economy.

Cultural Significance of Gold in India

Gold is a big part of Indian culture, especially during festivals and weddings. The demand for gold in India is driven by both investment and cultural reasons. This cultural significance makes gold an integral part of India’s economic fabric.

India’s Gold Import Policies

India is a major importer of gold. Its gold import policies greatly affect the global gold market. The government has taken steps to manage gold imports, balancing domestic demand with trade deficit management.

The BRICS nations’ gold strategies are more than just about wealth accumulation. They are part of a larger economic plan. This plan includes protecting against inflation, diversifying reserves, and reducing US dollar dependence. As these countries grow economically, their gold strategies will shape the global financial scene.

How Central Bank Demand Influences the Gold Market

Central banks’ growing interest in gold is changing the gold market a lot. This change affects both short-term price changes and long-term trends.

Short-term Price Impact

Central bank gold buying often leads to price swings in gold. Big purchases by banks, especially those with lots of gold, can push prices up. For example, in 2022, the People’s Bank of China bought more gold, making global prices rise.

Long-term Market Implications

Over time, steady demand from central banks can change the gold market a lot. This could alter supply and demand, mining levels, and market stability.

Supply Constraints and Mining Production

One big change is the risk of supply shortages. As banks buy more gold, there might be less for others. This could raise prices and encourage mining. But mining faces challenges like finding new sources, meeting environmental rules, and keeping costs low.

Gold Price Forecasts Based on Central Bank Activity

Experts watch central bank actions to guess gold prices. More buying by banks is good for gold prices, showing strong demand. But if banks buy less, prices might drop. Investors should keep an eye on these activities.

Knowing how central banks affect the gold market helps investors. Whether you’re new or experienced, staying updated on central bank moves is key.

Gold Reserves of Central Banks: Who Holds the Most?

As economic uncertainty grows, central banks worldwide are buying more gold. But which countries have the most? The gold reserves of central banks are key to a nation’s financial health.

Top 10 Countries by Gold Reserves

The top 10 countries hold a big part of the world’s gold. The United States, Germany, and Italy lead in gold reserves.

- United States: 8,133.46 tonnes

- Germany: 3,363.4 tonnes

- Italy: 2,451.8 tonnes

- France: 2,436.1 tonnes

- China: 2,168.5 tonnes

- Switzerland: 1,040.1 tonnes

- Japan: 765.2 tonnes

- India: 613.0 tonnes

- Russia: 585.0 tonnes

- South Korea: 104.4 tonnes

These countries’ gold reserves show gold’s key role in their financial plans.

Recent Changes in the Rankings

In recent years, the global gold reserve rankings have changed. Countries like China and Russia have been buying more gold. This has changed the global gold reserve picture.

India’s Position Among Global Gold Holders

India has been growing its gold reserves, moving up the rankings. Now, India has around 613 tonnes of gold, making it a top gold holder.

Gold-to-GDP Ratios: A Different Perspective

Looking at gold reserves, the gold-to-GDP ratio is also important. It shows how a country’s gold holdings compare to its economy. This ratio gives a unique view of a nation’s gold reserves, showing their importance in relation to its economic output.

The Reserve Bank of India’s Gold Strategy

The Reserve Bank of India (RBI) has been working hard to buy more gold. This move is changing India’s economy. It’s important to know why the RBI is buying gold and how it affects the economy.

RBI’s Recent Gold Purchases

The RBI has been buying gold, focusing on buying from within India. This helps local gold makers and cuts down on foreign gold needs.

Domestic vs. International Gold Acquisition

Buying gold from within India helps the local market and the economy. It also cuts down on costs and risks from buying gold abroad.

Gold Monetization Schemes

The RBI is pushing for gold monetization schemes. These schemes let people put their gold in banks and earn interest. It reduces the need for new gold and makes the most of what we already have.

Impact on India’s Economy and Currency

The RBI’s gold strategy is big for India’s economy and currency. Buying gold helps diversify foreign exchange reserves and lessens dependence on the US dollar.

Gold’s Effect on the Rupee

More gold reserves can strengthen the rupee by acting as a shield against economic troubles. A strong gold reserve also boosts investor trust in India.

Balance of Payments Considerations

Buying gold can affect India’s balance of payments, as it’s counted in the capital account. The RBI’s plan is to find a balance between buying gold and other economic goals.

What Central Bank Gold Buying Means for Individual Investors

Central banks buying more gold is big news for those looking to diversify their investments. It’s important to know the good and bad sides of this trend.

Investment Opportunities in a Gold-Focused Market

With central banks wanting more gold, the market is looking good for investors. There are many ways to take advantage of this.

Following Smart Money: Lessons from Central Banks

Central banks are seen as smart investors because they buy gold for the long haul. They buy a lot at once. De-dollarization efforts and economic uncertainty are why they’re buying gold.

Timing Your Gold Investments

Timing is everything when investing in gold. Keep an eye on what central banks are doing and market trends. Using dollar-cost averaging can help smooth out market ups and downs.

Risks to Consider Before Following Central Banks

Following central banks’ lead on gold has its risks. It’s important to know these risks before investing.

Different Timeframes: Central Banks vs. Individual Investors

Central banks plan for the long term, but individual investors have shorter goals. Think about your goals and how much risk you can take before investing in gold.

Liquidity Concerns for Retail Investors

Individual investors might find it harder to sell gold quickly. Make sure you can get to your money if you need it.

Understanding central bank gold buying and its risks and benefits can help you make smart investment choices.

How to Add Gold to Your Portfolio in India

If you’re an Indian investor, you might wonder how to add gold to your portfolio. There are many ways to invest in gold, and it’s key to know them.

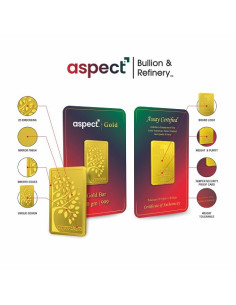

Physical Gold: Coins, Bars, and Jewelry

Buying physical gold is a classic choice. You can get gold coins, bars, or jewelry from trusted sellers.

Hallmarking Standards and Buying Tips

Make sure to buy gold jewelry or coins with a hallmark from the Bureau of Indian Standards (BIS). This proves the gold’s purity and authenticity.

Storage and Insurance Considerations

Storing physical gold needs careful thought. You might need a safe deposit locker or a home safe. Also, insuring your gold against theft or loss is vital.

Paper Gold: ETFs, Mutual Funds, and Sovereign Gold Bonds

Paper gold is a good alternative to physical gold. It lets you invest in gold without the storage hassle.

Tax Implications for Different Gold Investments

Know the tax rules for your gold investments. For example, gold ETFs face capital gains tax. But, Sovereign Gold Bonds (SGBs) are tax-free when redeemed.

Comparing Costs and Returns

Look at the costs of different paper gold products. Compare their expense ratios and returns to make a smart choice.

Digital Gold Options for Indian Investors

Digital gold is a handy option for investing in gold online. Digital gold investment apps let you buy, sell, and store gold digitally.

The Future of Gold in the Global Monetary System

Central banks worldwide are buying gold fast. Everyone wonders: what’s next for gold in our money system? Gold’s future is tied to central bank policies, especially with new trends like gold-backed currencies and digital currencies.

Potential for a New Gold-Backed Currency

The idea of a gold-backed currency has been around for years. But recent global tensions and economic worries have made it popular again. Such a currency could be a stable value and protect against inflation, appealing to countries wanting to diversify.

Central Bank Digital Currencies vs. Gold

CBDCs are gaining attention, but they face a challenge from gold. CBDCs offer fast digital transactions and might be less volatile. But gold is a solid asset not tied to any country’s money policy. The battle between CBDCs and gold will shape our money system’s future.

India’s CBDC Plans and Gold Reserves

India is also looking into CBDCs, like the Reserve Bank of India’s digital rupee. This could impact India’s gold holdings. If done right, a CBDC could work alongside gold, boosting financial stability.

Preparing for Monetary System Changes

As our money system changes, it’s key for investors and policymakers to keep up. Knowing how gold and CBDCs interact helps you prepare for the future. This knowledge is crucial for making smart investment choices.

Conclusion: Preparing Your Finances in a Changing World

The world’s finances are always changing, and you need to keep up. Central banks buying gold is a big sign of these changes. It’s important to understand this trend to make smart investment choices.

Gold helps central banks deal with economic uncertainty and inflation. You can also add gold to your investment mix. You can choose from physical gold, paper gold, or digital gold.

Getting ready for the future means keeping up with global economic trends. The gold buying by central banks shows the economy is shifting. Knowing these changes helps you make smart choices for your money.

In short, to get your finances ready for the future, you need to know about global trends. Stay informed and adjust your plans to handle the financial world’s challenges. This way, you can take advantage of new opportunities.