Exclusive Deals & Trending Items

Tribhovandas Bhimji Zaveri & Sons Ganesh Color Silver Coin of 20 Grams in 999 Purity Fineness

Shop NowLooking ahead to 2025, it’s key to know what affects gold price. In 2024, the current gold price reached new highs, over $2,700 per ounce. This rise was due to economic worries and big purchases by central banks.

So, what caused this increase? Investors turned to gold as a safe place due to inflation and economic doubts. Central banks also bought a lot, pushing prices up. This made live gold prices a big topic for investors and experts.

Key Takeaways

- Gold prices hit record highs in 2024, driven by economic concerns and central bank buying.

- Inflation and economic uncertainty were key factors influencing gold price.

- Central banks’ aggressive buying contributed to the surge in gold prices.

- Understanding these triggers is crucial for making informed investment decisions in 2025.

- Staying updated on live gold prices can help you navigate market trends.

The Gold Market Landscape in 2025

In 2025, the gold market is getting more complex. Experts like Kevin Shahnazari, founder of FinlyWealth, predict gold prices will rise. He points to global uncertainty, central bank actions, and monetary policy changes.

Current Gold Price Trends and Projections

Gold prices are going up, thanks to world economic issues and how investors act. Here are the main reasons:

- Global Economic Uncertainty: Political tensions and economic problems push people towards gold.

- Central Bank Buying: Central banks buying gold helps keep prices up.

- Monetary Policy: Changes in interest rates affect gold prices.

Global Market Outlook

The outlook for gold globally in 2025 is positive. Analysts expect prices to go up because of ongoing uncertainty and demand.

India-Specific Forecasts

In India, gold demand is expected to stay strong. This is because of cultural reasons and investment choices. The today gold rate is very important for Indian investors.

Why 2025 Is a Critical Year for Your Gold Investments

2025 is a key year for gold investments. It’s because of global economic factors and local demand. Investors should watch the gold price chart and gold spot price closely to make smart choices.

Understanding Gold Price Fundamentals

To make smart choices about gold investments, knowing the basics is key. In 2025, gold prices are shaped by many factors.

Supply and Demand Dynamics

The fight between gold supply and demand is crucial for prices. Central banks bought over 1,000 metric tons of gold in 2024. This is the third year they’ve bought a lot, showing strong demand.

Don’t forget about jewelry demand and investment demand. In India, jewelry demand goes up during festivals and weddings. This affects gold prices.

Historical Gold Price Patterns

Looking at gold price history can give you clues for the future. By studying past trends, you can make better choices for your gold investments.

Gold Price Charts: What They Reveal About 2025

Gold price charts are key for understanding the market and predicting trends.

Long-term Trend Analysis

Long-term trend analysis looks at gold price changes over time. It helps you see if gold is going up or down. This guides your investment choices.

Cyclical Patterns to Watch

Cyclical patterns, like seasonal demand or economic cycles, also affect gold prices. Knowing these patterns can help you invest at the right time. This way, you might catch prices when they’re low.

By grasping these basics and watching live gold prices, you can make better choices for your gold investments in 2025.

Global Economic Indicators Affecting Gold Prices

Global economic indicators are key in setting gold prices. Knowing these can guide your investment choices. As a smart investor, keeping up with these factors is crucial.

Inflation Rates and Their Impact

Inflation rates are vital in shaping gold prices. When inflation goes up, currency value drops. Gold then looks more appealing as a shield against inflation. Currently, rising global debt and recession fears are pushing investors towards gold.

Interest Rate Policies Worldwide

Central banks’ interest rate policies also affect gold prices. Lower rates make gold more appealing than other assets. The ongoing global monetary easing cycle is boosting gold’s appeal.

GDP Growth Forecasts and Gold Correlation

GDP growth forecasts are also key. The link between GDP and gold prices changes with economic phases. Knowing this link helps in making better choices.

Developed Markets

In developed markets, strong GDP growth can lead to higher interest rates. This might hurt gold prices. Yet, during economic uncertainty, even strong economies turn to gold as a safe haven.

Emerging Economies

Emerging economies have unique dynamics. Rising GDP in these markets can boost gold demand for reserves and investment.

| Economic Indicator | Impact on Gold Price |

|---|---|

| Rising Inflation | Increases gold price as a hedge against inflation |

| Lower Interest Rates | Makes gold more attractive compared to interest-bearing assets |

| GDP Growth in Emerging Economies | Can lead to increased demand for gold |

Understanding these global economic indicators and their effects on gold prices helps you navigate the gold market. This knowledge aids in making more informed investment decisions.

Central Bank Policies to Watch in 2025

As we get closer to 2025, central banks’ actions will greatly affect the gold market. Their decisions can change gold prices a lot. It’s very important for investors to keep up with these changes.

Federal Reserve Decisions and Their Ripple Effects

The Federal Reserve’s recent rate cuts have made gold more appealing. As the Fed deals with economic challenges, its moves will likely impact gold prices. Investors should pay attention to any changes in monetary policy. These can make gold more or less attractive as an investment.

Reserve Bank of India’s Gold Strategy

The Reserve Bank of India (RBI) has been managing its gold reserves carefully. In 2025, the RBI’s gold strategy will be watched closely. This includes:

- Monetary Policy Implications: How the RBI’s policies compare to global trends.

- Gold Import Regulations: Any updates in regulations that could change gold demand in India.

International Central Bank Gold Reserves

Central banks worldwide hold a lot of gold. The changes in these reserves can show us the global economic outlook. In 2025, investors should keep an eye on any shifts in international central bank gold reserves. These changes can affect gold prices.

By keeping up with central bank policies, you can make better choices for your gold investments in 2025.

Geopolitical Triggers for Gold Price Movements

In today’s world, politics greatly affects gold prices. Investors know that global tensions can change gold’s value.

Political Instability Zones

Places with political problems can make gold prices go up and down. Issues like conflicts, elections, and policy changes make investors nervous. They look for safe places like gold.

For example, trouble in the Middle East or problems in new markets can make people want more gold. This can change gold’s price.

Trade Wars and Sanctions

Trade fights and sanctions are big reasons for gold price changes. When countries put tariffs or sanctions on each other, markets get shaky. Gold becomes a safe choice for investors.

Trade disputes between big countries can affect how investors act. This can change gold’s price.

International Agreements Affecting Gold

Global deals, like trade agreements and mining rules, can also change gold prices.

Trade Pacts

Trade deals between countries can influence gold demand and prices. For example, a deal that talks about gold can change mining and gold supply.

Mining Regulations

Rules for gold mining, like environmental or labor laws, can affect gold costs and supply. Changes in these rules can also change gold prices.

Understanding these geopolitical factors can help you make better investment choices in the gold market.

Currency Fluctuations as Gold Price Signals

Currency changes are key in setting gold prices. Knowing these shifts helps in making smart investment choices. It’s crucial to see how currency movements affect gold prices.

US Dollar Strength vs. Gold Performance

The US dollar’s value greatly impacts gold prices. A weaker US dollar makes gold cheaper for foreign buyers, possibly raising demand and prices. But, a strong dollar can increase gold’s cost, lowering demand. Keep an eye on the US dollar index to guide your gold investments.

Indian Rupee Movements and Your Gold Investments

In India, the rupee’s value against the dollar is key. A weaker rupee makes gold pricier in rupees, affecting demand. A stronger rupee, however, can lower gold prices, boosting demand.

Exchange Rate Impacts

Exchange rates directly affect gold prices in local currencies. A weaker rupee against the dollar raises gold’s price in rupees. This can lead to:

- Higher costs for gold imports

- Lower demand due to higher prices

- Chances for investors to buy gold at good times

Hedging Strategies for Indian Investors

To lessen currency risk, Indian investors can use hedging. This might include:

- Investing in gold ETFs or mutual funds less affected by currency changes

- Using currency derivatives to protect against rupee-dollar rate risks

- Diversifying gold investments across different currencies or assets

Emerging Market Currencies and Gold Correlation

Emerging market currencies also affect gold prices. A drop in these currencies can increase gold demand as a safe asset. Knowing how these currencies relate to gold can help in making better investment choices.

Technology and Innovation Impacts on Gold Spot Price

In 2025, technology and innovation are changing the gold market. These changes are affecting the gold spot price, making it an exciting time for investors.

Digital Gold Platforms in India

India is seeing a rise in digital gold platforms. These platforms let investors buy and sell gold online. They offer a safe and easy way to invest in gold without needing physical storage.

Blockchain and Gold Trading

Blockchain technology is making gold trading more transparent and secure. It helps create digital gold tokens. These tokens can be traded on online platforms.

Mining Technology Advancements

Mining technology has made big strides in recent years. It has improved extraction efficiency and cut costs. Some key innovations include:

- Advanced extraction techniques

- Automated mining equipment

- Improved safety measures

Extraction Efficiency

New technologies help mining companies extract gold more efficiently. This reduces waste and boosts yields.

Cost Reduction Innovations

Technological advancements in mining have also cut costs. This makes gold production more affordable.

For example, China’s pilot program letting major insurance companies invest in gold will impact the global market. Such developments show the need to stay updated on gold industry technology.

Environmental Policies Affecting Gold Production

In 2025, environmental policies are changing how gold is made all over the world. The gold mining industry is facing pressure to be more sustainable. It needs to cut down on its environmental harm while keeping production levels up.

Sustainability Regulations in Mining

Rules on sustainability in mining are getting stricter. Governments and global groups want to lessen the environmental damage from gold mining. This includes less deforestation, water pollution, and habitat loss.

Mining companies must follow strict environmental rules now. This can raise costs and affect how efficiently they work.

Carbon Footprint Concerns

The carbon footprint of gold mining is a big worry. With the push to cut down greenhouse gas emissions, gold producers are looking for cleaner ways to mine. Using cleaner energy and better mining tech can lower environmental harm and save money over time.

ESG Investing and Gold Markets

ESG investing is a big deal in the gold market now. Investors want to support gold mining companies that follow high ESG standards. This demand is pushing for gold from mines that are sustainable and responsible.

Ethical Gold Sourcing

Ethical gold sourcing is key for ESG compliance. It means gold is mined and traded in ways that respect human rights and don’t harm the environment.

Impact on Premium Pricing

Gold that is certified as sustainably sourced can get a premium price. This helps mining companies that invest in green practices. They can sell their gold for more money.

| Aspect | Impact on Gold Production | Effect on Pricing |

|---|---|---|

| Sustainability Regulations | Increased operational costs | Potential for higher gold prices |

| Carbon Footprint Reduction | Adoption of cleaner technologies | Long-term cost savings |

| ESG Investing | Increased demand for responsibly mined gold | Premium pricing for ESG-compliant gold |

Gold investments have been doing well lately. With more focus on environmental policies, this trend is expected to keep going. Knowing about these changes can help gold investors make better choices.

How to Track Today’s Gold Rate for Smart Buying

In the fast-paced world of gold investment, knowing today’s rate is key to smart buying. As a smart investor, you must stay on top by using the right tools and strategies.

Reliable Gold Price Tracking Tools for Indian Buyers

To make smart choices, you need current and accurate gold price info. Here are some top tools:

- Mobile Apps: Apps like Gold Price Live and Kitco Gold give you live updates.

- Trusted Websites: Sites like GoodReturns and Economic Times are reliable for tracking.

Mobile Apps

Mobile apps are handy for checking gold prices anywhere. Some top picks are:

- Gold Price Live

- Kitco Gold

Trusted Websites

Websites are excellent for detailed gold price analysis and history. Check out:

- GoodReturns

- Economic Times

Understanding Intraday Fluctuations

Intraday changes can greatly affect your buying choices. Knowing these changes helps you find the best times to buy.

Setting Up Price Alerts for Optimal Purchases

Price alerts can change your gold buying game. They let you:

- Get alerts when gold prices hit your target.

- Buy at the right time without always watching the market.

To set up price alerts, use your chosen tool or app’s features.

Gold Price Per Gram: What You Need to Know

Investing in gold? Knowing the gold price per gram is key. India’s big gold market means you need to understand what affects the price.

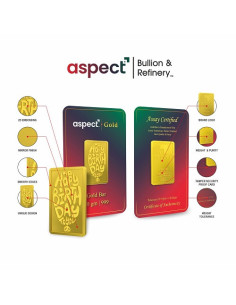

Premium Factors in Physical Gold

Buying physical gold costs more than its melt value. This is because of manufacturing, distribution, and the retailer’s profit. The price can change a lot based on the gold type, like coins, bars, or jewelry.

Purity Standards and Pricing in India

In India, gold purity is measured in karats, with 24-karat being the highest. But, 22-karat gold is more common for jewelry. BIS hallmarking checks the gold’s purity. It’s important to know the difference between karat and fineness.

BIS Hallmarking

The Bureau of Indian Standards (BIS) hallmarking is a seal of approval. It shows the gold jewelry meets quality standards. This gives buyers confidence.

Karat vs. Fineness

Karat shows gold purity, with 24-karat being 100% gold. Fineness is the gold content per 1000. For example, 916 fineness means the gold is 91.6% pure.

Making Sense of Price Variations Across Retailers

Prices can vary a lot between retailers. This is because of different premium charges. It’s smart to compare prices before buying. Knowing the daily gold rate and what affects it can help you make a good choice.

Seasonal Patterns in Indian Gold Prices

Seasonal patterns are key in setting gold prices in India. They are influenced by festivals, weddings, and harvest times. Knowing these patterns can guide your gold investment choices.

Festival Season Impact on Gold Demand

India’s festival season greatly increases gold demand. Festivals like Diwali and Dhanteras see a rise in gold sales.

Diwali and Dhanteras Buying Trends

Diwali and Dhanteras are the best times for gold buying. Indian buyers prefer gold coins and bars for good luck.

Akshaya Tritiya Considerations

Akshaya Tritiya is also a good day for gold purchases. It’s seen as lucky for investing in gold.

Wedding Season Buying Patterns

The wedding season in India also boosts gold demand. Gold jewelry is a big part of Indian weddings, leading to high demand during this time.

Agricultural Harvest Cycles and Rural Gold Purchases

Harvest cycles affect gold buying in rural areas. Farmers buy gold after harvesting, using their earnings for it.

Understanding these seasonal patterns helps you navigate the Indian gold market. It aids in making smart investment decisions.

Alternative Gold Investments for Your Portfolio

Looking to strengthen your investment portfolio? Alternative gold investments are now popular among investors. These options go beyond traditional gold, offering different ways to invest in gold. Each has its own benefits and things to consider.

Gold ETFs and Mutual Funds in India

In India, gold ETFs and mutual funds are gaining fans. They let you invest in gold without having to hold it physically. Gold ETFs, in particular, have seen a big increase in investment. For example, they brought in $9.4 billion in February, the most since March 2022.

Sovereign Gold Bonds: Benefits and Limitations

Sovereign Gold Bonds (SGBs) are also worth considering. Issued by the Reserve Bank of India, they offer unique benefits.

Tax Advantages

One big plus of SGBs is their tax benefits. If you hold them until they mature, you won’t have to pay capital gains tax. This makes them great for long-term investors.

Liquidity Considerations

But, SGBs might not be as liquid as other investments. They can be traded on stock exchanges, but the market might not always be active. Think about how liquid you need your investments to be before you buy.

Digital Gold Options for Modern Investors

Digital gold is a new way to invest in gold. It lets you buy, sell, and store gold online. This is especially good for younger investors who like online transactions.

When looking at these gold investment options, think about what you want to achieve. Whether it’s gold ETFs, sovereign gold bonds, or digital gold, each can help diversify your portfolio. They might even help you earn more.

Technical Analysis Signals for Gold in 2025

As we look ahead to 2025, technical analysis signals are key for understanding gold prices. Investors are turning to these signals to guide their gold investments.

Key Support and Resistance Levels to Monitor

Technical analysis focuses on finding key support and resistance levels. For gold, these levels are vital in predicting price changes. Experts say support levels are where gold has bounced back, while resistance levels are where it has struggled to rise. In 2025, keeping an eye on these levels is crucial for anticipating price shifts.

Jeffrey Gundlach, a well-known investor, believes gold will hit $4,000. He’s not sure if it will happen this year but thinks it’s a likely move after gold consolidated at around $1,800. This shows how important support and resistance levels are, especially as gold consolidates at $1,800.

“I think gold will make it to $4,000. I’m not sure that’ll happen this year, but I feel like that’s the measured move anticipated by the long consolidation at around $1,800 on gold.” – Jeffrey Gundlach

Moving Averages and Trend Indicators

Moving averages are essential in technical analysis. They smooth out price data, making trends easier to spot. The 50-day and 200-day moving averages are especially important, showing short-term and long-term trends. In 2025, investors should watch these averages to understand gold price directions.

Golden Cross and Death Cross Signals

A Golden Cross happens when the 50-day moving average crosses over the 200-day, signaling a bullish trend. A Death Cross, on the other hand, occurs when the 50-day falls below the 200-day, indicating a bearish trend. These signals are vital for adjusting investment strategies.

Relative Strength Index Interpretations

The Relative Strength Index (RSI) measures price movement speed and change. An RSI above 70 means gold is overbought, while below 30 means it’s oversold. In 2025, investors should use the RSI to spot potential gold price reversals.

Volume Analysis for Gold Trading Decisions

Volume analysis is key for confirming trends and spotting reversals. High volume with price movements shows strong market sentiment, while low volume suggests uncertainty. By studying volume, investors can make better gold trade decisions in 2025.

Creating Your Personal Gold Buying Strategy

When you explore the gold market in 2025, crafting a personal gold buying strategy is key. It helps you make smart investment choices. With the right plan, you can boost your earnings and cut down on risks.

Dollar-Cost Averaging with Gold

Dollar-cost averaging is a smart way to invest in gold. It involves spreading out your investments over time. This method lessens the effect of price swings.

Example: Instead of putting ₹1 lakh in gold all at once, invest ₹10,000 monthly for a year. This strategy can help you lower your investment cost over time.

Portfolio Allocation Recommendations for Indian Investors

Figuring out the right amount of gold in your portfolio is essential. For Indian investors, a 5% to 10% gold allocation is often suggested when prices are rising. Investing in stable markets through dollar-cost averaging can also be wise.

Age-Based Considerations

Your age affects how much gold you should invest in. Younger investors might put less in gold, while older ones might prefer more for stability.

Risk Tolerance Factors

Your comfort with risk is also important. If you’re cautious, you might choose a higher gold allocation to protect against market ups and downs.

Tax Considerations for Your Gold Investments

Knowing the tax rules for gold investments is crucial. In India, gold investments face capital gains tax. But, holding gold for over three years can lead to long-term capital gains tax benefits.

“Investing in gold is a long-term game. It’s not about timing the market but time in the market.”

By taking these factors and strategies into account, you can tailor a gold buying plan that fits your financial goals and risk level.

Conclusion: Navigating Gold Investments in Uncertain Times

When you’re exploring gold investments in 2025, staying up-to-date is key. Gold is a solid choice in uncertain times. It acts as a safe haven, protecting your wealth from market ups and downs.

Knowing what drives gold prices is important. This includes global economic trends, central bank actions, and world events. This knowledge helps you make smart choices for your gold investments. Whether you’re experienced or new, having a clear plan is vital for reaching your financial targets.

Gold investments can offer a sense of security in uncertain times. Keep an eye on the gold market and adjust your strategy as needed. This way, you’ll be ready to face both challenges and opportunities ahead.