Exclusive Deals & Trending Items

As geopolitical tensions rise worldwide, more investors are looking at safe-haven assets to protect their money. Bullion Brief June 2025 shows that gold prices have gone up because of these tensions and central bank buying.

Thinking about adding gold coins to your portfolio? It might be a smart choice, especially with the world’s current state. With so much uncertainty, investing in gold coins can offer a safe and stable option.

Key Takeaways

- Geopolitical tensions are influencing gold prices.

- Central bank purchases are driving demand for gold.

- Investing in gold coins can be a strategic move.

- Diversifying your portfolio with gold can mitigate risks.

- Global uncertainties make gold a valuable asset.

The Global Landscape in 2025: Understanding Today’s Geopolitical Risks

In 2025, the world is dealing with many geopolitical risks. These risks are affecting global markets and making investors unsure. The current situation is complex, with several factors adding to the uncertainty.

Major Global Conflicts and Tensions Affecting Markets

The tensions between big powers like the US and China are big problems. Trade wars and tariffs are common, causing market ups and downs.

Economic Uncertainties in the Post-Pandemic Era

The global economy is slowly getting back to normal after the pandemic. But, economic uncertainties remain. Supply chain problems and changes in how people shop are making things uncertain.

Currency Fluctuations and Inflation Concerns

Currency changes are a big worry, affecting investment values and prices. Inflation concerns are also growing. This is due to money policies and supply chain issues.

| Geopolitical Risk | Impact on Markets | Investor Response |

|---|---|---|

| US-China Tensions | Market Volatility | Diversification |

| Economic Uncertainty | Reduced Investment | Safe Haven Assets |

| Currency Fluctuations | Exchange Rate Risks | Hedging Strategies |

It’s key for investors to know about these risks, especially when looking at rare gold coins. By keeping up with global issues, economic ups and downs, and currency changes, you can make better choices.

Gold as the Traditional Safe Haven Asset

Gold has been a safe haven for investors through economic and geopolitical ups and downs. It’s a tangible asset with real value, trusted for centuries.

Historical Performance of Gold During Global Crises

Gold shines during global crises, showing its safe-haven status. Since the WHO declared a pandemic in March 2020, gold has risen by 98%. This highlights gold’s role as a shield against uncertainty.

In times of tension, gold outperforms other assets. It stabilizes investment portfolios.

Why Investors Turn to Gold in Uncertain Times

Investors seek gold in uncertain times for its unique qualities. It offers liquidity, scarcity, and portfolio diversification benefits. Unlike stocks or bonds, gold isn’t tied to market volatility.

Gold’s value isn’t tied to governments or companies. This makes it a strong safe haven.

Gold’s Role in Portfolio Diversification

Gold in a diversified portfolio can lower risk and boost returns. Its low correlation with other assets means it can protect against losses in downturns.

For those looking to buy gold coins for investment, finding the best place to purchase gold coins is key. It ensures authenticity and value.

The Advantage of Physical Gold Over Paper Gold

As tensions rise, physical gold’s appeal grows. Gold has been a trusted value for centuries. But, the difference between physical and paper gold is key in today’s market.

Physical gold is something you can hold, giving you security. It doesn’t have the risks that paper gold does.

Comparing Physical Ownership vs. Gold ETFs

Gold ETFs are like buying a promise of gold. But, there are risks like the issuer’s credit and the chance of not getting your gold back.

Physical gold lets you control your investment. You can store it safely and get to it when you need to.

| Investment Feature | Physical Gold | Gold ETFs |

|---|---|---|

| Tangibility | Yes | No |

| Counterparty Risk | No | Yes |

| Liquidity | Variable | High |

Counterparty Risk Considerations

Counterparty risk is big with gold ETFs. If the issuer fails, you could lose your money. Physical gold doesn’t have this risk.

“The most significant advantage of physical gold is that it is not someone else’s liability; it is a real asset that you own outright.”

Liquidity and Accessibility Factors

Gold ETFs are liquid, but physical gold’s liquidity depends on its form and where it is. Gold coins are easy to trade, making them a liquid form of physical gold.

When buying gold coins, look for reputable dealers. This helps you make a smart investment choice.

Types of Gold Coins Worth Considering in 2025

When looking to invest in gold coins in 2025, knowing the different types is key. The gold coin market offers many choices. These choices cater to various investment goals and tastes.

Bullion Coins: American Eagles, Canadian Maples, and Krugerrands

Bullion coins are favored for their high gold content and easy trading. The American Eagle, Canadian Maple Leaf, and South African Krugerrand are well-known. These coins are made from pure gold, usually 22 or 24 karats, and their value is based on gold content.

It’s important to buy bullion coins from trusted dealers to ensure they are real. Also, look at the premium over the spot gold price. This premium can change based on the coin and the dealer.

Indian Gold Coins: Sovereign Gold Coins and Others

India offers its own gold coins that investors like. The Sovereign Gold Coin (SGC) is one, made by the Reserve Bank of India (RBI). These coins are a solid investment and hold cultural value.

Other Indian gold coins from private companies are also worth looking at. But, make sure they are genuine and pure.

Collectible and Numismatic Gold Coins

For a more detailed investment, consider collectible or numismatic gold coins. These coins are valued for their gold, rarity, history, and condition.

Factors Affecting Numismatic Value

The value of numismatic coins depends on several things. These include age, rarity, condition, and demand. Coins with special histories or limited minting can be very valuable.

Popular Collectible Series

Collectors often go for ancient coins, commemorative coins, and coins with unique designs. Investing in numismatic coins requires working with trusted dealers. Also, consider getting your coins certified by third-party services.

Whether you choose bullion or numismatic coins, knowing the options can guide your 2025 investment decisions.

Buying Gold Coins: A Step-by-Step Guide for Indian Investors

In 2025, Indian investors can benefit from a step-by-step guide to buying gold coins. This is a traditional way to protect against economic ups and downs. Knowing how to buy gold coins is key to diversifying your portfolio.

Determining Your Investment Goals and Budget

Before you start buying gold coins, it’s essential to determine your investment goals and budget. Are you looking for a long-term investment or a short-term gain? Investors should consider their goals and budget when buying gold coins.

You should assess your financial situation. Decide how much you are willing to invest in gold coins.

Understanding Purity, Weight, and Pricing

When buying gold coins, understanding their purity, weight, and pricing is vital. Gold coins are typically made of 22-karat or 24-karat gold. The weight is usually measured in grams or ounces.

You should also be aware of the pricing. This includes the spot price of gold plus a premium.

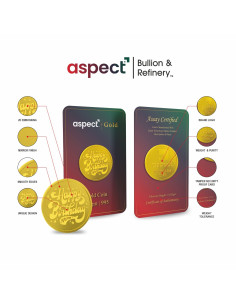

Verifying Authenticity and Certification

Verifying the authenticity and certification of gold coins is a critical step. Look for coins that are certified by reputable mints or assayers. In India, you can opt for coins certified by theBharatiya Reserve Bankor other recognized authorities.

This ensures that your gold coins are genuine and of the stated purity.

The Purchasing Process

The final step is the purchasing process. You can buy gold coins from authorized banks, government mints, or reputable jewelers. It’s advisable to research and compare prices before making a purchase.

Additionally, consider the resale value and the liquidity of the gold coins you choose.

By following these steps, you can make an informed decision when buying gold coins. This ensures your investment is secure and meets your financial goals.

Where to Buy Gold Coins in India

With geopolitical risks on the rise, finding a reliable source to buy gold coins in India is more important than ever. You have several options to consider, each with its own advantages.

Authorized Banks and Financial Institutions

Many authorized banks in India offer gold coins, providing a secure and trustworthy source for your investment. Banks like the State Bank of India and HDFC Bank offer a range of gold coins.

Government Mints and Official Distributors

Government mints are another reliable source. The India Government Mint, for instance, produces high-quality gold coins that are sold through various channels, including their official website and authorized distributors.

Reputable Jewelers and Bullion Dealers

Reputable jewelers and bullion dealers are also viable options. They often provide a wide range of gold coins, and some even offer certification. Look for jewelers who are members of recognized associations.

Online Platforms and Their Reliability

Online platforms have made buying gold coins more accessible. However, it’s crucial to verify their authenticity. Look for platforms that offer certified gold coins and have good customer reviews.

When buying gold coins online, ensure that the platform provides detailed information about the product, including purity, weight, and pricing. Also, check for secure payment options and reasonable delivery times.

Price Considerations When Purchasing Gold Coins

When you buy gold coins, knowing the price is key. The cost of gold coins is more than just the gold’s spot price. Several factors play a role.

Understanding Premiums Over Spot Price

The premium over the spot price is important. It’s the extra cost added to the gold’s spot price. This covers minting, distribution, and other expenses.

Premiums can vary a lot. They depend on the coin’s brand, mint, and production costs. It’s smart to compare premiums to find a good deal.

Factors That Influence Gold Coin Pricing

Many things affect gold coin prices. These include:

- Coin popularity and demand: More sought-after coins cost more.

- Production costs: Coins with detailed designs or limited editions are pricier.

- Distribution and marketing costs: Coins sold through certain channels may have higher premiums.

- Legal and regulatory costs: Following laws and regulations adds to the expense.

Timing Your Purchase in the Market Cycle

Timing is crucial when buying gold coins. Watching market trends and the cycle can help. Think about your investment goals and budget too.

Understanding these price factors helps you make a wise investment in gold coins.

Storage and Security Solutions for Your Gold Coin Investment

Keeping your gold coin investment safe is as crucial as the investment itself. After buying gold coins, you must store them securely to safeguard your asset.

Home Storage Options and Security Measures

Storing gold coins at home is handy but needs strong security. A top-notch safe or a hidden safe box is a good start. Also, make sure your home has a solid security system, like alarms and CCTV cameras, to scare off thieves.

For extra security, think about:

- Storing your gold coins in a different spot from other valuables.

- Not telling others about your gold collection.

- Checking your storage regularly to make sure the coins are safe.

Bank Safe Deposit Boxes: Pros and Cons

Bank safe deposit boxes are a secure choice over home storage. The benefits include:

- Top-notch security, like alarms and video cameras.

- Access is watched and limited.

But, there are downsides to consider:

- They’re only open during certain hours.

- Banks might close or change their access rules.

Private Vaulting Services in India

Private vaulting services are another safe way to store your gold coins. They offer:

- Modern vaults.

- Insurance for your stored assets.

When picking a private vaulting service, make sure it’s trustworthy and has a good security record.

Insurance Considerations for Physical Gold

It’s wise to insure your gold coins against theft, loss, or damage, no matter where you store them. Insurance can give you financial security and peace of mind.

Here’s a look at different storage options:

| Storage Option | Security Level | Accessibility | Cost |

|---|---|---|---|

| Home Storage | Variable | High | Low to High |

| Bank Safe Deposit Box | High | Medium | Low |

| Private Vaulting Services | High | Medium | Medium to High |

By looking at your storage options carefully and using the right security, you can keep your gold coin investment safe.

Tax Implications of Buying and Selling Gold Coins in India

It’s important to know about taxes when you buy or sell gold coins in India. As an investor, you should understand how taxes can impact your earnings.

Current Gold Taxation Laws in India

India has rules for taxing gold coins. The tax you pay depends on if the coins are seen as an investment or for resale. Always talk to a tax expert to see how these rules apply to you.

Short-term vs. Long-term Capital Gains

When you sell gold coins, you get short-term or long-term capital gains. Long-term capital gains are taxed less if you hold the coins for over 36 months. But, check the exact time frame for gold coins.

GST and Other Applicable Taxes

The Goods and Services Tax (GST) is charged on buying gold coins. The GST rate changes based on the gold type and seller. You might also face cess or surcharge taxes.

Record-Keeping Requirements for Gold Investors

Keeping detailed records of your gold coin deals is key for tax purposes. You should have purchase receipts, sale deeds, and other important documents. A good record-keeping system helps with taxes and audits.

| Tax Component | Description | Applicability |

|---|---|---|

| Capital Gains Tax | Tax on profit from sale of gold coins | Applicable on sale of gold coins |

| GST | Goods and Services Tax on gold coins | Applicable on purchase of gold coins |

| Record-Keeping | Maintenance of transaction records | Essential for tax compliance |

Knowing these tax rules helps you make better choices when dealing with gold coins in India.

Gold Coins vs. Other Investment Options in 2025

With tensions rising, investors are turning to gold coins as a safe choice. But how do they compare to other investments? It’s key to know the benefits of gold coins when diversifying your portfolio.

Comparing Gold to Equity Markets

Equity markets can be shaky, especially when tensions are high. Gold coins, however, tend to shine in such times. Gold and equities often move in opposite directions, making gold a smart diversifier. For example, during the 2008 crisis, gold prices soared while stocks fell.

Key differences between gold and equities:

- Gold is a tangible asset, not subject to the same counterparty risks as equities.

- Gold’s value is not directly tied to corporate performance or economic indicators.

- Gold can act as a hedge against inflation and currency devaluation.

Gold vs. Real Estate in the Current Climate

Real estate is a favorite investment, but it faces challenges like liquidity and market swings. Gold coins, on the other hand, are liquid, easy to store, and transfer. While real estate can earn rental income, gold coins offer a simpler way to diversify.

| Investment | Liquidity | Volatility | Income Generation |

|---|---|---|---|

| Gold Coins | High | Low to Moderate | No |

| Real Estate | Low | Moderate to High | Yes |

Digital Assets and Cryptocurrencies as Alternatives

Digital assets, like Bitcoin, are gaining fans as alternative investments. They promise big returns but come with high risks and volatility. Gold coins, by contrast, are more stable and less risky.

Consider your risk tolerance when choosing between gold coins and digital assets. Gold might be better if you want a stable investment.

Fixed Income and Government Securities

Fixed income investments, like government bonds, offer steady returns but often have low yields. Gold coins can protect against the loss of purchasing power that fixed income investments may face over time.

When looking at investment options in 2025, think about how gold coins can enhance your portfolio. Their unique qualities make them a great choice for diversification and protection against uncertainty.

Common Mistakes to Avoid When Buying Gold Coins

Investing in gold coins requires knowing common pitfalls. You want to make smart choices to increase your returns.

Here are some key mistakes to watch out for:

Overpaying for Numismatic Value

Some investors pay too much for rare coins. These coins are valuable but can have high premiums. For example, a rare coin might cost 50% more than its melt value. It’s essential to understand the market value and not get caught up in the excitement of a rare find.

Falling for Counterfeit or Misrepresented Products

Counterfeit gold coins are a big risk. To avoid this, buy from reputable dealers and check the coins’ authenticity. Look for hallmarks, certificates of authenticity, and assay marks.

| Authenticity Feature | Description |

|---|---|

| Hallmarks | Marks indicating the coin’s metal content and origin |

| Certificates of Authenticity | Documents verifying the coin’s genuineness |

| Assay Marks | Marks indicating the coin’s metal content |

Neglecting Storage and Insurance

After buying gold coins, secure storage is crucial. Use a safe deposit box at a bank or a private vaulting service. Also, insure your investment against loss or theft.

“The safety of your investment is just as important as the investment itself.”

Timing the Market Incorrectly

Timing the gold market can be tough, even for experts. Instead, focus on your long-term investment goals. This way, you can handle market ups and downs better.

Knowing these common mistakes helps you make better choices when buying gold coins.

Expert Predictions for Gold in 2025-2030

The gold market is set for big changes from 2025 to 2030, say top analysts. As investors try to make sense of the world economy, knowing what experts predict about gold prices is key.

Price Forecasts from Leading Analysts

Many well-known analysts have shared their gold price predictions. Goldman Sachs thinks gold will hit $2,300 per ounce by 2025’s end. They point to ongoing global risks and tensions as reasons.

Experts at the World Gold Council also see gold doing well. They say it’s a good hedge against inflation and currency changes. “Investors are looking to diversify, and gold is a great choice,” they explain.

Factors That Could Drive Gold Higher

Several things could push gold prices up in the future. These include:

- Escalating geopolitical tensions, especially in areas rich in natural resources

- Continued economic uncertainty, including possible recessions in big economies

- Inflation worries, as governments use big money policies

- Currency changes, like a drop in the US dollar’s value

As

“the global economic scene keeps changing, gold’s safe-haven status will grow,”

the International Monetary Fund recently noted.

Potential Risks to the Gold Market

Even with a positive outlook, there are risks to gold. These include:

| Risk Factor | Description |

|---|---|

| Interest Rate Changes | Rising interest rates might make bonds more appealing, cutting gold demand. |

| Global Economic Recovery | A strong economic bounce could make gold less attractive. |

| Currency Strength | A strong US dollar could make gold pricier for foreign buyers, lowering demand. |

Knowing these risks is vital for investors planning their gold strategies for the next few years.

Conclusion: Is Buying Gold Coins Right for Your Portfolio?

With global risks on the rise in 2025, investors are looking for safe places to keep their money. Buying gold coins can be a wise choice, offering a solid and reliable value. Before adding gold coins to your portfolio, think about your investment goals and how much risk you can handle.

Gold coins can help diversify your portfolio, making it less dependent on shaky investments like stocks. They can protect against inflation, currency changes, and market ups and downs. With the right information, adding gold coins to your portfolio can be a smart move.

Before investing in gold coins, look at their purity, weight, and price. Also, consider how you’ll store and keep them safe. This way, your gold coin investment will match your financial goals and help you deal with today’s market challenges.